Shiseido’s Growth Strategy

Data SectionFinancial and Non-Financial Highlights

Financial Highlights

Financial Value

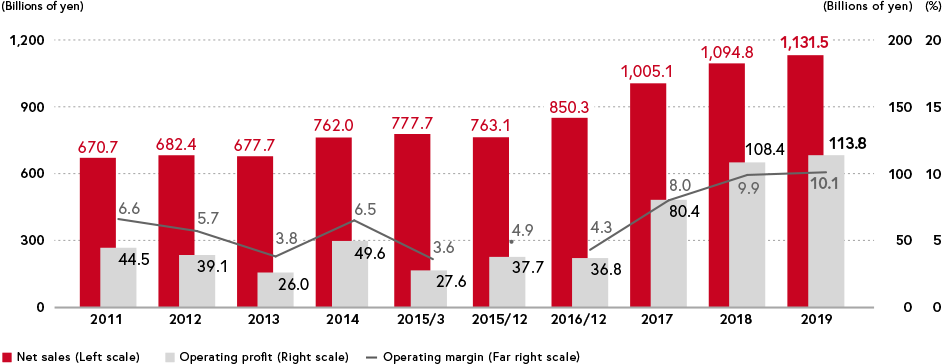

Net Sales, Operating Profit, and Operating Margin*1

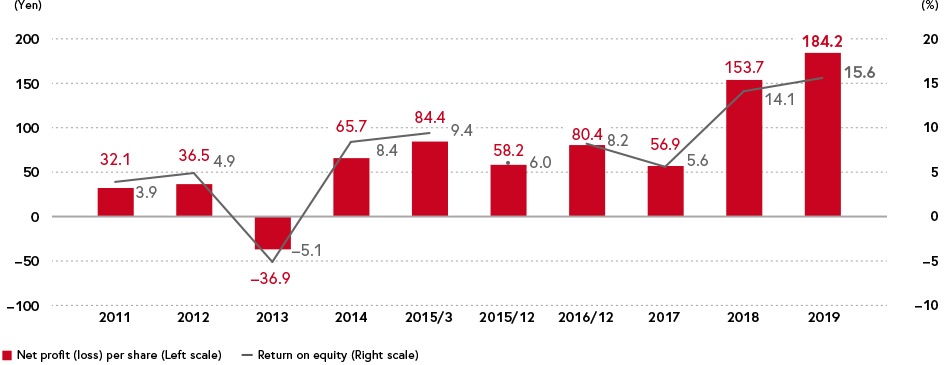

Net Profit (Loss) per Share*2 and Return on Equity*3 *4

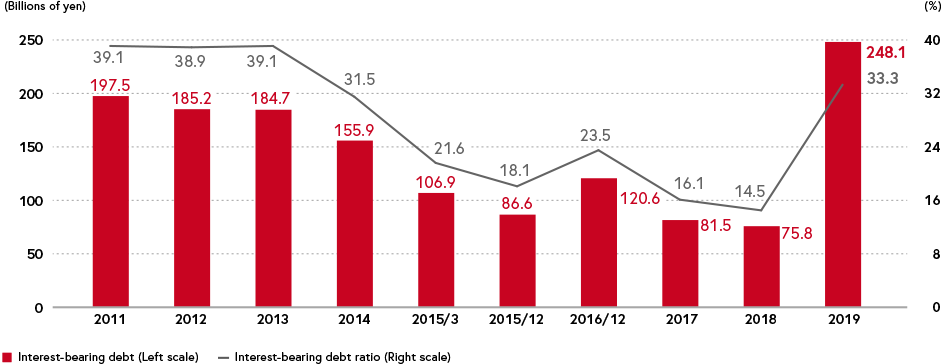

Interest-Bearing Debt and Interest-Bearing Debt Ratio*3 *5

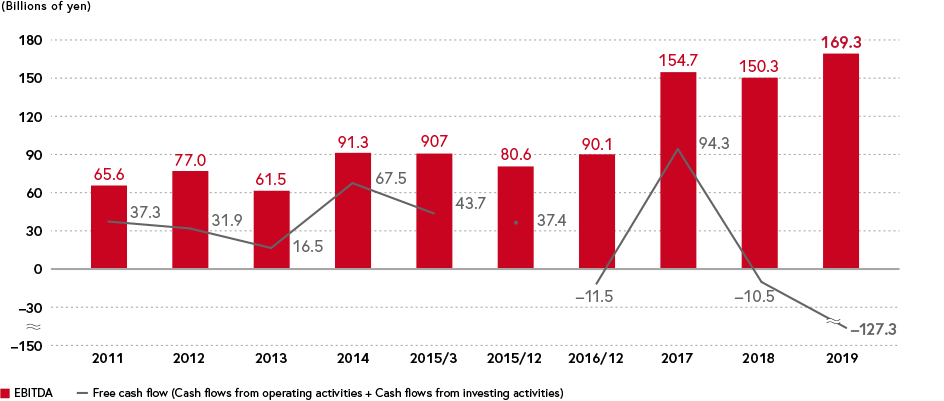

EBITDA*6 and Free Cash Flow

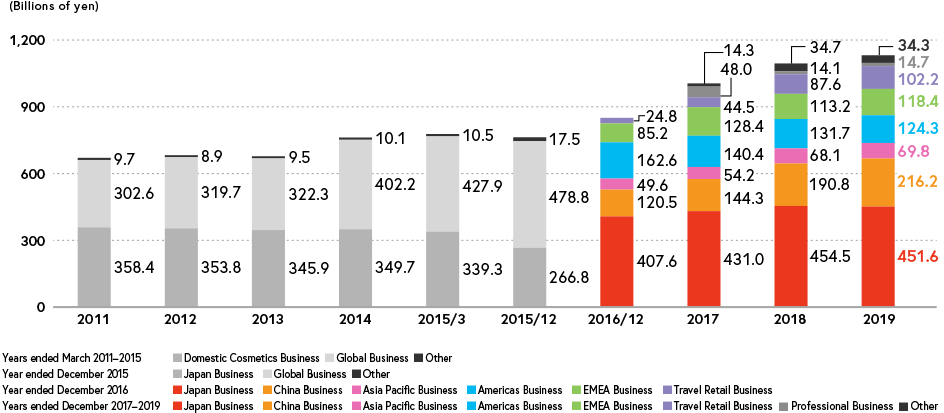

Net Sales by Reportable Segment*1 *7 *8 *10

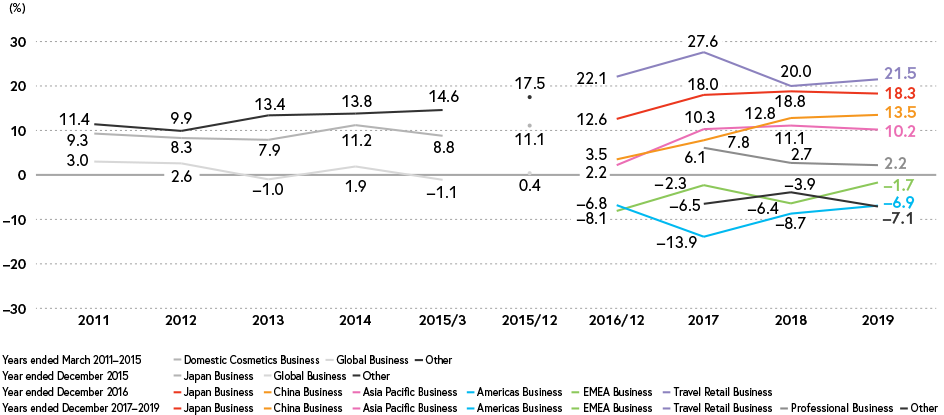

Operating Margin by Reportable Segment*1 *7 *9 *10

- The fiscal year ended December 31, 2015 is the nine months from April 1, 2015 to December 31, 2015 for Shiseido and its consolidated subsidiaries in Japan and the 12 months from January 1, 2015 to December 31, 2015 for all other subsidiaries.

- Net profit (loss) per share is calculated before dilution based on the average number of shares outstanding during the fiscal year.

- Shiseido Group subsidiaries in the Americas formerly recognized samples and promotional items associated with marketing activities at stores as assets when acquired and expensed them when shipped to customers. However, Effective from the year ended March 2012, these subsidiaries began to expense these items when acquired as part of the efforts to standardize Group accounting policies. The Shiseido Group applied this change retrospectively and restated the figures for the year ended March 2011 accordingly. Effective from the fiscal year ended March 31, 2014, certain subsidiaries of the Shiseido Group retrospectively adopted a new standard for Employee Benefits (IAS 19, amended June 16, 2011) and changed the method for recognizing changes in net defined benefit obligation. The Shiseido Group applied this change retrospectively and restated the consolidated financial statements for the fiscal year ended March 31, 2013, accordingly.

- Consolidated ROE for the fiscal period ended December 31, 2015 is calculated using consolidated net income attributable to owners of parent for the year as the numerator and the average of equity at March 31, 2015 and December 31, 2015 as the denominator.

- Interest-bearing debt ratio = Interest-bearing debt / Invested capital* *Invested capital = Interest-bearing debt + Equity

- EBITDA (Earnings before interest, tax, depreciation, and amortization) = Income (loss) before income taxes + Interest expense + Depreciation and amortization expense + Impairment loss on goodwill and other intangible assets

- Domestic Professional Division sales are included in the Global Business segment.

- Net sales by reportable segment represent sales to external customers only and do not include intersegment/interarea sales or transfers.

- Operating margin by reportable segment does not include eliminations/corporate.

- The Shiseido Group has revised its reportable segment classification method in line with its amended internal management structure, effective from fiscal 2019. Shiseido Beauty Salon Co., Ltd., formerly included in the Professional Business, is now positioned in the Other segment. Shiseido Astech Co., Ltd. and Hanatsubaki Factory Co., Ltd., which previously fell under the Japan Business, are now included in the Other segment. Effective from the third quarter of fiscal 2018, IPSA Co., Ltd., which had been included in the Japan Business, was moved to the Other segment in accordance with the change in the Group’s internal management structure. Segment data for fiscal 2018 reflect the above-mentioned change.

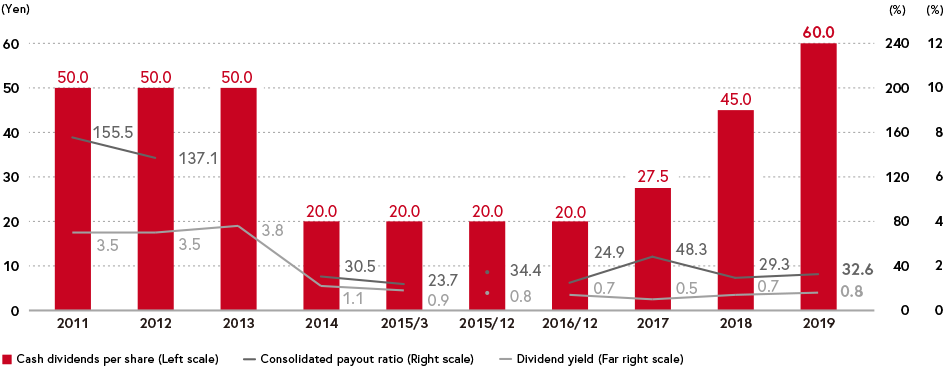

Shareholder Value

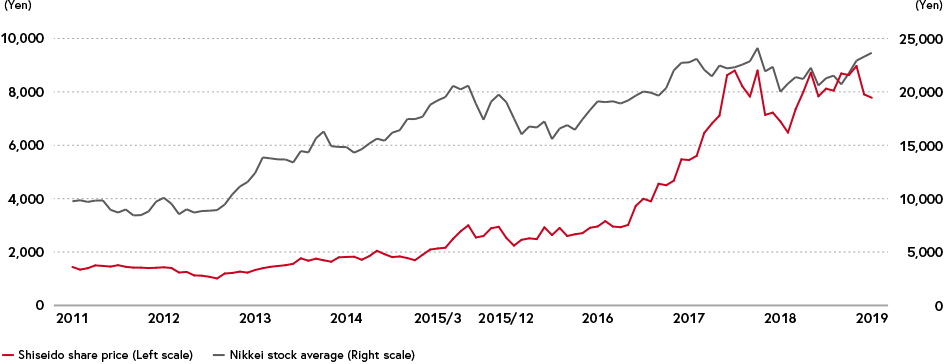

Shiseido Share Price*1 and Nikkei Stock Average

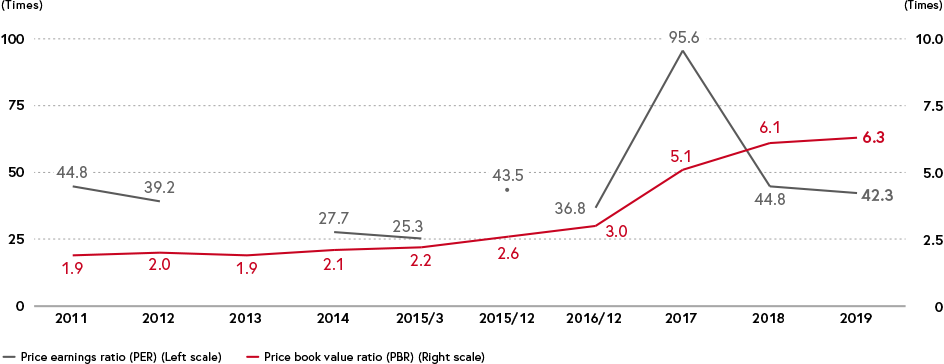

Price Earnings Ratio (PER)*2 *3 and Price Book Value Ratio (PBR)*4

Cash Dividends per Share, Consolidated Payout Ratio*2 and Dividend Yield*5

- Closing stock price at month-end

- PER and the consolidated payout ratio are not presented for the year ended March 2013 because of the net loss.

- Price earnings ratio = Closing stock price at fiscal year-end / Net profit per share

- Price book value ratio = Closing stock price at fiscal year-end / Net assets per share

- Dividend yield = Cash dividends per share / Closing stock price at fiscal year-end

Non-Financial Highlights

Human and Social Value

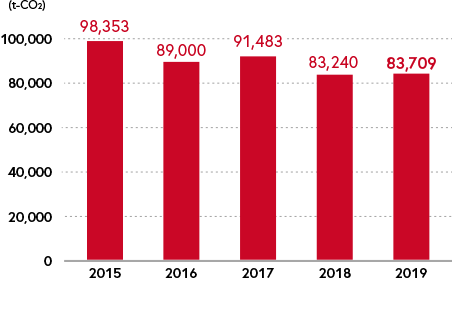

CO₂ Emissions*1 *2

In regard to CO₂ and other greenhouse gases, which are a cause of climate change, Shiseido is aiming to reduce emissions at its factories and across its entire business as it strives to mitigate climate change. In 2019, we utilized more sources of renewable energy at production bases in Japan and overseas.

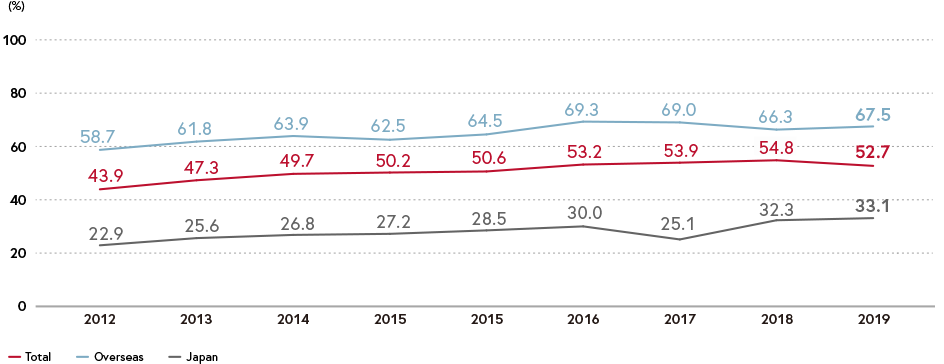

Female Leaders*3

Shiseido has been actively promoting women to positions of leadership. Overseas, over 60% of leadership positions have been held by females. In Japan, through further promotion of efforts that encourage the active role of female employees, Shiseido aims to raise the percentage of female leaders to 40% by the end of 2020.

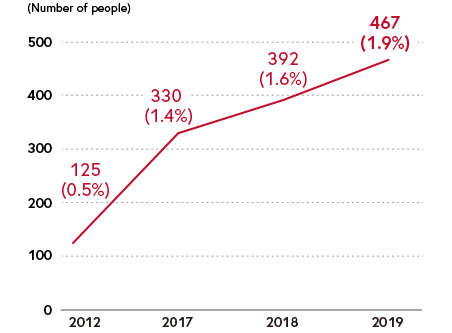

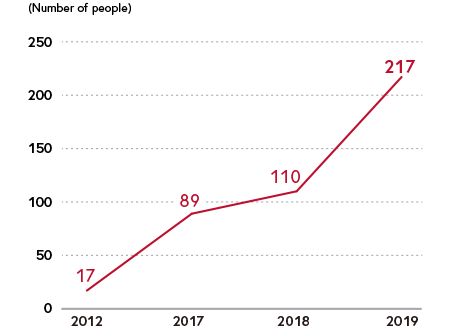

Number and Ratio of Non-Japanese Hires in Japan*4 *5

Mid-Career Hires in Japan*4 *5

Shiseido is strengthening the promotion of diversity because it believes that collaboration among employees with diverse ideas and values leads to new value. As such, the number of non-Japanese hires in Japan has been steadily increasing since the year ended March 2012. Shiseido is also emphasizing mid-career hiring, which has seen a significant increase in recent years.

- From the fiscal year ended December 31, 2015, Shiseido and its consolidated subsidiaries changed its fiscal year-end from March 31 to December 31. Accordingly, data for CO₂ emissions in 2015 covering the nine-month period from April 1, 2015 to December 31, 2015 has been converted on an annual basis.

- Ascertained performance / all domestic and overseas factories; all non-production sites in Japan; major non-production sites overseas.

- For the years ended March 2012 through March 2015, the percentage of female leaders is as of April 1 each year in Japan and January 1 each year overseas. For the period ended December 2015 and thereafter, the percentage of female leaders is as of December 31 for both Japan and overseas. In Japan, the definition for women in management positions is synonymous with that used by the Ministry of Health, Labour and Welfare.

- Shiseido Company, Limited

- Figures for the fiscal year ended March 2012 are as they were on March 31, 2012, and figures for the fiscal years ended December 2017 onwards are as they were on December 31 of those respective years.