- Home

- INVESTORS

- Corporate Governance

- Corporate Governance Structure

Corporate Governance Structure

■Corporate Governance Structure

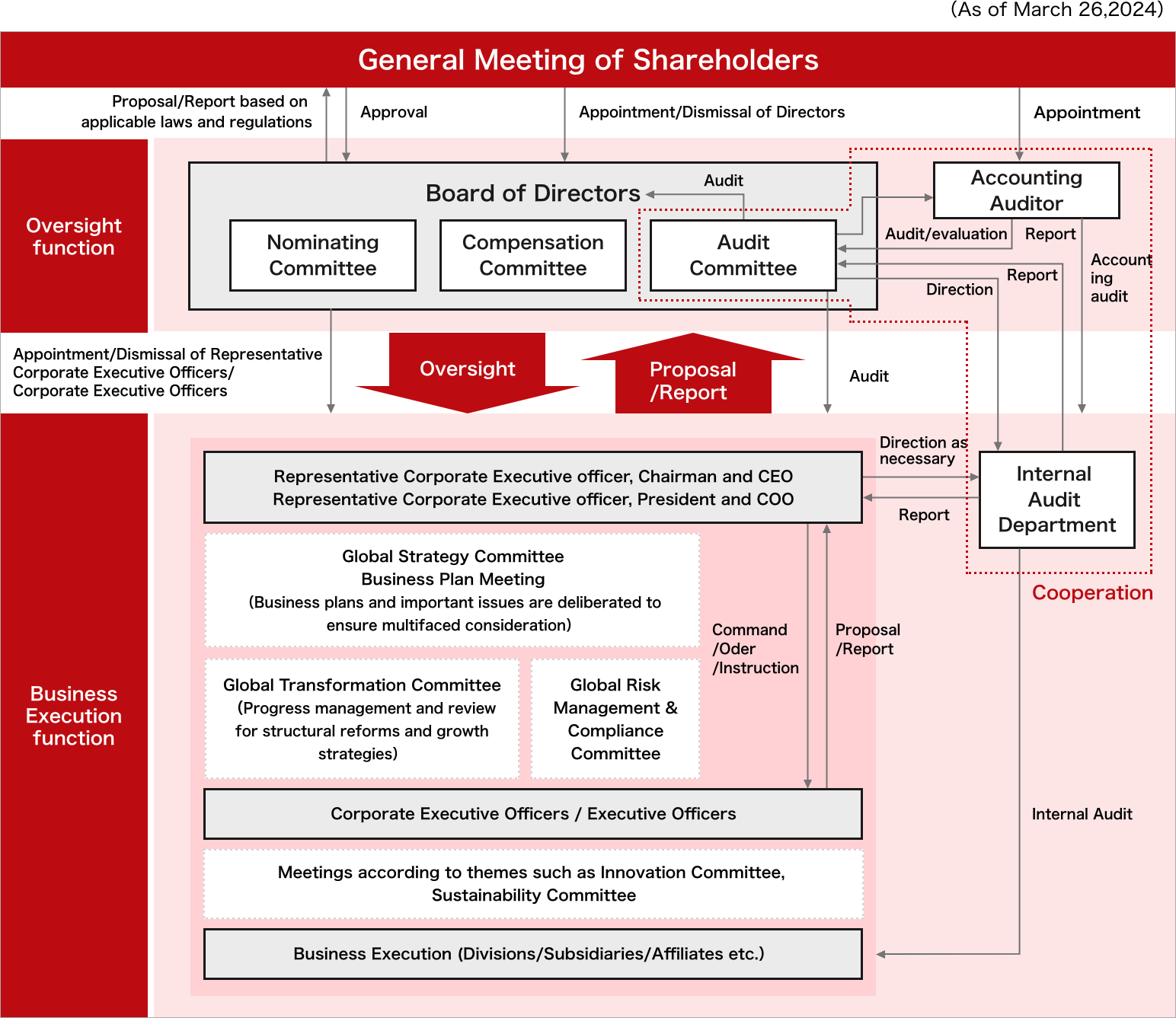

The Company has long been committed to improving the corporate governance through a range of initiatives including the adoption of governance system aligned with the “monitoring board-type system” where the board is putting more focus on oversight responsibilities to ensure transparency and fairness in governance practice, while ensuring effective strategic planning and timely execution thereof. We take this effort a step further, the Company has transited to a Company with Three Statutory Committees in order to maximize corporate value based on resolution of the Ordinary General Meeting of Shareholders held on March 26, 2024.

The Board of Directors focus on determining the basic management policy and management strategy while overseeing the implementation thereof, while also delegating significant authority to the Corporate Executive Officers, thereby accelerating the decision-making process for executing the Company’s business and implementation of its business strategies.

Corporate governance Structure Chart

In addition, with the recognition that promoting of the Three Lines Model contributes to strengthening corporate governance, the business department on the first line, the HQ Corporate departments and the regional headquarters on the second line and the Internal Audit Department on the third line work together while aiming to promote healthy growth strategies and enhance sustainable corporate value, and establishment and improvement of risk scenarios and risk mitigation activities are continuously carried out.

■Board of Directors

The Board of Directors meetings are held approximately once a month. It focuses on deciding basic management policy and management strategy and overseeing the implementation thereof to reinforce the oversight function and accelerate overall business execution of the Company in a rapidly changing environment. In addition, the Board of Directors discusses and decides matters stipulated in laws and regulations/the Company's Articles of Incorporation as well as matters provided for in the Regulations of the Board of Directors and delegate the authority to decide on other matters to Representative Corporate Executive Officers or Corporate Executive Officers.

The Company’s Board of Directors is composed of eleven (11) Directors including seven (7) Independent External Directors.

We held the Board of Directors meetings fourteen (14) times in fiscal year 2024.

From the executive side, proposals and reports were made primarily regarding the review of the medium-term management strategy and strategic actions, structural reforms and M&A along with their progress, the progress of the new core system (FOCUS), significant risks of the Shiseido Group, and IR activities (such as sharing investor feedback). In addition to these discussions, regular reports were provided by the nomination, compensation and audit committees. Accordingly, the Board of Directors effectively performed the oversight function.

In addition to the abovementioned fourteen (14) meetings of the Board of Directors, pursuant to the provisions of Article 370 of the Companies Act and Article 26, Paragraph 2 of the Company's Articles of Incorporation, there were two deemed resolutions where a resolution at a Board of Directors meeting is deemed to have been passed.

■Nominating Committee, Compensation Committee and Audit Committee

[Nominating Committee]

The Nominating Committee resolves matters such as proposals regarding appointment and dismissal of directors to be submitted to general meetings of shareholders and matters regarding the succession of directors. In addition, the Nominating Committee deliberate appointment and dismissal of the representative Corporate Executive Officers and Corporate Executive Officers, areas for which Corporate Executive Officers take responsibility, appointment and dismissal of the CEO, as well as matters regarding the succession of the CEO etc. and reports results of the deliberations to the Board of Directors.

The Committee is composed of four (4) Independent External Directors and its chairperson is selected from the committee members with the resolution of the Nominating Committee.

We held the Nominating Committee meetings eight (8) times in 2024.

It mainly discussed the succession of Directors, made resolutions regarding the selection of Director candidates to be submitted to the shareholders' meeting, and monitored the implementation status of the CEO succession. Additionally, it deliberated on matters related to the appointment of the CEO, the selection of the Representative Corporate Executive Officers and Corporate Executive Officers, and the determination of the areas of responsibility for the Corporate Executive Officers, providing recommendations to the Board of Directors.

[Compensation Committee]

The Compensation Committee resolves policies on decisions regarding remuneration of Directors and Corporate Executive Officers, designs of the remuneration policy for Directors and Corporate Executive Officers, and details of remuneration to individual Directors and Corporate Executive Officers, etc.

The committee is composed of four (4)Independent External Directors and its chairperson is selected from the committee members with the resolution of the Compensation Committee.

We held the Compensation Committee ten (10) times. It mainly discussed and resolved matters regarding the design of the CEO's compensation, changes to the performance indicators for long-term incentives, and the compensation of Directors and Corporate Executive Officers. Additionally, it oversaw the determination of compensation for Executive Officers other than Directors and Corporate Executive Officers.

[Audit Committee]

The Audit Committee conducts audit and prepares audit reports on performance of duties of Directors and Corporate Executive Officers, etc., and makes decisions on proposals for appointment, dismissal, or non-reappointment of accounting auditors submitted to General Meetings of Shareholders.

The committee is composed of a total of five (5) members: three (3) Independent External Directors and two (2) full-time Audit Committee members who are non-executive directors. The chairperson is an Independent External Director selected from the committee members with the resolution of the Audit Committee.

Click here for the activities of the Audit Committee in fiscal year 2024

■Major Committees of the Executive Side

[Global Strategy Committee]

Prior to decision-making by the CEO, this committee deliberates on group policies, organizational transformations, new businesses/brand launches and other particularly import matters for the Shiseido Group.

[Business Plan Meeting]

This meeting discusses business strategies and plans for core brands, regions, and key corporate functions.

[Global Risk Management & Compliance Committee]

The committee aims to accurately grasp global and regional social changes and the current situation of the Group. Based on this, it identifies management risk factors, deliberates prioritized material risks and countermeasures against the risks as well as the important matters regarding ethics and compliance.

Related Information:

ABOUT US

-

Who we are

-

History

-

Profile

-

Governance

-

Quality Management

-

Supply Network

-

Region/Business

BRANDS

-

Prestige

-

Premium

-

Inner Beauty

-

Life Quality Makeup

SUSTAINABILITY

-

Strategy / Management

-

Society

-

Environment

-

Governance

-

Reports / Data

-

Related Information

INNOVATION

-

Research and Development

-

Research Areas

-

Research outcomes

-

Product safety

-

Product Development Policy

-

Initiatives for doctors and researchers

CAREERS

-

DISCOVER OUR WORLD OF OPPORTUNITY

- Shiseido careers

INVESTORS

-

IR Library