Shiseido’s Growth Strategy

Shiseido’s Growth StrategyBusiness Strategy

On May 12, 2020, the Company withdrew its consolidated forecast for the fiscal year ending December 31, 2020.

A new forecast was disclosed on August 6, 2020, at the time of the second quarter results announcement.

Please refer to the link below for details.

Overview of the Three-Year Plan

2019 Results

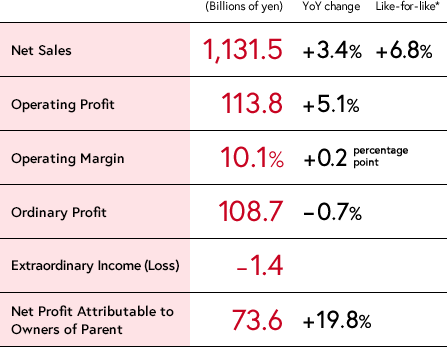

Achieving Record-High Net Sales, Operating Profit, and Net Profit

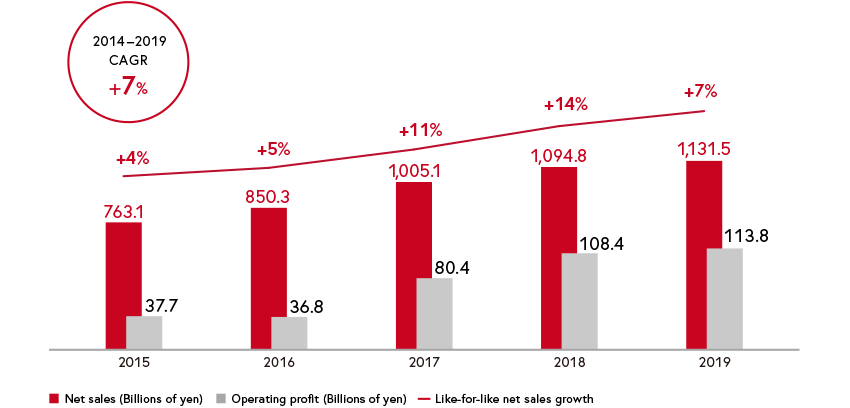

Regarding our consolidated business performance in 2019, despite the drastic changes and rising uncertainty in our business environment, net sales rose 3.4% year-on-year (6.8% like-for-like*), to ¥1,131.5 billion, driven by the growth of the prestige business, where we stepped up investments. Operating profit increased 5.1%, to ¥113.8 billion, and we

achieved our target operating margin of more than 10% ahead of the schedule established at the start of our medium-to-long-term strategy VISION 2020. Net profit attributable to owners of parent surged 19.8%, to ¥73.6 billion, on the back of higher operating profit and reduced tax expenses, resulting in record-high net sales, operating profit, and net profit.

FX-neutral, excluding the impact of withdrawals from the amenity goods business in 2018 and the FERZEA and Encron brands in 2019, the application of U.S. accounting standard ASC 606 in 2019, and the acquisition of U.S. skincare brand Drunk Elephant

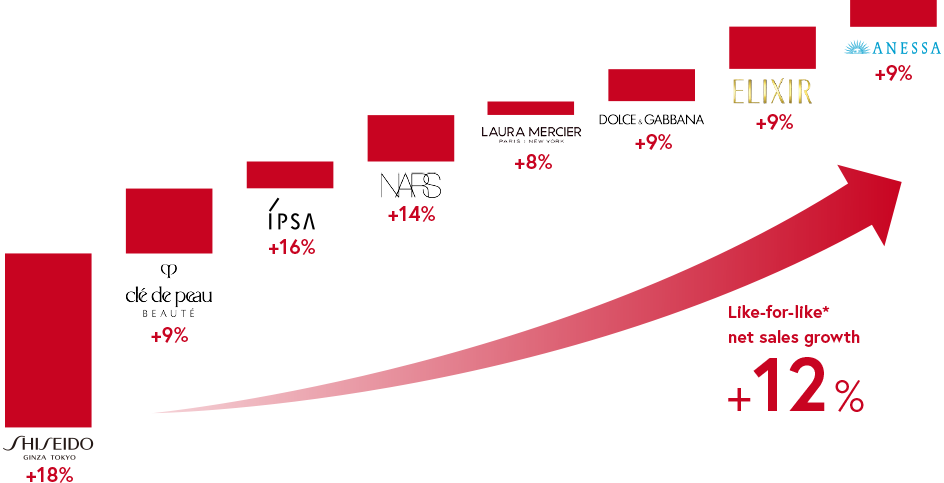

Prestige Brands Continue to Drive Growth

Accounting for nearly half of our consolidated net sales, prestige brands continue to act as a significant growth driver for our global business. Among these, brand SHISEIDO is offered in 85 countries and regions around the world and has grown into an over ¥200 billion brand. In addition, sales of our made-in-Japan cosmetics brands ELIXIR and ANESSA have continued to grow dramatically, particularly in Asia.

We will pursue further growth of our core brands through greater investments in marketing.

Achieving 12% Net Sales Growth from Eight Global Brands Combined

Excluding the impact of foreign currency exchange and the application of U.S. accounting standard ASC 606 in 2019.

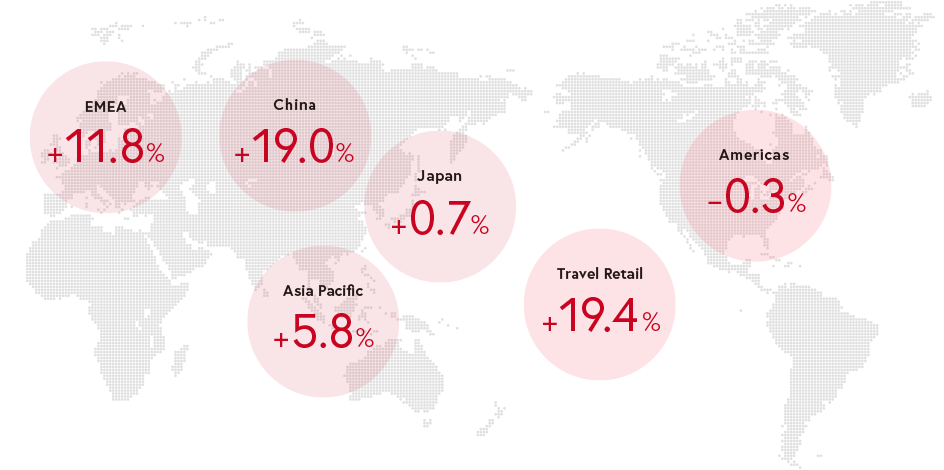

Delivering Steady Results in China, EMEA, and Travel Retail Businesses

In the Japan Business, amid reluctant consumer spending after the consumption tax hike and sluggish inbound demand, we continued to focus on our “skin trinity” of skincare, base makeup, and sun care. In the China Business, prestige brands and made-in-Japan cosmetics brands such as ELIXIR and ANESSA continued to perform remarkably despite the difficult situation in the Hong Kong market. The Travel Retail Business, meanwhile, continued to grow mainly in Asia, owing to active investments in marketing.

The EMEA Business achieved a double-digit increase in net sales on the back of robust growth in the skincare and fragrance categories, where we stepped up investments. In the Americas Business, in light of the severe market environment, we continued efforts to improve profitability, including the closure of unprofitable bareMinerals boutiques.

YoY Sales Growth (Like-for-Like*)

Excluding the impact of withdrawals from the amenity goods business in 2018 and the FERZEA and Encron brands in 2019, the application of U.S. accounting standard ASC 606 in 2019, and the acquisition of U.S. skincare brand Drunk Elephant.