- Home

- INVESTORS

- Corporate Governance

- Remuneration for Directors and Corporate Executive Officers

Remuneration for Directors and Corporate Executive Officers

1. Basic Philosophy of the Remuneration to Directors and Executive Officers of the Company

The Company regards the remuneration policy for Directors and Corporate Executive Officers as an important matter for corporate governance. For this reason, in accordance with the following basic philosophy, the Directors and Corporate Executive Officers remuneration policy of the Company is deliberated and determined in the Compensation Committee chaired by an External Director to incorporate objective points of view.

Basic philosophy and policy of the remuneration to Directors and Corporate Executive Officers

The remuneration policy to Directors and Corporate Executive Officers shall:

- 1.encourage to realize the corporate mission;

- 2.aim to ensure attractive remuneration to acquire and retain top talent in global talent market;

- 3.aim to enhance the long-term corporate value and strongly incentivize to achieve the company’s long-term vision and medium- to long-term strategy;

- 4.have a mechanism incorporated to prevent overemphasis on short-term views while instilling motivation to achieve short-term goals;

- 5.be designed as transparent, fair and reasonable from the viewpoint of accountability to stakeholders including shareholders and employees, and remuneration shall be determined through appropriate processes to ensure those points.

- 6.be designed to establish remuneration standards based on the significance (Grade) of role/responsibility reflecting the mission of respective Directors and Executive Officers, and differentiate remuneration according to the level of strategic target accomplished (achievements).

2. The Company’s Directors and Corporate Executive Officers Remuneration Policy

Based on the above basic philosophy, the Compensation Committee of the Company has resolved its policy on decisions regarding matters including remuneration, etc. of individual Directors and Corporate Executive Officers.

The Company’s Directors and Corporate Executive Officers remuneration policy, including an outline of the contents of the policy on decisions regarding matters including remuneration, etc. of individual Directors and Corporate Executive Officers, is described below in detail.

◼ Overall picture

The remuneration of Corporate Executive Officers (including those who concurrently assume the position of Directors) comprises “basic remuneration” as fixed remuneration as well as “annual incentive” and “long-term incentive-type remuneration (non-monetary remuneration)” as performance-linked remuneration, and the Company sets remuneration levels by benchmarking peer companies in the same business industry or in the similar business size inside or outside Japan and by taking the Company’s financial condition into consideration. Matters including remuneration, etc. of individual Corporate Executive Officers are deliberated on and determined by the Compensation Committee.

All of the Company’s Corporate Executive Officers concurrently serve as Executive Officers, and their remuneration is determined based on their Grade as Executive Officers, among other factors. In addition, in the case of Directors who also serve as Corporate Executive Officers, compensation for their service as a Director is not included in this remuneration.

The roles expected of Directors are the oversight of executive activities and the provision of advisory functions regarding management. To ensure that these expected roles can be fulfilled from a position that is not influenced by performance fluctuations, the compensation for non-executive Directors, including External Directors, consists solely of basic remuneration (fixed remuneration).

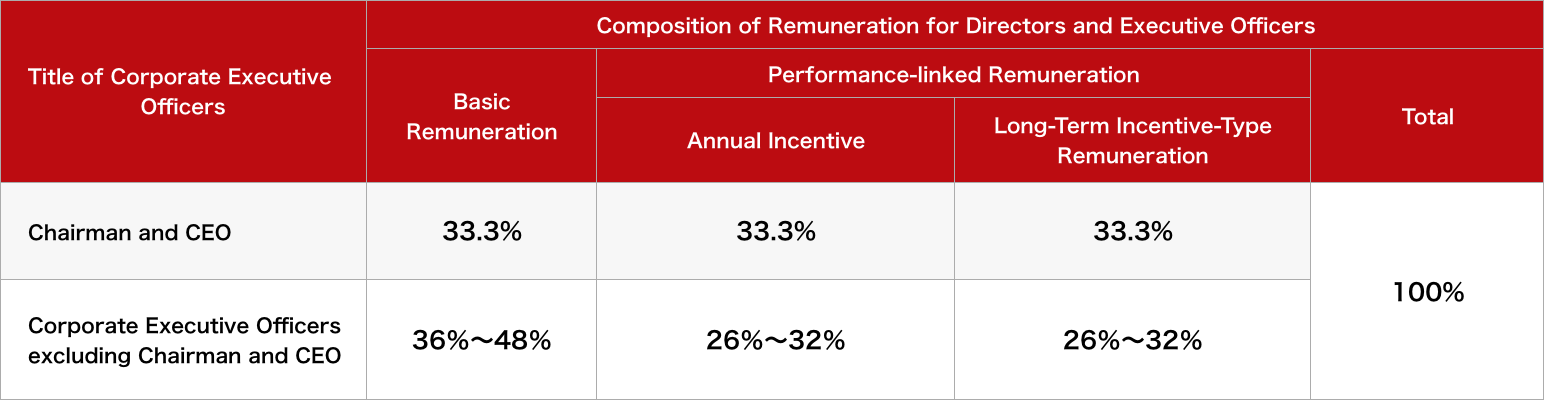

〔The proportion of each remuneration element by remuneration type for Corporate Executive Officers〕

The proportion of remuneration of Corporate Executive Officers is set by Grade, and the higher the Grade becomes, the higher the proportion of performance-linked remuneration becomes.

Notes :

- 1.The proportions shown in the above table may change depending on the Company’s performance and/or its stock price’s fluctuation, as financial value of performance-linked remuneration is shown at target where the Company pays 100%.

- 2.There is no differentiated proportion of each remuneration element for Corporate Executive Officers pegged to having a representation right.

◼ Basic remuneration

Basic remuneration is deliberated and determined by the Compensation Committee and is paid in equal installments every month.

The Company designs basic remuneration in accordance with Grades based on the size and level of responsibility of Corporate Executive Officers in charge, as well as the impact on business management of the Group. In addition, even at the same Grade, the basic remuneration may increase within a certain range based on the individual Corporate Executive Officer’s performance for the previous fiscal year (numerical business performance and personal performance evaluation). This ensures the Company to reward Corporate Executive Officers for their individual outstanding achievement.

◼ Performance-linked remuneration

The performance-linked remuneration consists of an “annual incentive” provided as an incentive for achieving goals for the corresponding fiscal year, and “performance-linked stock compensation (performance share units) as long-term incentive-type remuneration” provided with the aims of establishing a sense of common interests with the shareholders and instilling motivation to enhance corporate value over the medium to long term. Accordingly, it is designed to motivate the Corporate Executive Officers to manage business operations while being more conscious about the Company’s performance and share price from the perspectives of not only a single year but also over the medium to long term.

■ Annual incentive

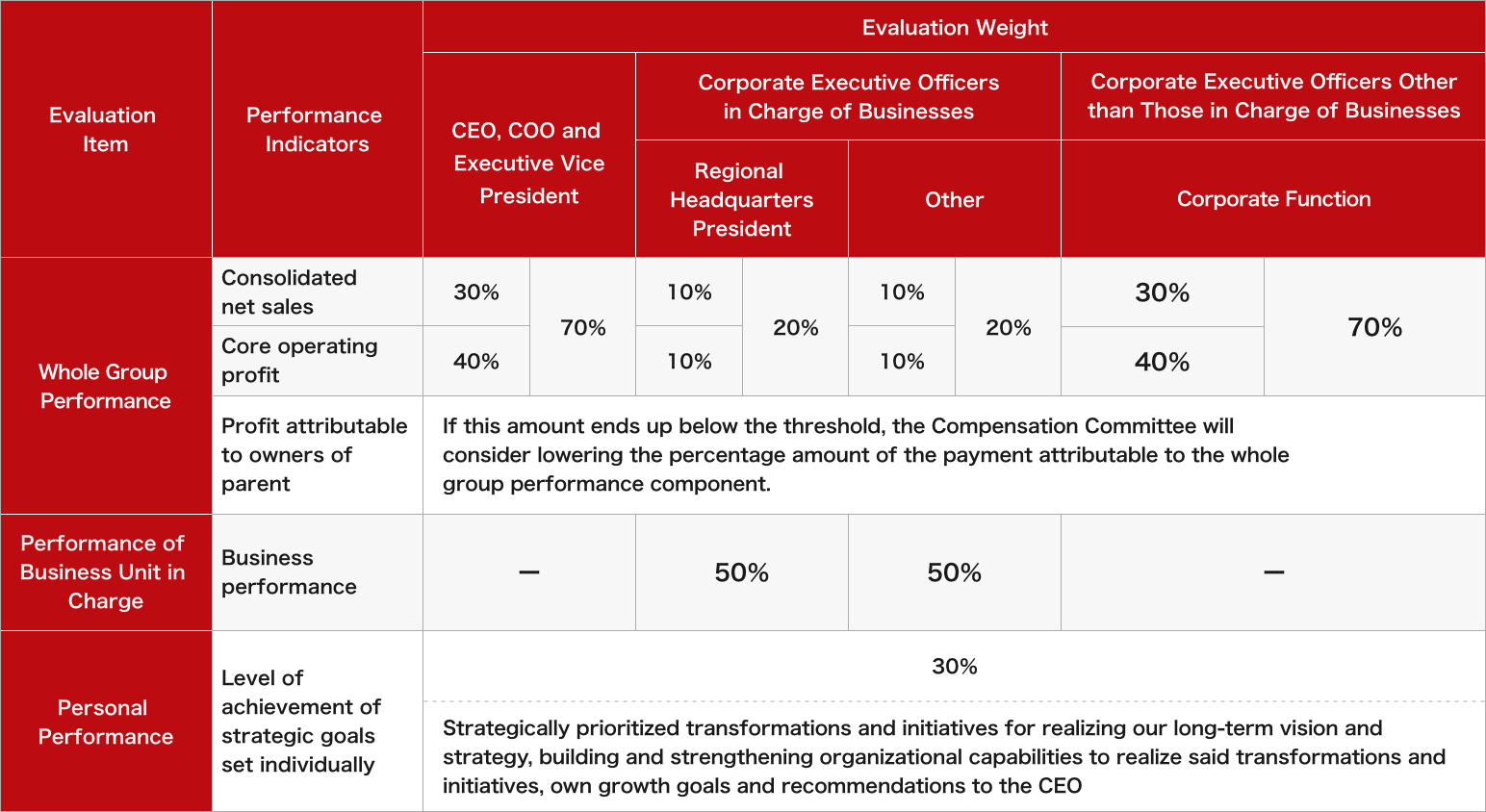

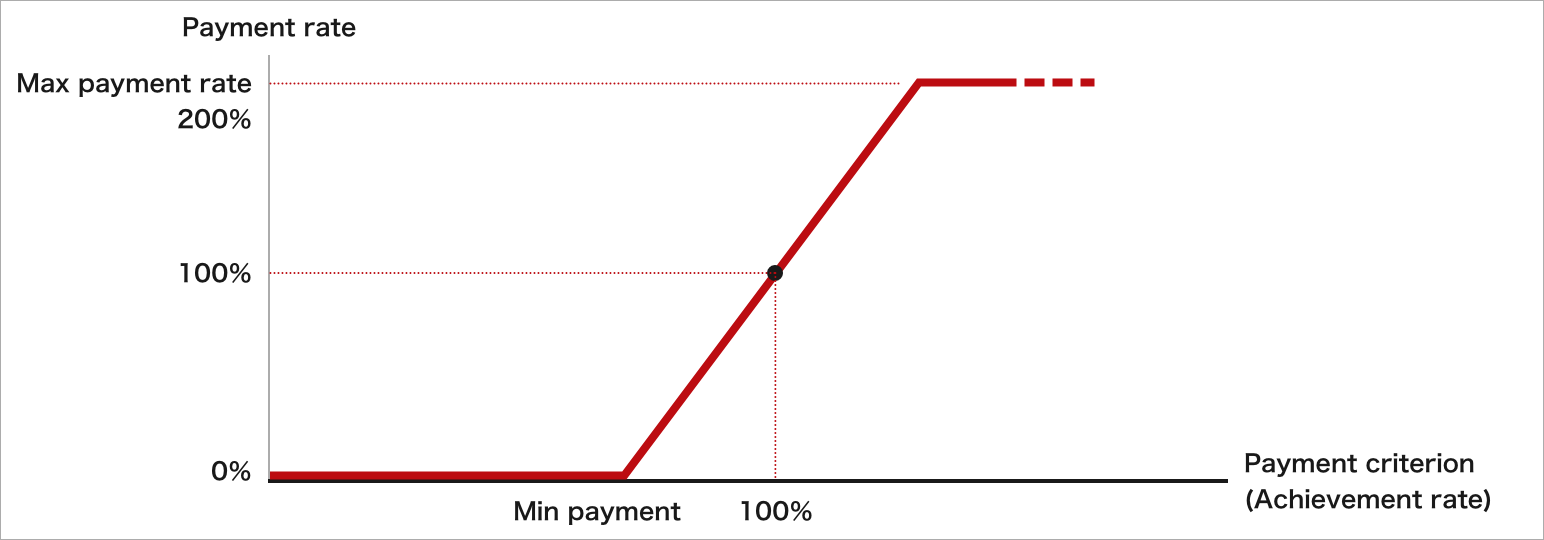

Of the performance-linked remuneration the Company has set performance items for the annual incentive in accordance with the scope of responsibility of Corporate Executive Officers as described in the table below, in addition to the achievement rate of target consolidated net sales and core operating profit which are financial indicators, as common performance indicators across all the Corporate Executive Officers, and the range of changes in the percentage amount of payment is set between 0% and 200%. Although it is essential that the entire management team remains aware of matters involving profit attributable to owners of parent, it is crucial that management not let the benchmark weigh too heavily on proactive efforts particularly involving future growth-oriented investment and resolving challenges with our sights set on achieving long-term growth. As such, upon the Compensation Committee deliberation, the Company has preliminarily established certain performance standards (thresholds) as described in the table below, with the evaluation framework designed so that the Compensation Committee will consider the possibility of lowering the percentage amount of the annual incentive payment attributable to the whole group performance component of the total annual incentive, if results fall below the thresholds. In determining the achievement rate of each target and threshold for consolidated net sales, core operating profit and profit attributable to owners of parent, actual performance may be adjusted based on the deliberations and decisions by the Compensation Committee. In cases where such adjustments are made, it shall be stated in the disclosure materials of the actual remuneration of Corporate Executive Officers.

In addition, we set the personal performance evaluation of all Corporate Executive Officers in order to add the level of achievement regarding strategic goals that cannot be measured by the financial performance figures alone, such as efforts for restructuring of the business platform to realize sustainable growth, to evaluation criteria.

Annual incentive is paid once a year.

〔Performance indicators and evaluation weights for annual incentive for Corporate Executive Officers determined by the area of responsibility〕

Notes :

There is no difference in the performance indicators and the weight of performance indicators applied to Corporate Executive Officers based on whether a Corporate Executive Officers has a representation right or otherwise.

〔Model of annual incentive payment rate〕

■ Long-term incentive-type remuneration

From fiscal year 2019, the Company has introduced performance share units, a type of performance-linked stock compensation, and has incentivized the creation of corporate value over the medium to long term through annual grants. As performance indicators to evaluate the enhancement of economic value, a mix of quantitative targets to be aimed for with a long-term perspective has been set under the medium- to long-term strategy. In addition, as benchmarks on creation of social value, the Company has set multiple internal and external indicators pertaining to the environment, society and governance (ESG). Accordingly, the remuneration is designed for the purpose of creating corporate value from both aspects of economic and social values, as well as establishing a sense of common interests with shareholders.

〔Purposes of introducing the LTI〕

The LTI is adopted for the purposes of establishing effective incentives for creating and maintaining corporate value over the long term, and ensuring that the Directors’ and Corporate Executive Officers’ interests consistently align with those of our shareholders. To such ends, the LTI will help:

- i) promote efforts to create value by achieving our long-term vision and strategic goals,

- ii) curb potential damage to the corporate value and maintain substantial corporate value over the long term,

- iii) attract and retain talent capable of taking on leadership in business, and

- iv) realize a “Global One Team” by fostering a sense of solidarity among management teams of the entire Shiseido Group and instilling the consciousness of participating in the running of the Company.

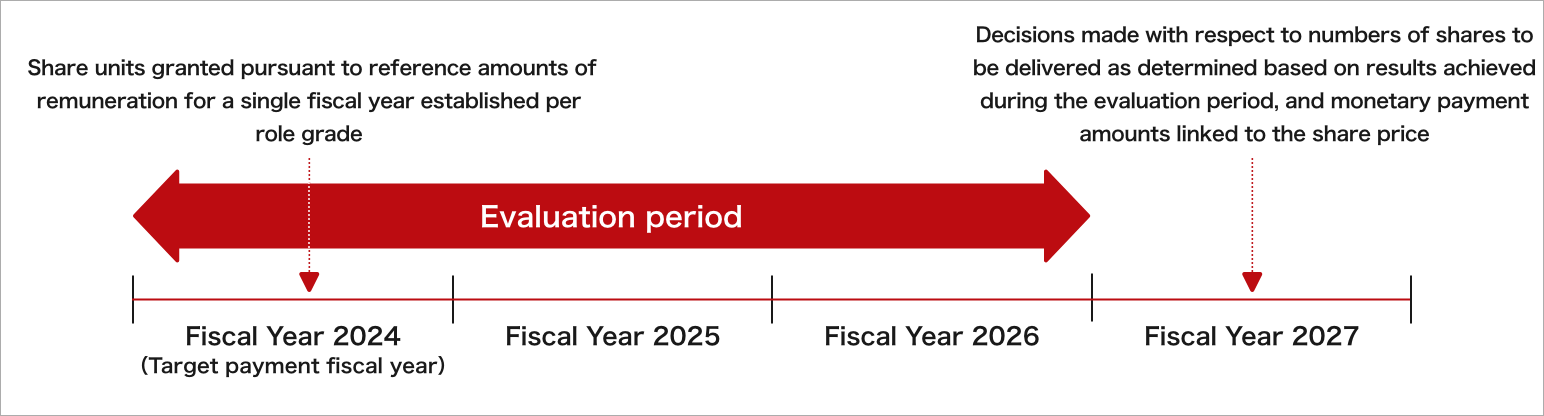

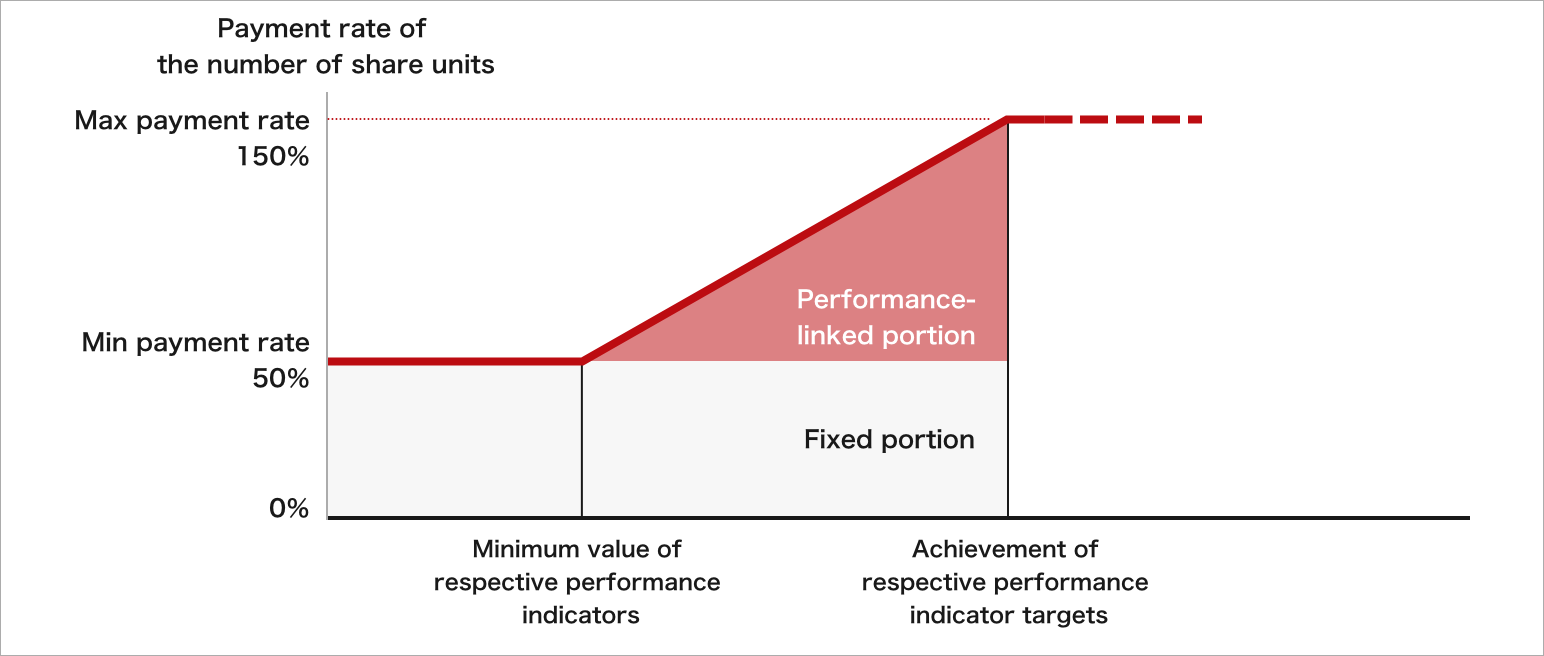

Under the Company’s performance share units, the Company will grant a reference share unit to each of the eligible parties once every fiscal year, and on each annual grant, the number of fiscal years that the payment relates to shall be one fiscal year. To make such grants, the Company shall establish multiple performance indicators whose evaluation period is for three years including the fiscal year related to the payment. The Company shall use the respective achievement ratios of each performance indicator to calculate the payment rate in a range from 50% to 150% after the end of the evaluation period, and it shall use the payment rate to increase or decrease the number of share units. The eligible parties shall be paid monetary remuneration claims for the delivery of the shares of the Company’s common stock and cash corresponding to the applicable number of share units, and then each eligible party shall receive delivery of shares of common stock of the Company by paying all the monetary remuneration claims using the method of contribution in kind. Meanwhile, it features a fixed portion involving a set payment in addition to its performance-linked portion. As such, the LTI is designed to help eligible parties realize the aims of more robustly ensuring that their sense of interests consistently aligns with those of our shareholders, curbing potential damage to corporate value and maintaining substantial corporate value over the long term, and helping to attract and retain competent talent.

Regarding the evaluation indicators, starting from the fiscal year 2025, we have adopted relative TSR (Total Shareholder Return) and ROIC (Return on Invested Capital) as financial target indicators, comprising 80% of the overall evaluation weight for long term incentive type remuneration. This decision aims to further motivate the efficient generation of profits from the capital invested in our business activities and enhance shareholder value, in line with the realization of our Action Plan 2025-2026 and subsequent growth strategies.

In addition, as benchmarks pertaining to social value, the Company has adopted multiple internal and external indicators pertaining to the environment, society and governance (ESG). The composition of these performance indicators pushes forward the enhancement of corporate value from both aspects of economic and social values.

To receive payments under the LTI, eligible parties are required to have served continuously in the position of Corporate Executive Officer or Executive Officer during a certain period set in advance.

The Company has introduced the malus and clawback provisions for performance share units. Specifically, in certain conditions, such as in case of serious misconduct of the eligible parties, the Compensation Committee is entitled to make the decision to reduce the number of the share units or receive a refund.

The long-term incentive-type remuneration is also paid to principal executive persons in and outside Japan to realize a “Global One Team” by fostering a sense of solidarity among global management teams and instilling the consciousness of participating in the running of the Company.

〔LTI schedule〕

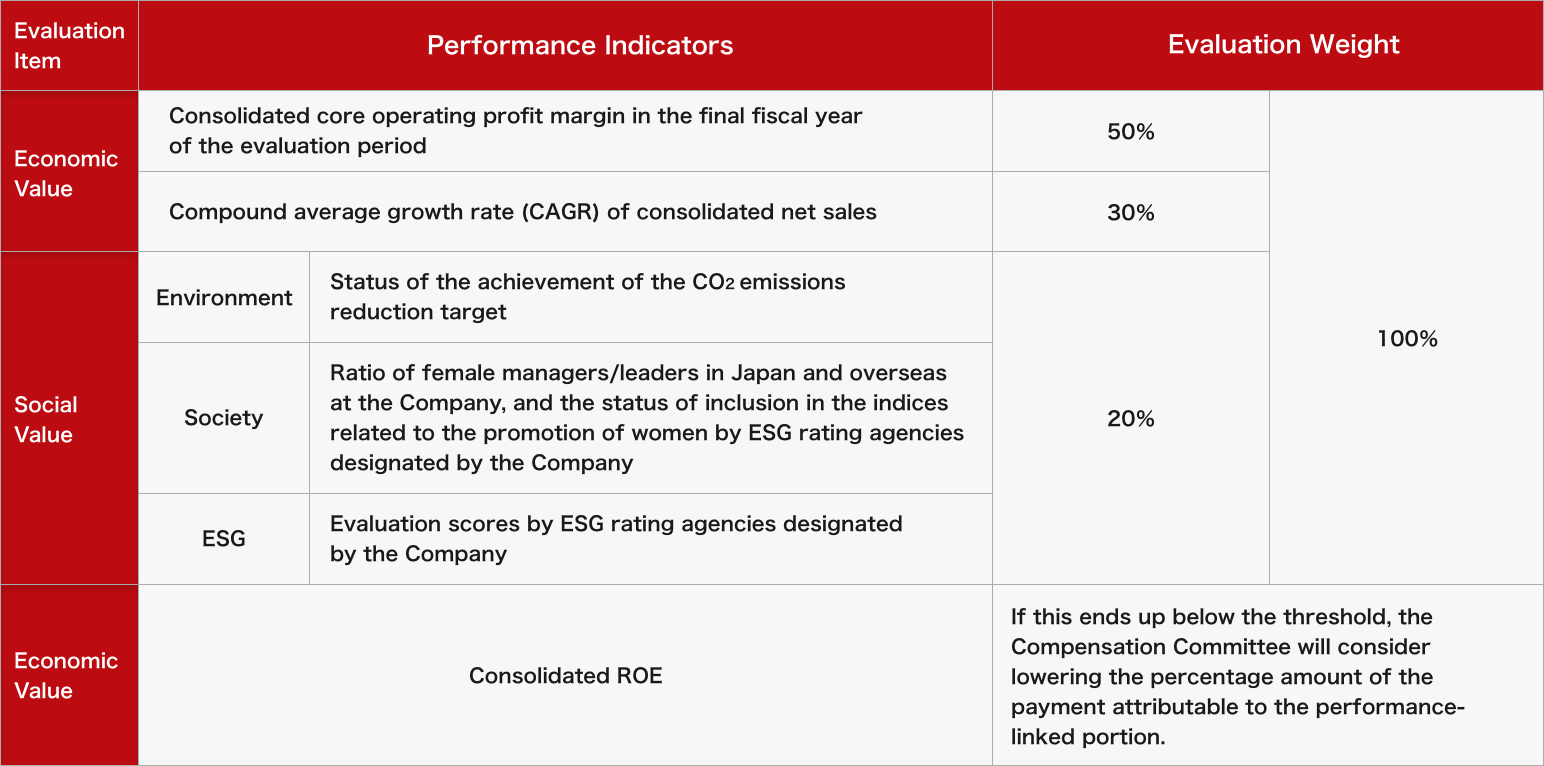

〔Performance indicators and evaluation weights for performance-linked portion of the LTI〕

- *The evaluation in 2025 is based on the MSCI ESG Rating.

〔Model for payment rate of the number of share units for the LTI〕

The details regarding the amounts of compensation for Directors and Corporate Executive Officers for the fiscal year 2024, as well as the performance indicators related to performance-linked remuneration, are disclosed in the securities report under "Remuneration of Directors, Corporate Executive Officer and Audit & Supervisory Board Members".

Click here for the Annual Securities Report_Remuneration of Directors, Corporate Executive Officer and Audit & Supervisory Board Members.

ABOUT US

-

Who we are

-

History

-

Profile

-

Governance

-

Quality Management

-

Supply Network

-

Region/Business

BRANDS

-

Prestige

-

Premium

-

Inner Beauty

-

Life Quality Makeup

SUSTAINABILITY

-

Strategy / Management

-

Society

-

Environment

-

Governance

-

Reports / Data

-

Related Information

INNOVATION

-

Research and Development

-

Research Areas

-

Research outcomes

-

Product safety

-

Product Development Policy

-

Initiatives for doctors and researchers

CAREERS

-

DISCOVER OUR WORLD OF OPPORTUNITY

- Shiseido careers

INVESTORS

-

IR Library