Shiseido’s Growth Strategy

Shiseido’s Growth StrategyFinancial Strategy

In 2019, Shiseido was able to realize record-highs for net sales, operating profit, and net profit. In 2020, the final year of VISION 2020, we will push forward with our business activities while keeping a sharp focus on the future under the tough market conditions.

As I commence my second year as CFO with Shiseido, I will leverage the realizations I have made over the past year to further improve our business operations. Strengthening Shiseido’s real-time business analytics capabilities on a consolidated basis is one of the key priorities for my team in 2020. Our newly-established Business Transformation team is driving the design and gradual implementation of a globally shared IT platform. I can say with confidence that this new global platform, known as FOCUS, is a best-in-class system that offers standardized data and optimized processes. While having such capabilities is not necessarily a competitive advantage in today’s environment, the absence of advanced, real-time business analytics can be an impediment to reaching our next milestone if not addressed with urgency.

Outstanding people, processes and systems are all key enablers of our success and are critical to raising Shiseido’s overall performance and profitability to a level comparable with or ahead of our global peers. In order to promote our businesses at a speed that matches that of the changes in the business environment, we will become a data-enabled organization that is able to grasp global conditions in real time and accurately analyze data.

While forging ahead with FOCUS, we must remain conscious of the need to have a world-class team of finance professionals. With the aim of achieving an industry-leading cost structure, Shiseido is working to optimize its balance sheet, ensure disciplined cash allocation, and manage and improve its financial metrics. In 2020, we will continue to make the utmost effort to increase shareholder value.

Michael CoombsCorporate Officer

Chief Financial Officer

Improving Capital Efficiency

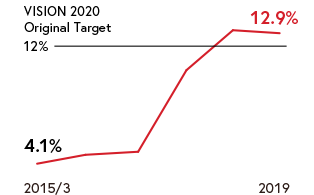

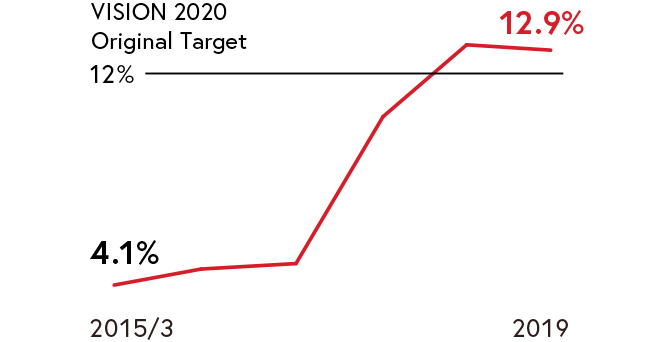

ROIC*1

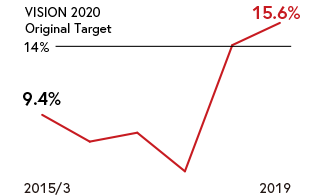

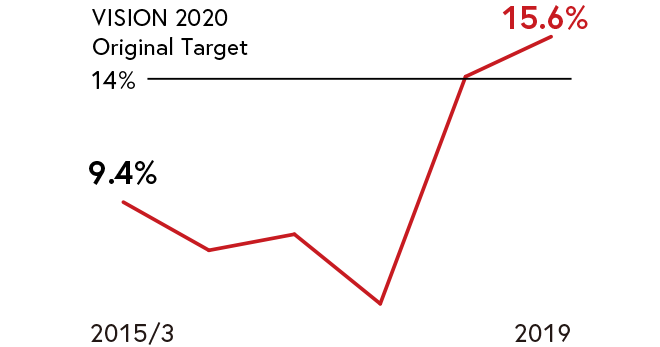

ROE

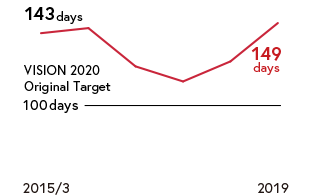

Cash Conversion Cycle*2

- ROIC (Return On Invested Capital) = Operating Profit × (1 – Effective Tax Rate) / (Interest-Bearing Debt + Equity)

- Cash Conversion Cycle (days) = Receivables Turnover Period (days) + Inventory Turnover (days) – Payables Turnover Period (days) (average of each indicator during the period is used)

In 2019, return on invested capital (ROIC) came to 12.9%, exceeding its VISION 2020 original target of 12% but representing a slight decline from the previous fiscal year due to the higher interest-bearing debt incurred from business acquisitions. Return on equity (ROE) was 15.6%, thereby also surpassing its VISION 2020 original target of 14%. As a result, both ROIC and ROE reached their targets ahead of schedule.

Meanwhile, we recorded a cash conversion cycle (CCC) of 149 days, which was longer than that of the previous fiscal year, owing to an increase in inventory. We will continue to do our utmost to establish a flexible production and supply capacity and achieve greater precision in our demand forecasts as we target a CCC of 100 days.

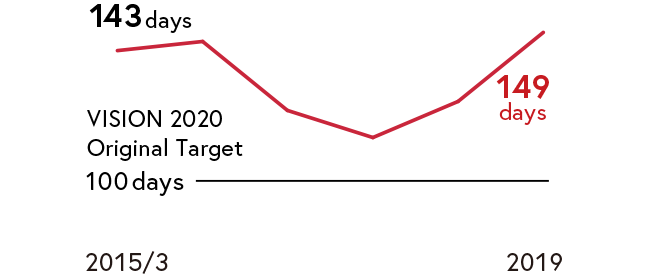

Unlocking Value across Our Business

Major System Transformation Under Way

We established our new Business Transformation Department in 2019 and are proceeding with the development of a globally standardized IT platform called FOCUS. This platform will allow us to pursue shorter order lead times, a more refined demand-forecasting process, and higher marketing ROI.

In addition to revamping and innovating our IT systems, FOCUS will help us change all of our processes at Shiseido by merging together various personnel, processes, and systems with the intent of realizing our long-term target operating margin of 15% and sustainable growth in the future. Through FOCUS, we will fine-tune our ability to create value in all of our business.

Toward an Ideal Profit Structure

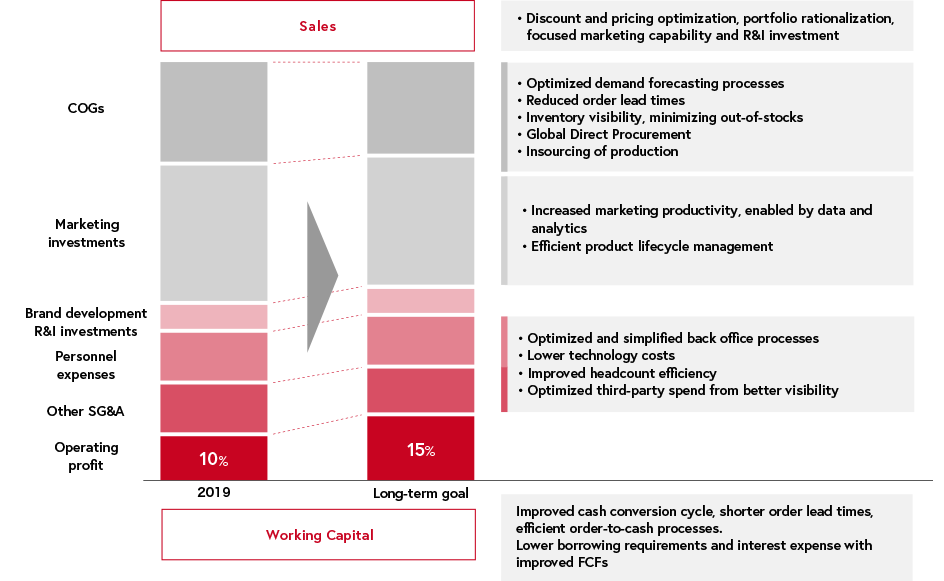

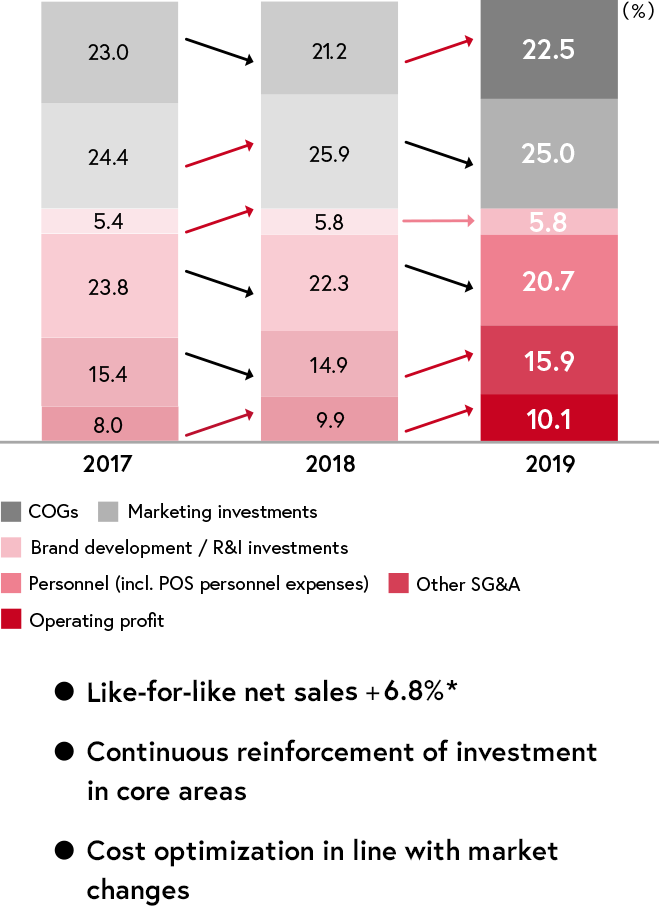

2019 Profit Structure

Excludes the impact of withdrawals from the amenity goods business in 2018 and the FERZEA and Encron brands in 2019, the application of U.S. accounting standard ASC 606 in 2019, and the acquisition of U.S. skincare brand Drunk Elephant

Shiseido is placing its highest priority on maximizing profits by maintaining sales growth. Our marketing ROI has improved thanks to our efforts in optimizing costs according to shifts in the market environment and shifting investments toward digital marketing, in addition to continuous strategic investments in core brands. In 2019, the cost of sales ratio expanded primarily due to a rise in inventory and costs associated with the construction of our Nasu Factory, while the proportion of costs accounted for by other SG&A expenses also climbed owing to an increase in logistics costs, among other factors.

With our sights set on achieving further growth in net sales and profitability, we will continue to step up our investments in priority areas such as marketing, brands, and research and innovation, and move forward with cost-control measures.

Aggressive Investment for Sustainable Growth

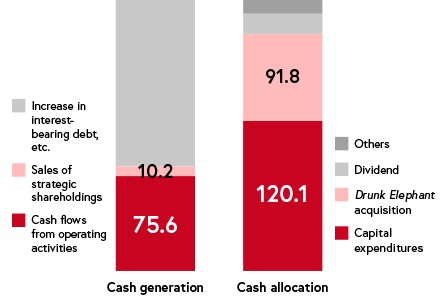

Cash Generation & Allocation (Billions of yen)

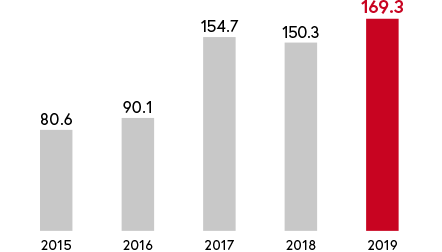

EBITDA (Billions of yen)

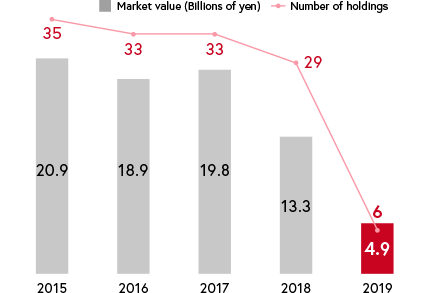

Strategic Shareholdings (Non-Consolidated, Listed Companies)

We solidly achieved the ability to generate cash through our businesses and realized a record-high EBITDA of ¥169.3 billion in 2019. In addition, we aggressively carried out investments with the goal of realizing long-term growth, such as through capital expenditures to boost our production capacity and the acquisition of U.S. skincare brand Drunk Elephant. At the same time, we have been gradually reducing strategic shareholdings to ensure more efficient use of capital, pursuant to the Corporate Governance Code. Going forward, based on a strict approach to cash allocation, we will continue to expand our cash generation capacity while stepping up investments geared toward sustainable growth, including investments to strengthen our supply structure, which has been an issue, and to promote the standardization of our IT systems on a global basis.

Achieving Steady Growth in the Americas and EMEA

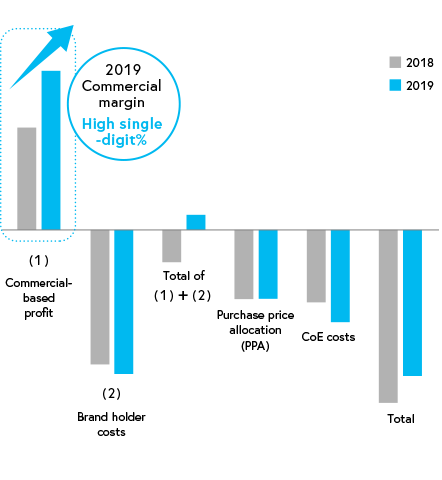

Americas Business Profit Structure*

Excluding Drunk Elephant

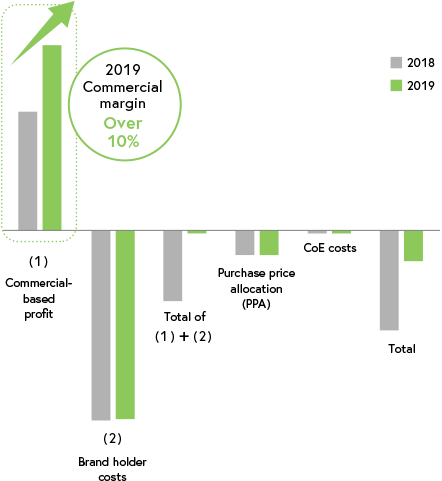

EMEA Business Profit Structure

Profitability in the Americas and EMEA Businesses, which we have been pursuing as a priority issue, is showing steady improvement. In the Americas Business, operating loss decreased by ¥3.4 billion year on year on a statutory basis. Commercial-based profit (1) rose substantially on the back of lower fixed costs due to structural reforms to bareMinerals as well as higher marketing ROI stemming from digitalization. Combining the higher aforementioned profit with brand holder costs (2) related to NARS, bareMinerals, Laura Mercier, and other U.S.-based brands, the Americas Business was able to return to profitability. Meanwhile, costs related to Centers of Excellence climbed as a result of strengthening global service functions such as the Technology Acceleration Hub, a research & innovation base for digital technologies.

In the EMEA Business, commercial-based profit (1) improved drastically owing to the favorable sales growth of fragrances. Combining this increased profit with brand holder costs (2) related to Dolce&Gabbana and other EMEA-based brands, the EMEA Business nearly reached the break-even point in terms of profitability, while operating loss therein improved by ¥5.8 billion year on year on a statutory basis.

Shareholder Return Policy

Realization of Total Returns Comprising Direct Income Gain and Medium-to-Long-Term Capital Gain

Please refer to the link below for Dividend Forecast for FY2020.

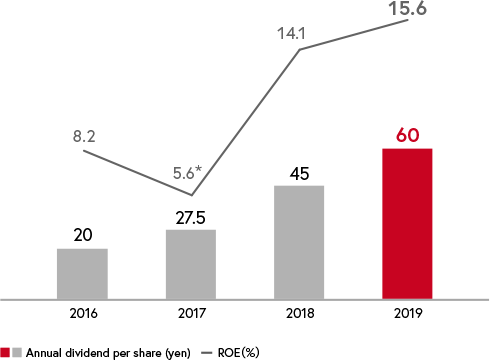

Dividend per Share and ROE

An impairment loss was recognized for Bare Escentuals, Inc.

To ensure that we maintain a single-A credit rating, which allows us to raise funds under advantageous terms, we target a debt-to-equity ratio of 0.3 and an interest-bearing debt to EBITDA ratio of 1.0. While doing so, we implement financing activities that support future growth in a timely manner using optimal methods taking into account the market environment and other factors. However, to realize an optimal capital structure that enables the pursuit of further improvements to capital efficiency, we may periodically revise these targets, as well as our shareholder return policy, in consideration of profitability and our ability to generate cash flows.

In regard to the Company’s shareholder return policy, we aim for total returns that comprise direct income gain and medium-to-long-term capital gain. Based on this approach, we will emphasize strategic investments toward sustainable growth and aim to maximize corporate value. Meanwhile, we intend to adopt a basic approach of enhancing invested capital efficiency while considering the cost of capital, in order to increase dividends and share price over the medium-to-long term. In determining dividends, we will focus on our consolidated business results and free cash flow as we work to realize stable and continuous shareholder returns over the long term that target a DOE (dividend on equity) ratio of 2.5% or higher. Also, we maintain an approach of flexibly buying back shares with consideration for the market environment.