- Home

- INVESTORS

- Stock and Bond Information

- Stock Information

Stock Information

(As of December 31, 2025)

-

Common Shares Issued

400,000,000

(including 463,674 in treasury stock)

-

Number of Shareholders

148,791

-

Stock Listings

Common Stock: Tokyo Stock Exchange (Code: 4911)

American Depositary Receipts: U.S. Over-the-Counter

-

Share Units

100

-

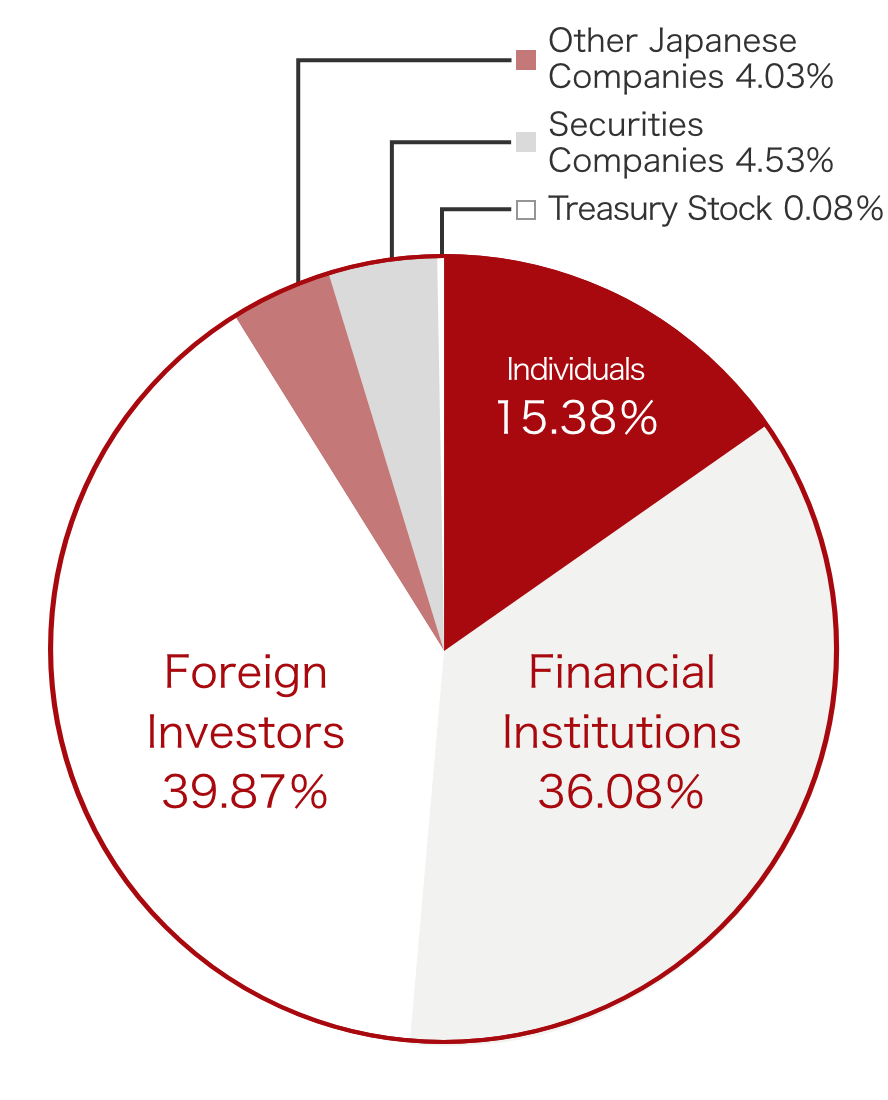

Shareholder Composition by Number of Shares Held

-

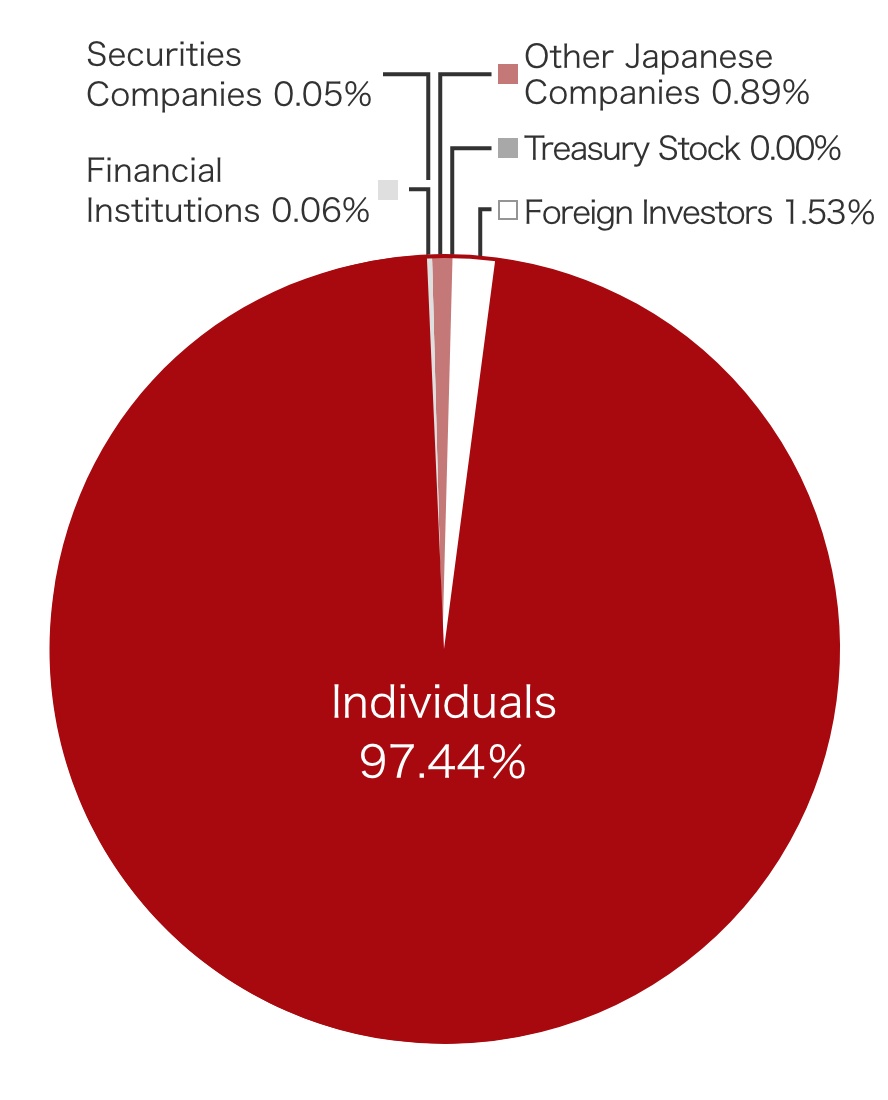

Shareholder Composition by Number of Shareholders

Principal Shareholders

| Shareholders | Number of Shares Held (thousand shares) |

Percentage of Shareholding (%) |

|---|---|---|

| The Master Trust Bank of Japan, Ltd. (Trust Account) | 68,321 | 17.10 |

| GOVERNMENT OF NORWAY | 21,741 | 5.44 |

| Custody Bank of Japan, Ltd. (Trust Account) | 20,514 | 5.13 |

| STATE STREET BANK AND TRUST COMPANY 505001 | 9,643 | 2.41 |

| NORTHERN TRUST CO. (AVFC) RE NON TREATY CLIENTS ACCOUNT | 9,248 | 2.31 |

| STATE STREET BANK AND TRUST COMPANY 505301 | 8,915 | 2.23 |

| Mizuho Trust & Banking Co., Ltd. re-trusted to Custody Bank of Japan, Ltd. Employees Pension Trust for Mizuho Bank |

7,000 | 1.75 |

| THE BANK OF NEW YORK 134104 | 6,381 | 1.59 |

| NORTHERN TRUST CO. (AVFC) RE IEDU UCITS CLIENTS NON LENDING 15 PCT TREATY ACCONT | 5,988 | 1.49 |

| JP MORGAN CHASE BANK 385781 | 5,923 | 1.48 |

- *Calculations of percentage of shareholding are based on the total number of issued and outstanding shares excluding treasury stock.

ADR Information

In addition to common shares, our ADRs are traded over-the-counter (OTC) in the U.S.

| Type of ADR Program | Sponsored Level 1 ADR |

|---|---|

| Exchange | OTC (Over-the-counter) |

| ADR Ratio | 1 ADR: 1 Common Share |

| Symbol | SSDOY |

| CUSIP | 824841407 |

| Depositary Bank | The Bank of New York Mellon 240 Greenwich Street 8W New York, NY 10286, U.S.A. |

| Local Custodian Bank |

Mizuho Bank, Ltd. |

| Share Price Reference |

Click here for BNY MELLON's website |

ABOUT US

-

Who we are

-

History

-

Profile

-

Governance

-

Quality Management

-

Supply Network

-

Region/Business

BRANDS

-

Prestige

-

Premium

-

Inner Beauty

-

Life Quality Makeup

SUSTAINABILITY

-

Strategy / Management

-

Society

-

Environment

-

Governance

-

Reports / Data

-

Related Information

INNOVATION

-

Research and Development

-

Research Areas

-

Research outcomes

-

Product safety

-

Product Development Policy

-

Initiatives for doctors and researchers

CAREERS

-

DISCOVER OUR WORLD OF OPPORTUNITY

- Shiseido careers

INVESTORS

-

IR Library