Shiseido’s Growth Strategy

Corporate GovernanceFeatures of Shiseido’s Corporate Governance

Shiseido’s basic policy on corporate governance defines governance as the “platform to realize sustainable growth by fulfilling the corporate mission.” We strive to maximize medium-to-long-term corporate and shareholder value by implementing and reinforcing corporate governance to maintain and improve management transparency, fairness, and speed, and through dialogue with all stakeholders, from consumers, business partners, employees, and shareholders to society and the earth. At the same time, by fulfilling its responsibilities as a public entity of society, Shiseido works to optimize the value it delivers to respective stakeholders.

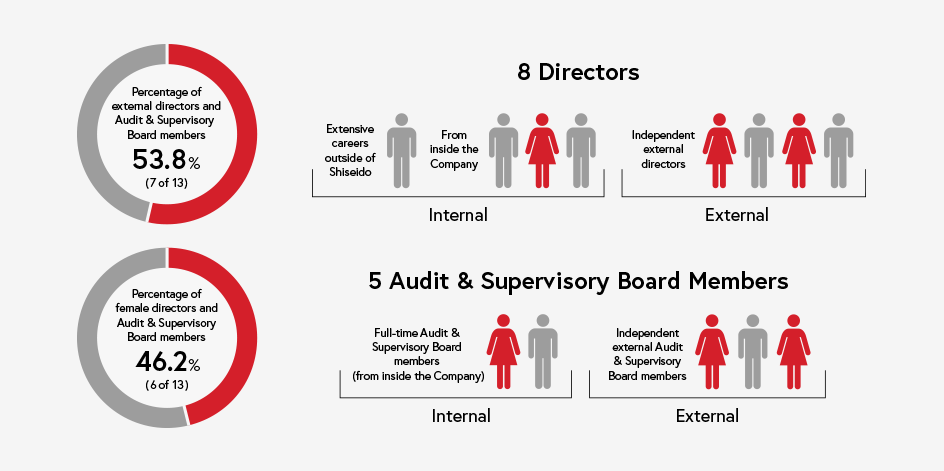

- Shiseido’s Governance in Numbers

- Directors and Audit & Supervisory Board Members

- Current Structure

- Skills and Expertise Required of Directors and Audit & Supervisory Board Members

- Executive Remuneration – A Remuneration System That Strikes a Balance between Short-Term and Long-Term Incentives

- Shiseido’s Long-Term Incentive Plan for Motivating Management to Promote Growth over the Medium-to-Long Term

Shiseido’s Governance in Numbers

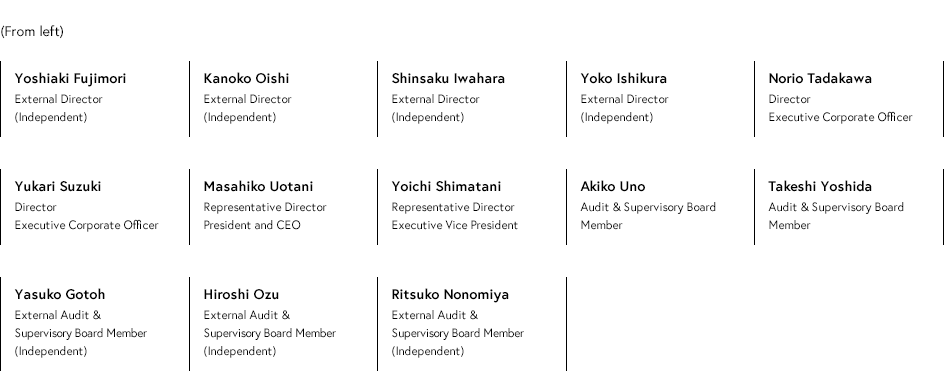

Directors and Audit & Supervisory Board Members

Current Structure

The Company has adopted a company with an audit & supervisory board organizational structure with double-check functions for business execution: supervision by the Board of Directors and audits by Audit & Supervisory Board members. In order to maintain and improve management transparency, fairness, and speed as per the Basic Policy for Corporate Governance, the Company has reinforced the supervisory function of the Board of Directors by incorporating outstanding functions, including those of a company with nominating committee and company with audit and supervisory committee, etc.

Effective January 2016, the Shiseido Group has launched a global matrix organization which cross-matches six regions with brand categories. Under this matrix organization, the global headquarters is responsible for supervising the overall Group and providing necessary support, while many of the responsibilities and authorities that used to be retained by the Company are delegated to respective regional headquarters of Japan, China, Asia Pacific, the Americas, EMEA, and Travel Retail. The Board of Directors held repeated discussions with regard to an ideal state of the Company’s corporate governance system under this matrix organization, including composition and operation of the Board of Directors. As a result, it concluded that adopting the monitoring board-type structure would ensure sufficient and effective supervisory functions over the Shiseido Group overall, and resolved to implement the monitoring board-type corporate governance while leveraging advantages of a company with an audit & supervisory board structure.

Skills and Expertise Required of Directors and Audit & Supervisory Board Members

Given that the Company requires directors and Audit & Supervisory Board members to supervise business execution and conduct decision-making on critical matters, it selects candidates based on their personality and insight, regardless of attributes such as gender, age, and nationality, as they must possess various viewpoints and backgrounds, in addition to diverse and sophisticated skills.

Scroll horizontally to view the following table. →

| Global management / Business strategy | Marketing / Experience of the Company's business and the industry | Technology / Innovation | ESG (Environment, Society, Governance) | Legal affairs / Risk management |

Finance / Accounting / M&A | |

|---|---|---|---|---|---|---|

| Masahiko UotaniRepresentative Director, President and CEO |

|

|

|

|||

| Yoichi ShimataniRepresentative Director, Executive Vice President |

|

|

|

|||

| Yukari SuzukiDirector, Executive Corporate Officer |  |

|

||||

| Norio TadakawaDirector, Executive Corporate Officer |  |

|

|

|||

| Yoshiaki FujimoriExternal Director (Independent) |  |

|

|

|||

| Yoko IshikuraExternal Director (Independent) |  |

|

||||

| Shinsaku IwaharaExternal Director (Independent) |  |

|

|

|||

| Kanoko OishiExternal Director (Independent) |  |

|

||||

| Takeshi YoshidaAudit & Supervisory Board Member |  |

|

|

|||

| Akiko UnoAudit & Supervisory Board Member |  |

|

|

|||

| Yasuko GotohExternal Audit & Supervisory Board Member (Independent) |  |

|

|

|||

| Ritsuko NonomiyaExternal Audit & Supervisory Board Member (Independent) |  |

|

||||

| Hiroshi OzuExternal Audit & Supervisory Board Member (Independent) |  |

|

● mark indicates principal areas of expertise (maximum 3 areas per person)

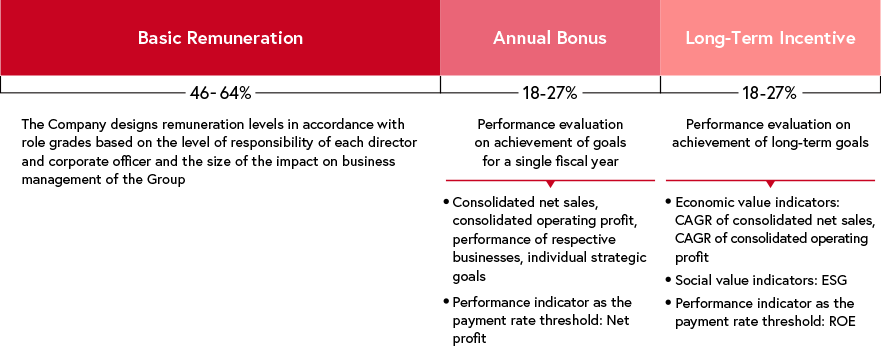

Executive Remuneration – A Remuneration System That Strikes a Balance between Short-Term and Long-Term Incentives

The Company regards the remuneration policy for directors, Audit & Supervisory Board members, and corporate officers as a matter of the utmost importance for corporate governance.

Remuneration for directors and corporate officers comprises basic remuneration and performance-linked remuneration. The Company sets appropriate executive remuneration levels by making comparisons with those of companies in the same industry or of the same scale in Japan and overseas, taking the Company’s financial condition into consideration.

Composition of Executive Remuneration

Key Points of the Remuneration System

- Comprises basic remuneration, which is offered as fixed remuneration, and annual bonuses and long-term incentives, which are offered as performance-linked remuneration

- Introduces a role grade system designed so that the higher the role grade the greater the ratio of the performance-linked component of remuneration

- Deems the achievement of performance targets in a single fiscal year and in the medium-to-long term to be of equal importance and sets performance indicators for annual bonuses and long-term incentives consistent with their respective objectives. The Company has designed these performance indicators to motivate directors and corporate officers to realize growth over not only a single fiscal year but also the medium-to-long term

- With particular emphasis on long-term incentives, sets indicators that can evaluate performance from the perspectives of both economic and social value, in order to maintain and improve corporate value

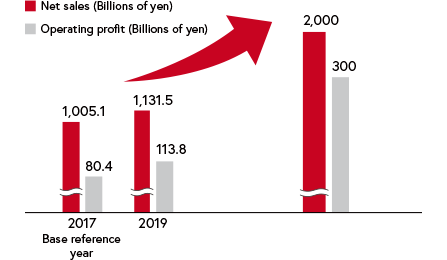

Shiseido’s Long-Term Incentive Plan for Motivating Management to Promote Growth over the Medium-to-Long Term

Aim of Introducing the Long-Term Incentive Plan

To establish effective incentives for creating and maintaining long-term corporate value and foster an awareness of the common interests we have with our shareholders, we have introduced performance share units, a type of performance-linked stock remuneration.

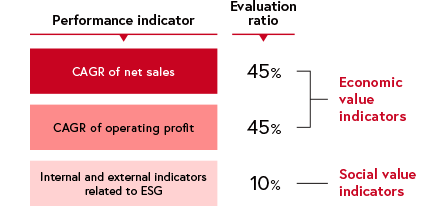

Performance Evaluation Indicators for the Long-Term Incentive Plan

The Company has set the long-term targets of net sales of ¥2 trillion and operating profit of ¥300 billion and recognizes that continuous and constant growth in sales and profits is necessary to achieve those targets. For this reason, we have established compound average growth rate (CAGR) as a performance indicator to improve economic value. We have also set internal and external performance indicators to improve and advance performance continuously from an ESG perspective, and we use these indicators as a mechanism for evaluating performance over a three-year period.

Furthermore, we have added consolidated return on earnings (ROE), an important indicator for shareholders, as a performance indicator for determining the payment rate threshold. If performance falls below the threshold, the Company does not pay the performance-linked component. Through these measures, we will ensure profits above a certain level while implementing investments for growth and robust decision-making. We also expect these measures to further heighten awareness among directors and corporate officers of the common interests we have with our shareholders.

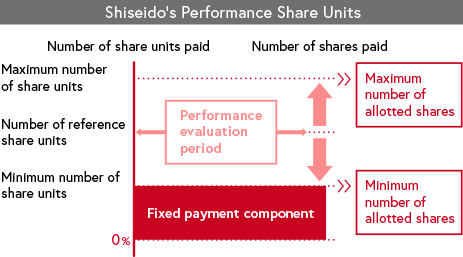

Performance Share Units

- Performance share units serve as a type of performance-linked stock remuneration whereby the Company allots a reference share unit to eligible parties and increases or decreases the number of units in accordance with the achievement rate for performance evaluation indicators during the evaluation period. The Company then pays to eligible parties shares of the Company’s stock or an equivalent monetary amount corresponding to the number of determined units. In this way, the system is suitable for fostering awareness of the Company’s share price and reflecting performance results in remuneration.

- The Company’s performance share units comprise two parts: a performance-linked component and a fixed payment component for the three-year performance evaluation period. As part of the performance-linked component, the Company pays shares after increasing or decreasing the number of reference share units in accordance with the compound average growth rate of both consolidated net sales and consolidated operating profit and with the achievement rates for ESG-related targets as a non-financial indicator. The fixed payment component is not linked to performance and is designed to foster an awareness of the common interests we have with our shareholders and secure and maintain superior personnel.

Share unit: units equivalent to shares after the evaluation period

Details of our Corporate Governance

- Company’s System for the Management and Execution of Business

- Process of Evolution

- Corporate Governance System

- Committees

- Evaluation of the Effectiveness of the Board of Directors

- Remuneration for Directors, Audit & Supervisory Board Members and Corporate Officers

- Audit Structure

- Compliance and Risk Management

- Internal Control Systems of the Company