- Home

- INVESTORS

- Corporate Governance

- Audit Structure

Audit Structure

Status of Internal Audit

1. Internal Audit Objectives and Policies

The Group's internal audits aim to contribute to sustainable growth and the enhancement of corporate value through the promotion of appropriate control and improvement activities based on THE SHISEIDO PHILOSOPHY1. Conducted in accordance with “The Internal Audit Rules” established by the Internal Audit Department, these audits comprehensively examine the state of our Group's internal controls from the perspectives of operational effectiveness and efficiency, reliability of reporting, compliance with relevant laws and internal regulations, and asset preservation. Additionally, the department assesses the appropriateness and effectiveness of risk management and provides advice and recommendations for improvements.

The Representative Corporate Executive Officer and CEO recognizes that robust governance and proper internal controls are essential to enhance the corporate value of the Shiseido Group and achieve trustworthiness in our business. With significant changes in internal and external environments, the importance of internal audits has grown, and the CEO is committed to providing the Internal Audit Department with the necessary resources to conduct effective audit activities that ensure the adequacy of the Group’s governance and internal controls. The internal audit function serves as a driving force for the Company’s continuous evolution into an organization guided by strong ethics and integrity, striving to earn the trust of all stakeholders.

2. Organization and Personnel Structure

Following the resolution at the General Meeting of Shareholders on March 26th, 2024 regarding “Transition to a Company with Three Statutory Committees,” the Internal Audit Department has been restructured to include a dual reporting line to both the Audit Committee and the Representative Corporate Executive Officer and CEO. The department maintains its independence and objectivity, regularly reporting the status and results of internal audits to the Audit Committee and the Board of Directors, alongside monthly reports to the Representative Corporate Executive Officer and CEO and Representative Corporate Executive Officer and CFO and weekly reports to the full-time Audit Committee members.

In the event of conflicting instructions or decisions between the Representative Corporate Executive Officer and CEO and the Audit Committee, the opinion of the Audit Committee shall prevail.

With regard to internal control over financial reporting, in accordance with the internal control reporting system based on the Financial Instruments and Exchange Act, the Internal Audit Department, as an independent division, compiles and reviews the group-wide assessment of internal control and then conducts a final assessment. The status of audit implementation and evaluation results are reported in the same manner as above.

As of December 31, 2024, we have 21 members of the Internal Audit Department at the headquarters and six members of the Internal Audit Department at offices belonging to the regional headquarters in China, Asia, the Americas and Europe (mainly locally hired). Approximately half of our employees hold professional certifications such as Certified Internal Auditor (CIA), Certified Information Systems Auditor (CISA), Certified Fraud Examiner (CFE), or Certified Public Accountant in Japan and the U.S., and we encourage those who do not hold these certifications to obtain them as we aim to build trust as a highly professional organization. In addition, members of the department have an average of five years of experience in the Company’s internal auditing and possess extensive knowledge and expertise in the field. The Internal Audit Department also maintains and reviews a skills matrix to ensure a well-balanced composition of personnel. Where specialized expertise is lacking within the department, staff with the required skills are brought in from other departments to strengthen the team’s capabilities. When resources are insufficient in terms of in-house expertise and number of staff, outside experts are utilized as needed.

In addition to the above, we have 17 full-time auditing staff with reporting lines to local management at major subsidiaries in Japan and overseas, depending on the risk base, to form a system capable of responding quickly to local situations.

To improve the quality of our internal audits, several CIAs experienced in conducting external quality evaluations conducted internal audit quality evaluations based on the International Standards for the Professional Practice of Internal Auditing (2017 Standards) of the Institute of Internal Auditors (IIA), and we are continuously improving our departmental management and operations to prepare for periodic external evaluations in the future. As we unify core IT systems at the global level, we are taking this chance to enhance data analysis capabilities in the Internal Audit Department to improve audit quality.

Audit Committee‘s Audits and Initiatives toward Strengthening Its Functions

The Company has five Audit Committee members: two full-time internal members and three external members with no special interest in the Company, and the chairperson is an outside director who has held a number of influential roles including director at government agencies and operating companies. The Company has appointed full-time Audit Committee members to strengthen our internal controls and governance framework. This is achieved through an audit function that incorporates information obtained via regular audit activities, such as interviews with executive officers, reports from the Internal Audit Department, on-site visits of subsidiaries, and participation in key internal meetings.

The Audit Committee has implemented measures to enhance the effectiveness of the three-way audit framework, which involves the Audit Committee, the Internal Audit Department, and the accounting auditor. As part of this initiative, the accounting auditor provides reports on the status of audits on a quarterly basis. Additionally, the Audit Committee holds biannual discussions on key management issues and convenes three-way audit liaison meetings. These efforts ensure audit findings and responses are shared among the three parties in a timely manner to improve the overall effectiveness of the audit process under the leadership of the Audit Committee.

The Audit Committee oversees the Internal Audit Department, receiving regular reports on the progress and outcomes of internal audits based on the internal audit plan. When necessary, the Audit Committee provides directives to the Internal Audit Department regarding internal audit matters. Furthermore, the Audit Committee organizes the “Subsidiary Auditor Liaison Meeting,” which comprises auditors from group subsidiaries that have auditors, to facilitate the sharing of management issues and information on internal control risks from each subsidiary. It also monitors the status of business execution across the Group.

Moreover, the Audit Committee has established the "Shiseido Group Audit Committee Whistleblower Hotline" as an internal reporting channel for cases involving suspected misconduct by directors, corporate executive officers, or other members of the leadership team. The committee conducts thorough investigations while ensuring the protection of whistleblowers.

In addition, with the aim of maintaining and improving the effectiveness of the Audit Committee, the Committee conducted an evaluation of its effectiveness by reviewing the annual audit activities based on the following evaluation items and discussing them at the Audit Committee meeting. As a result of our evaluation, we concluded that the Audit Committee functioned effectively during the current fiscal year.

| Evaluation Criteria |

|

|---|

Accounting Audits

The Company's accounting audit is conducted by KPMG AZSA LLC, an accounting auditor pursuant to the Companies Act and the Financial Instruments and Exchange Act.

The names of certified public accountants that have conducted auditing and the name of auditing firm are as follows:

Matters Concerning Accounting Auditor (As of December 31, 2024)

-

1.Name of the Auditing Firm

KPMG AZSA LLC -

2.Years of Continuous Service as Accounting Auditor

The Company appointed KPMG AZSA LLC as its accounting auditor on June 29, 2006, and the current fiscal year marks 19 years since the appointment. -

3.Names of Certified Public Accountants Engaged in Audit work

Masakazu Hattori (consecutive auditing period: five years)

Kentaro Hayashi (consecutive auditing period: five years)

Yuki Kodaka (consecutive auditing period: one year)

Note: The rotation of engagement partners is carried out appropriately in accordance with the policies established by KPMG AZSA LLC.

The rotation of engagement partners at KPMG AZSA LLC is regulated by laws, regulations on independence, and the audit firm’s policies (including policies of KPMG International Limited) regarding the maximum period of time for involvement in audit and attestation services. KPMG AZSA LLC monitors rotation status from the perspective of continuous involvement and independence, including assistant auditors. -

4.Composition of Assistants involved in the Audit

Assistants involved in the audit consisted of 17 certified public accountants, 10 successful applicants who have passed the Certified Public Accountant Examination, and 42 others (tax and IT auditing) -

5.Policy, Reasons, and Evaluation for Selection of Accounting Auditor

At the Company, the appointment and dismissal of the accounting auditor by the Audit Committee is implemented based on unanimous agreement. The decision is made through evaluations by the Representative Corporate Executive Officer and CFO, as well as the heads of departments related to financial accounting and auditing, and discussions involving all Audit Committee members.

The Company’s policy for determining dismissal or non-reappointment of the accounting auditor is as follows.

The Audit Committee shall dismiss the accounting auditor pursuant to the provisions of Article 340 of the Companies Act in the event the Company determines that the accounting auditor is seriously hindered as an accounting auditor; for example, if the accounting auditor breaches its official duty, neglects their official duty, or commits misconduct. Also, in the event that the accounting auditor deems it difficult to perform their duties properly, or in the event that the Audit Committee deems it appropriate to change accounting auditors in order to improve the audit, the Audit Committee shall decide the content of the proposal on the dismissal or non-reappointment of the accounting auditor, taking into account the opinion of the executive body, and the Board of Directors shall submit the proposal at the General Meeting of Shareholders based on the decision.

The Audit Committee evaluated the accounting audits for fiscal year 2024 and confirmed the appropriateness of the auditor, quality control, independence and professional competence of the audit team, appropriateness of the audit plan, communication with the Audit Committee members and other relevant parties, status of the accounting auditor’s remuneration, and processes, and resolved to reappoint the accounting auditor for the fiscal year 2025.

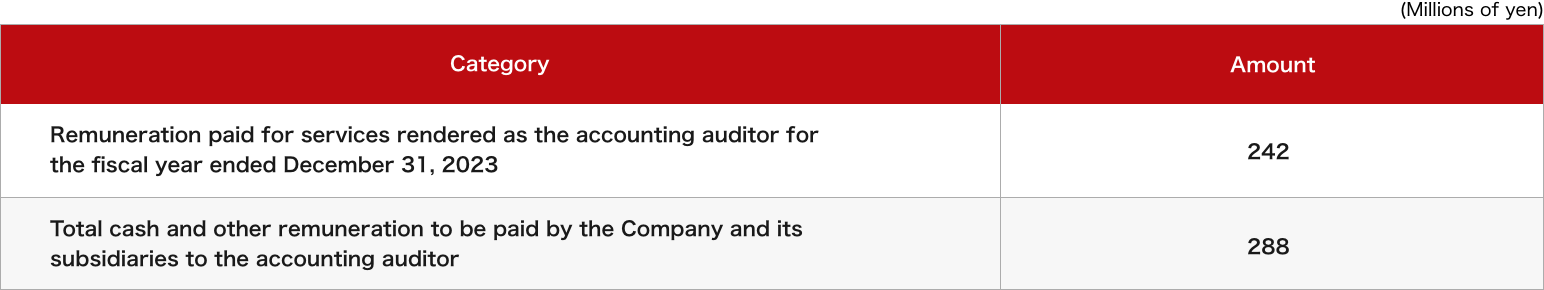

Remuneration, etc. to the Accounting Auditor

Notes:

- 1.In the audit contract between the Company and its accounting auditor, remuneration paid for audits under the Companies Act and remuneration paid for audits under the Financial Instruments and Exchange Act are not clearly distinguished and cannot be practically separated. Therefore, the total payment for both is shown in “Remuneration paid for services rendered as the accounting auditor for the fiscal year ended December 31, 2024” above.

- 2.In addition to the above, the amount of remuneration paid for services rendered as the accounting auditor includes 10 million yen as the amount of additional fees related to the preceding fiscal year.

Reason for Audit Committee to Have Agreed to Remuneration, etc. to the Accounting Auditor

The Audit Committee of the Company reviewed the status of performance of duties and basis for the calculation of the estimated amount of remuneration in the previous fiscal year as well as the validity of both descriptions in the audit plan prepared by the accounting auditor during the fiscal year and the estimated amount of remuneration, using the “Practical Guidelines for Cooperation with accounting auditors” released by the Japan Audit & Supervisory Board Members Association as a guide, and by way of necessary documents obtained from directors, internal relevant departments and the accounting auditor as well as interviews to obtain information from them, and determined that the fees, etc. of the accounting auditor were appropriate, in agreement with Article 399, Paragraphs 1 and 2 of the Companies Act.

Details of Services Other Than Audit

The Company entrusted the accounting auditor with the “preparation of ‘document from the accounting auditor to the managing underwriting firm’ concerning bond issuance,” which is a service other than services under Article 2, paragraph (1) of the Certified Public Accountants Act (services other than audit). The amount of remuneration, etc. is 2 million yen, which is included in the “Total cash and other remuneration to be paid by the Company and its subsidiaries to the accounting auditor” under the “Remuneration, etc. to the Accounting Auditor” above.

Policy Relating to Determination of Dismissal of or Not to Reappoint Accounting Auditor

In the event that the Company determines that keeping an accounting auditor as its accounting auditor causes material trouble to the Company for the reasons, among others, that the accounting auditor has violated its duties, negated its duties or behaved in a manner inappropriate as an accounting auditor, the Audit Committee shall dismiss the accounting auditor pursuant to Article 340 of the Companies Act.

Furthermore, in the event that it is deemed that the accounting auditor is unable to carry out its duties duly or change of the accounting auditor to another audit firm is reasonably required to enhance the appropriateness of accounting audit, the Board of Directors shall submit a proposal to the general meeting of shareholders for the dismissal of the accounting auditor or not to reappoint the accounting auditor in accordance with the resolution of the Audit Committee on the proposal resolved in consideration of the opinion of the executive agency.

ABOUT US

-

Who we are

-

History

-

Profile

-

Governance

-

Quality Management

-

Supply Network

-

Region/Business

BRANDS

-

Prestige

-

Premium

-

Inner Beauty

-

Life Quality Makeup

SUSTAINABILITY

-

Strategy / Management

-

Society

-

Environment

-

Governance

-

Reports / Data

-

Related Information

INNOVATION

-

Research and Development

-

Research Areas

-

Research outcomes

-

Product safety

-

Product Development Policy

-

Initiatives for doctors and researchers

CAREERS

-

DISCOVER OUR WORLD OF OPPORTUNITY

- Shiseido careers

INVESTORS

-

IR Library