Information Disclosure and Dialogue with Shareholders and Investors

1. Basic Policy

Shiseido fully recognizes that timely and appropriate disclosure of corporate information to shareholders and investors forms the basis of a sound securities market. We will make constant efforts to improve our internal systems to ensure prompt, accurate, and fair disclosure of corporate information to all shareholders and investors at the same time, and will focus on timely and appropriate disclosure of corporate information to shareholders and investors. Through this timely and appropriate disclosure as well as constructive dialogue, we will aim to increase our medium-to-long-term corporate value by building favorable relationships with the capital market and incorporating market opinions and valuations in feedback to the management of the Company.

2. Information Disclosure

(1) Standards for Information Disclosure

a. Timely disclosure of material information

We will disclose information in accordance with the Financial Instruments and Exchange Act, other related laws, and rules on timely disclosure as defined by the Tokyo Stock Exchange (“TSE”), on which Shiseido is listed. Additionally, material information will be determined by the information management officer (the officer in charge of disclosure) upon consultation with relevant departments within the Company according to the contents of the information concerned.

b. Voluntary disclosure

Any information not required by the above rules on timely disclosure will be disclosed by us in light of timeliness and fairness if we consider it useful for investment decisions.

(2) Method of Information Disclosure

Disclosure of material information prescribed in the rules for timely disclosure and voluntary disclosure of other useful information not required by the rules will be made through TDnet, a timely disclosure system provided by the TSE (“TDnet”). Information disclosed on TDnet will also be disclosed promptly via the Shiseido corporate website.

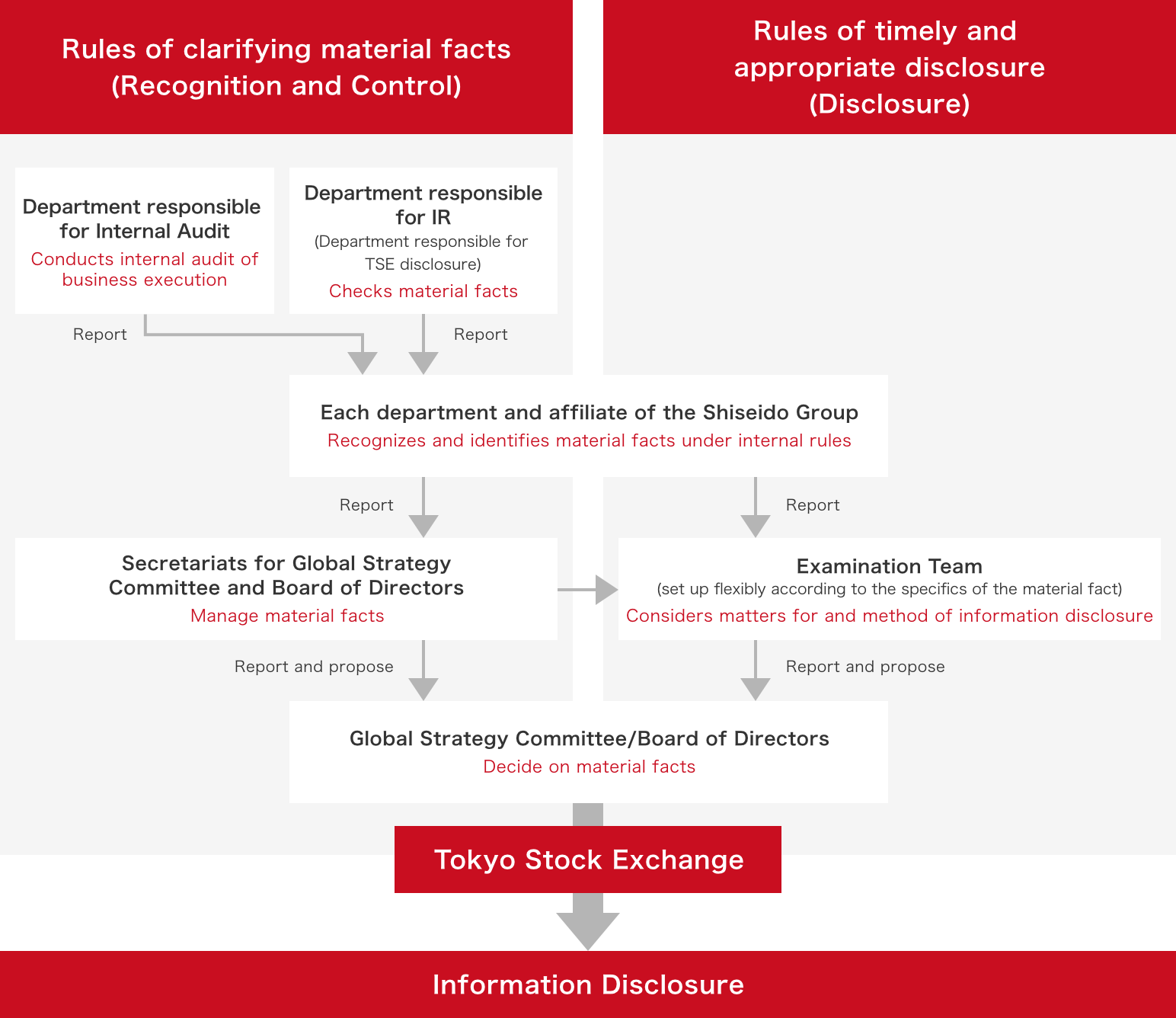

(3) System for Information Disclosure

In order to recognize and identify what kinds of facts fall under the category of material facts, each office and department of the Shiseido Group has put together a list of material facts under internal rules that reflect laws and listing regulations, and decides on a case-by-case basis whether or not a certain fact is a material fact.

In addition, when an applicable case is brought to the Global Strategy Committee, Board of Directors, or any other decision-making body for report or approval, the IR department responsible for TSE disclosure checks whether or not it falls under the category of material facts in accordance with the Timely Disclosure Rules of the TSE with respective departments serving as secretariat being held responsible for managing confidential information regarding such material facts.

On top of this framework for clarifying material facts, we also have other frameworks for timely and appropriate disclosure, such as an Examination Team, which is set up flexibly according to the specifics of the material fact. Its work involves not only the examination of the information subject to disclosure, but also the preparation and confirmation of disclosure documents.

It is after all these frameworks are drawn on that the Global Strategy Committee, the Board of Directors, or any other decision-making body approves a case and decides to take an information disclosure action, immediately after which the information is disclosed in an appropriate manner through the TSE and the Shiseido corporate website.

<The Company’s System for Information Disclosure of Facts of Decisions Made, Facts of Actual Events,

and Financial Information>

3. Constructive Dialogue with Shareholders and Investors

Investor relations (IR) activities of the Company are overseen by its Executive Officer in charge of IR, who ensures positive cooperation between departments through such means as internal liaison meetings on information for disclosure in order to support constructive dialogue with shareholders and investors. To promote understanding of Shiseido’s philosophy, business strategy, and financial situation, we do not limit our IR activities to general meetings of shareholders and individual investor meetings. We also hold regular IR events, such as briefings on our business results for analysts and institutional investors, events for individual shareholders, and briefings for individual investors. In addition, we aim to enhance the information we share with our shareholders and investors through publications at the Shiseido corporate website, Integrated Report, Sustainability Report, and Notice of Convocation of the Ordinary General Meeting of Shareholders. At the same time, as we aim to further increase our corporate value, we relay the views and concerns learned through dialogue with shareholders and investors to the Board of Directors, various meetings for information sharing, and key internal stakeholders through emails and other communication.

4. Management of Insider Information, etc.

(1) Fair Disclosure

To avoid selective disclosure of nonpublic and voluntarily disclosed information to specific investors, we will manage information properly in accordance with internal rules for internal stakeholders involved with such information. In addition, when we recognize that certain rumors about the Company are circulating that can significantly affect the capital market, we will disclose information promptly through channels such as TDnet.

(2) Quiet Periods

To prevent leaks of financial results before announcement and to assure fairness, Shiseido observes a quiet period before an announcement of business results. The quiet period is from the day after the closing date until the date on which earnings are announced each quarter. During the quiet period, we do not answer inquiries or make any comments on business results. Should it prove necessary to make timely disclosure during the quiet period, Shiseido will do so under the rules on timely disclosure.

(3) Forward-Looking Statements

Statements of information disclosed by Shiseido other than historical facts are forward-looking statements that reflect our plans and expectations at the time of the announcement. These forward-looking statements involve risks, uncertainties, and other factors that may cause actual results and achievements to differ from those anticipated in these statements.

- Last revised in December 2022

Dialogues with shareholders and investors

Key IR Activities

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| One-on-One Meetings with Investors and Analysts | Approx. 500 | Approx. 550 | Approx. 600 |

| Overseas IR Activities (Including Online) | 2 | 4 | 4 |

| Domestic and International Conferences Organized by Securities Firms | 4 | 6 | 10 |

| IR Events | 14 | 15 | 13 |

| Small-Scale Meetings | 4 | 6 | 4 |

| Large-Scale Meetings | 2 | 4 | 2 |

| Briefing Sessions / Facility Tours | 6 | 5 | 6 |

| Individual Investor Briefings | 2 | ー | 1 |

| SR Dialogues with Major Institutional Investors and Proxy Advisory Firms | 12 | 12 | 12 |

| Number of Shareholders Attending the Annual Shareholders’ Meeting | 1,268 | 1,322 | 419* |

- *For the purpose of ensuring fairness, corporate gifts are no longer offered to onsite attendees

The opinions received in these dialogues with shareholders and investors are shared at the Board of Directors and top management meetings, and are treated as reference information in considering matters such as what need to be improved in comparison with our global competitors and how to improve the impression of the Company from the outside, various financial and non-financial indicators that we should pay attention to, and towards our next strategies, etc.

ABOUT US

-

Who we are

-

History

-

Profile

-

Governance

-

Quality Management

-

Supply Network

-

Region/Business

BRANDS

-

Prestige

-

Premium

-

Inner Beauty

-

Life Quality Makeup

SUSTAINABILITY

-

Strategy / Management

-

Society

-

Environment

-

Governance

-

Reports / Data

-

Related Information

INNOVATION

-

Research and Development

-

Research Areas

-

Research outcomes

-

Product safety

-

Product Development Policy

-

Initiatives for doctors and researchers

CAREERS

-

DISCOVER OUR WORLD OF OPPORTUNITY

- Shiseido careers

INVESTORS

-

IR Library