Progress of the Evolution of Corporate Governance

The Shiseido Group (Shiseido or the Group) defines corporate governance as its "platform to realize sustainable growth by fulfilling its corporate mission," and is enhancing corporate governance to achieve the objectives of its medium-to-long-term strategy, VISION 2020. We began full-fledge initiatives toward strengthening corporate governance in 2001, and the ongoing reforms to date can be divided into three stages.

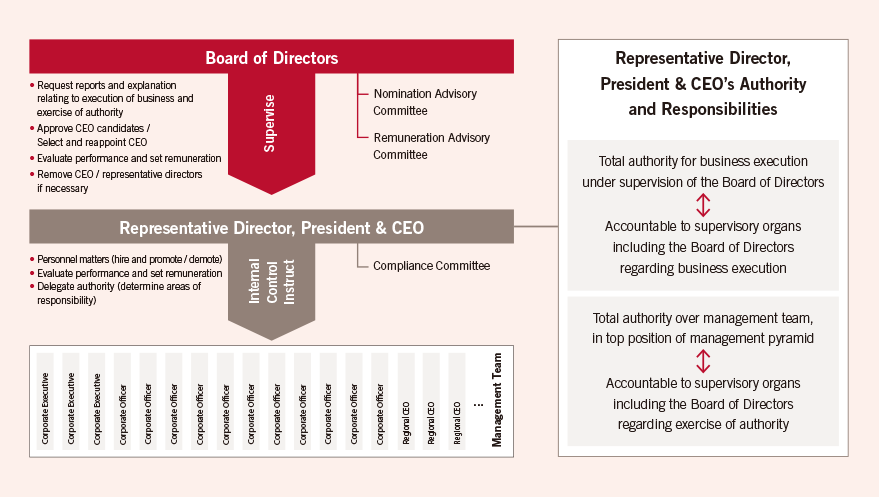

The first stage initiated corporate governance reform. Initiatives to separate the functions of management supervision and execution included the introduction of the corporate officer system. At the second stage, we implemented many initiatives for creating the framework of our corporate governance such as the establishment of the Nomination Advisory Committee and the appointment of external directors. In this way, we have set out objective quantitative and pro forma standards. We enhanced the quality of corporate governance by rigorously employing this framework and actively disclosing the outcomes. We have now begun the third stage, in which we are targeting corporate governance that furthers sustainable growth. We will achieve "tense collaboration" by balancing management oversight and supervision with the broad authority vested in the president and CEO, which he or she needs in order to exercise ultimate leadership of Shiseido's global management.

This tense collaboration does not excessively limit or decrease the CEO's authority, but rather establishes a process driven by full accountability of the CEO to the Board of Directors and other supervisory organs to regularly evaluate the CEO and management execution given the broad authority vested in the CEO. This process also sets a precedent for evaluations by the Nomination Advisory Committee and the Remuneration Advisory Committee, which are carried out on a regular basis.

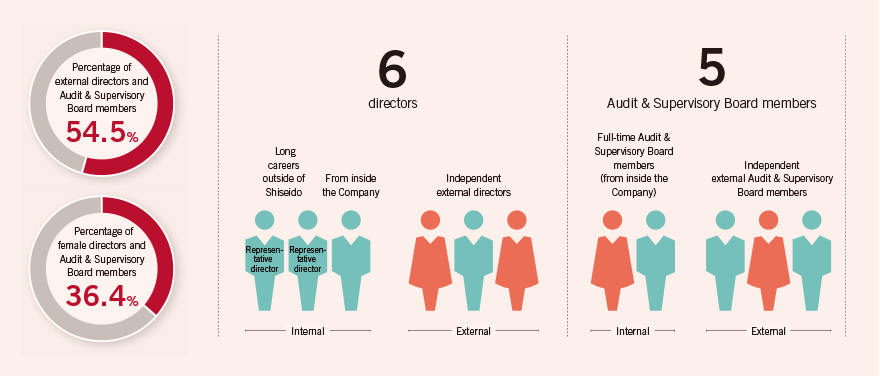

Shiseido's Governance by the Numbers

Directors and Audit & Supervisory Board Members (As of April 1, 2018)

Corporate Governance System

Basic Policy

The Group, including Shiseido Company, Limited (the Company), sets out "to inspire a life of beauty and culture" as its corporate mission, and defines corporate governance as its "platform to realize sustainable growth by fulfilling its corporate mission." We strive to maximize medium-to-long-term corporate and shareholder value by implementing and reinforcing corporate governance to maintain and improve management transparency, fairness, and speed, and through dialogue with all stakeholders from consumers, business partners, employees, and shareholders to society and the earth. At the same time, by fulfilling its responsibilities as a member of society, Shiseido works to optimize the value it delivers to respective stakeholders.

Reason for Choosing the Current Structure

The Company has selected the framework of a company with an Audit & Supervisory Board structure with double check functions for business execution: supervision by the Board of Directors and audits of legality and adequacy by Audit & Supervisory Board members. In order to maintain and improve management transparency, fairness, and speed as per the basic policy for corporate governance, the Company has reinforced the supervisory function of the Board of Directors by incorporating outstanding functions including those of a company with nominating committee, etc.

Effective January 2016, Shiseido committed to a new matrix organization encompassing five brand categories and six regions. Under this organization, the Company serves as the global headquarters responsible for providing overall supervision of the Group and the support it requires, and is promoting localization of responsibility and authority by delegating much of the authority formerly exercised by the Company to respective regional headquarters for Japan, China, Asia Pacific, the Americas, EMEA, and Travel Retail. The Board of Directors frequently discussed issues including the composition and operation of the Board of Directors to determine an ideal corporate governance system, premised on this organization and management structure. As a result, the Board of Directors concluded that adopting a monitoring board structure would be appropriate for ensuring adequate overall supervision of Shiseido. Accordingly, the Company has been implementing monitoring board corporate governance while leveraging the advantages of being a company with an Audit & Supervisory Board.

Diversity of Directors and Audit & Supervisory Board Members

The Company believes that the Board of Directors of the Company should be composed of directors with various viewpoints and backgrounds, on top of diverse and sophisticated skills, for effective supervision over the execution of business as well as decision-making on critical matters. Furthermore, the Company believes that Audit & Supervisory Board members should have the same diversity and sophisticated skills as the directors, as they have a duty to attend meetings of the Board of Directors and state opinions as necessary.

When considering diversity, the Company selects candidates based on their personality and insight regardless of attributes such as gender, age, and nationality in order to stress diversity of these attributes as well as diversity in terms of competencies including professional skills and experience in various fields related to business management.

In addition, the Company has set term limits for external directors and external Audit & Supervisory Board members so that management can benefit from views that are not bound by the Company's existing structures, and ensures appropriate transition to newly appointed external directors and external Audit & Supervisory Board members by allowing a handover period from those who have served for an extended period.

Management Supervision System

Ratio of External Directors on the Board of Directors

The Company's articles of incorporation limit the number of directors to 12. The Company considers issues including business portfolio and scale in electing the optimum number of directors to appropriately supervise management.

The Company shall have at least three external directors to ensure that they have a certain degree of influence within the Board of Directors. The Company has established a target of making at least half of the directors external.

Independence is an emphasis in selecting external directors and Audit & Supervisory Board members. In principle, external director and Audit & Supervisory Board member candidates must meet the Company's criteria for independence and have an independent mindset.

-

Criteria for Independence

of External Directors and

Audit & Supervisory

Board Members

(Summary) -

- Not a person who is or has ever been responsible for executing the business of the Company or its affiliated companies (collectively, the Shiseido Group)

- Not a person for whom the Shiseido Group is or has ever been a major client or a person who has executed business for an entity for which the Shiseido Group is or has ever been a major client

- Not a person who is or has ever been a major client of the Shiseido Group or a person who has executed business for an entity that is or has ever been a major client of the Shiseido Group

- Not a person who executes or has ever executed business for an entity in which the Shiseido Group is a major shareholder

- Not a person who is or has ever been a major shareholder of the Company or a person who has executed business for an entity that is or has ever been a major shareholder of the Company

- Not a professional such as an attorney or a consultant who has received a large amount of money from the Shiseido Group

- Not a person who is receiving or has ever received a large donation from the Shiseido Group or a person who has executed business for an entity that is receiving or has ever received a large donation from the Shiseido Group

- Not a person who is or has ever been an accounting auditor of the Company or a person who has belonged to an entity that is or has ever been an accounting auditor of the Company

- Not a spouse or close relative of any person excluded above

- Not a person affiliated with a company that reciprocally appoints a director or Audit & Supervisory Board member from the Shiseido Group

- Not a person who could otherwise be reasonably judged unable to fulfill the duties of an independent director or independent Audit & Supervisory Board member

(Please refer to the Corporate Governance Report available at Shiseido's corporate website for details.)

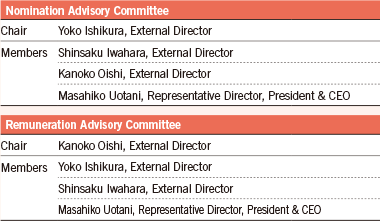

Committees

Basic Policy

With a view to promoting transparency and objectivity in management, the Company has established two committees to advise the Board of Directors: the Nomination Advisory Committee, which makes recommendations on director and corporate officer candidates and promotions; and the Remuneration Advisory Committee, which makes recommendations on executive remuneration and performance evaluation standards. Both committees are chaired by external directors to ensure objectivity.

Furthermore, the Compliance Committee has been established as a committee that reports directly to the CEO. It collaborates with compliance organizations at the six regional headquarters and provides overall direction for activities that improve corporate quality, including the promotion of legal compliance, fair business practices, and risk countermeasures. Committee members are selected from across the Group and include the heads of each region.

Evaluation Working Group

Within the Company's corporate governance, there is a need to appropriately concentrate authority in the CEO while maintaining a strong oversight function to counterbalance that authority. Accordingly, the Company has established the Evaluation Working Group as a shared organization of the Nomination Advisory Committee and the Remuneration Advisory Committee to discuss and consider matters relating to the CEO, including reappointment and replacement. The Evaluation Working Group conducts performance evaluation that includes a personal evaluation of the CEO, and confirms the appropriateness of the CEO's remuneration. In this way, the Evaluation Working Group comprehensively oversees the CEO from two aspects: appointment and dismissal, and incentives. To emphasize its independence from the CEO and the CEO's business execution framework, the Evaluation Working Group consists solely of external directors and external Audit & Supervisory Board members.

Members of the Nomination Advisory Committee and the Remuneration Advisory Committee

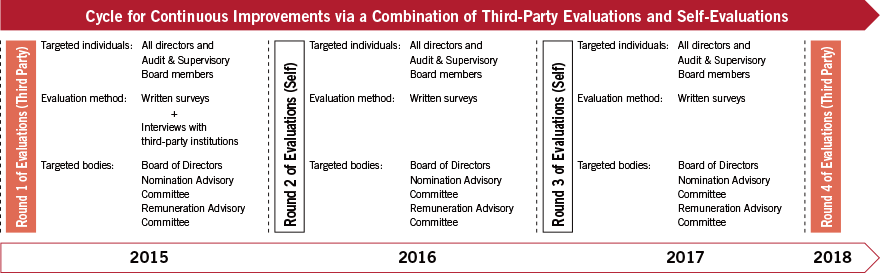

Evaluation of the Effectiveness of the Board of Directors

Basic Policy

With the aim of evaluating the effectiveness of the Board of Directors, the Company has in place a policy of regularly identifying issues related to enhancing the effectiveness of the Board of Directors, the Nomination Advisory Committee, and the Remuneration Advisory Committee and confirming the status of efforts to resolve such issues. To incorporate an objective evaluation and analysis from a standpoint that is independent from the Company, third-party evaluations are conducted once every three years. The Company confirms the status of efforts to resolve issues identified through these third-party evaluations, and conducts self-evaluations during the years between third-party evaluations to determine specific initiatives to undertake each year.

Changing the Awareness of Issues

Initiatives Determined through the 2015 Evaluation

- Narrow down agenda items at Board meetings to focus on truly important matters

- Enhance the provision of information to the external directors

- Clarify the functions and authority of both advisory committees

- Expand the task diversity of the Board of Directors

- Develop succession plans for the CEO

- Develop succession plans for the external directors

Initiatives Determined through the 2016 Evaluation

- Narrow down agenda items at Board meetings to focus on truly important matters (ongoing)

- Enhance the provision of information to the external directors (ongoing)

- Strengthen communication between the external directors and the Audit & Supervisory Board

- Develop succession plans for the CEO (ongoing)

- Clarify the functions and role of the Audit & Supervisory Board amid the transition to a monitoring board structure

Initiatives Determined through the 2017 Evaluation

- Develop succession plans for the CEO (ongoing)

- Reconfirm the importance of external directors and develop succession plans

- Ensure even higher levels of diversity for the Board of Directors

- Strengthen communication between the external directors and the Audit & Supervisory Board (ongoing)

- Enhance the secretariat system for the Board of Directors and both advisory committees and strengthen collaboration with the secretariat of the Audit & Supervisory Board

- Enhance the provision of information to the Audit & Supervisory Board regarding both advisory committees

Ongoing Initiatives—Developing Succession Plans for the CEO, External Directors and External Audit & Supervisory Board Members

Within the evaluations of the effectiveness of the Board of Directors, the Company determined that the development of succession plans for the CEO is a task that should be continuously examined by the Board of Directors, the Nomination Advisory Committee, and the Remuneration Advisory Committee. The Company believes that the CEO should have the responsibility and authority to select his or her own successor and that the CEO should be in charge of drafting succession plans. In addition, the Nomination Advisory Committee, which is responsible for certain functions of the Board of Directors, should receive sufficient reports from the CEO regarding the details of the succession plans and the candidates chosen. After the exchange of opinions, the committee should provide feedback to the CEO, evaluating the candidates chosen from an independent standpoint and examining their appropriateness based on management issues the Company is facing.

In addition, the evaluations of the effectiveness of the Board of Directors have highlighted the need for developing succession plans for external directors and external Audit & Supervisory Board members, who play an essential role in monitoring the Company's management. The Company believes that the development of succession plans, which should include oversight on various conditions pertaining to term of office and clear criteria for successor candidates, is an issue that should be constantly on the agenda of the Nomination Advisory Committee rather than something only addressed prior to the succession event.

Remuneration for Directors, Audit & Supervisory Board Members,

and Corporate Officers

Overview of the Policy for Remuneration for Directors, Audit & Supervisory Board Members, and Corporate Officers

The Company regards the remuneration policy for directors, Audit & Supervisory Board members, and corporate officers as an important matter for corporate governance. The policy is therefore designed by the Remuneration Advisory Committee, chaired by an external director, based on the following basic philosophy while incorporating objective points of view.

Remuneration for directors and corporate officers consists of basic remuneration and performance-linked remuneration. The Company sets appropriate remuneration levels by making comparisons with companies in the same industry or of the same scale in Japan and overseas, taking the Company's financial condition into consideration.

External directors and Audit & Supervisory Board members receive only basic remuneration, as fluctuating remuneration such as performance-linked remuneration is inconsistent with their supervisory functions from a stance independent from business execution. Shiseido also abolished its officers' retirement benefit plan as of June 29, 2004, the date of the 104th Ordinary General Meeting of Shareholders.

- The remuneration policy

for directors, Audit &

Supervisory Board

members, and corporate

officers shall -

- contribute to realizing the corporate mission;

- be designed to provide the amount of remuneration commensurate with the Company's capability to secure and maintain superior personnel;

- be designed to reflect the Company's medium-to-long-term business strategy, and to strongly motivate directors, Audit & Supervisory Board members, and corporate officers eligible for remuneration to achieve medium-to-long-term growth;

- have a mechanism incorporated to prevent wrongdoing and overemphasis on short-term views; and

- be designed to be transparent, fair, and reasonable from the viewpoint of accountability to stakeholders including shareholders and employees, and shall ensure these points by determining remuneration through appropriate processes.

Director, Audit & Supervisory Board Member, and Corporate Officer Remuneration Policy for the Three Years from 2018 to 2020

The Company positions the three years from 2018 to 2020 as a period in which it will pursue new strategies to accelerate growth.

The three-year period from 2015 to 2017 was positioned as a time for the Company to rebuild its business foundation. Accordingly, the remuneration policy for directors and corporate officers for these three years was designed to motivate directors and corporate officers to lead this transformation by implementing drastic reforms. The policy also included an incentive for directors and corporate officers to strategically tackle issues that may require actions that may negatively impact business performance in the short term but must be resolved in order to realize growth over the long term.

From 2018, the Company will continue to undertake efforts in structural reforms while working to create a virtuous cycle that will help accelerate growth. This will essentially involve adhering to the business structure prevailing up through 2017, while on the other hand revising the remuneration scheme to place more focus on the notion of "pay linked to the corporate mission," which constitutes a step beyond the notion of "pay for performance" whereby remuneration paid to a corporate officer and director reflects his or her accomplishments. Under the notion of "pay linked to the corporate mission," the Company will evaluate the extent to which long-term strategies reflecting its management approach and corporate philosophy have been achieved, in addition to considering net sales, operating income, and other quantitative financial results.

Under the new remuneration policy, the Company has increased the maximum rate of the annual bonus payment, meaning that its officers are now eligible for a larger annual bonus payment than before in the event that growth achieved greatly exceeds the objectives. Also, the long-term incentive-type remuneration, another component of performance-linked compensation, now involves providing stock compensation that is equivalent in monetary value to the annual bonus in principle. As such, performance-linked compensation as a whole is now more substantially linked to performance, given that the maximum rate of the annual bonus payment has been increased.

• Basic Remuneration

Basic remuneration corresponds to each officer's role grade, which is based on the scale and scope of responsibilities and impact on Group management. Moreover, basic remuneration may increase within the same role grade within a designated range in accordance with the performance of respective directors or corporate officers in the previous fiscal year in terms of numerical business performance and personal performance evaluation. This mechanism allows the Company to adjust basic remuneration in light of the achievements of respective directors and corporate officers.

The Company will continue to pay external directors and Audit & Supervisory Board members fixed basic remuneration with no variable component as under the previous system.

• Annual Bonus

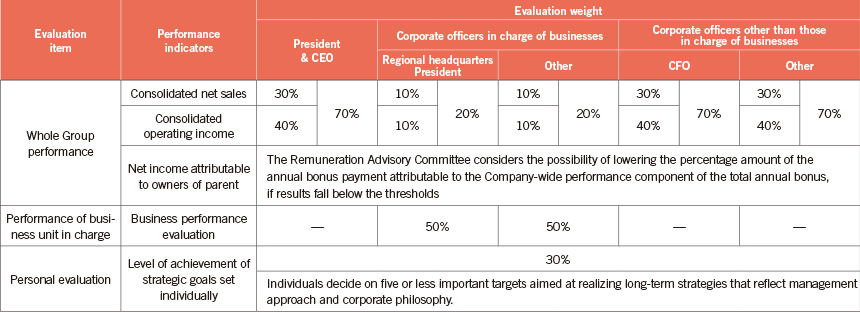

The Company has determined evaluation items for the annual bonus linked to performance in accordance with the scope of responsibilities of the respective director or corporate officer as described in the table on the next page. The achievement rates for consolidated net sales and consolidated operating income targets are common performance indicators used for all directors and corporate officers. Although, on the one hand, it is essential that the entire management team remains aware of matters involving net income attributable to owners of parent, on the other hand, it is crucial that management not let such a benchmark weigh too heavily on proactive efforts particularly involving future growth-oriented investment. As such, after deliberations by the Remuneration Advisory Committee, the Company has provisionally established certain standards (thresholds) as described in the table above, with the evaluation framework designed so that the Remuneration Advisory Committee will consider the possibility of lowering the percentage amount of the annual bonus payment attributable to the Company-wide performance component of the total annual bonus, if results fall below the thresholds. In addition, as was the case for remuneration policy up to 2017, the Company has set personal performance evaluation components for all directors and corporate officers to provide a standard for evaluating the level of achievement of strategic goals in initiatives that cannot be measured with financial performance data, such as rebuilding the business foundation for sustainable growth.

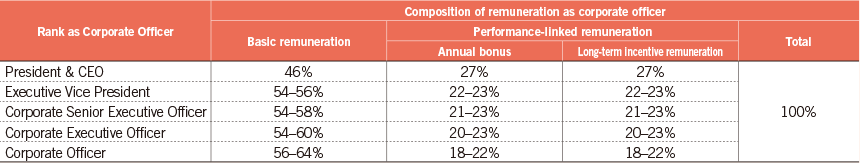

Proportion of Remuneration by Remuneration Type for Each Rank of Director

- 1. In this model, the basic remuneration amount is the median in the applicable role grade, and the achievement rate related to performance-linked remuneration is 100%.

- 2. There is no difference in the proportion of remuneration by remuneration type applied to directors based on whether a director has representation rights.

- 3. Because different remuneration tables will be applied depending on the role grade of respective directors and corporate officers, proportion of remuneration by remuneration type will vary even within the same rank.

- 4. Separate compensation paid to a director who serves as the chairman of the Board is not included in this table.

Evaluation Weights of Annual Bonus for Directors

There is no difference in the performance indicators and the weight of those indicators applied to directors based on whether a director has representation rights.

• Long-Term Incentive-Type Remuneration

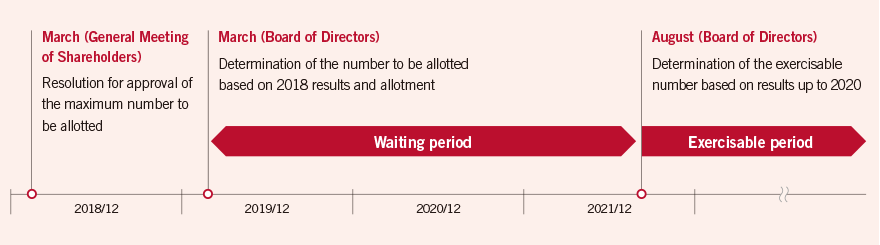

The Company has imposed performance terms and conditions on the stock compensation-type stock options included in performance-linked remuneration. The limits on this long-term incentive-type remuneration apply on two occasions: when the stock acquisition rights are allotted, and when the allotted stock acquisition rights have vested.

When actually allotting the stock acquisition rights after obtaining approval for the maximum number of stock acquisition rights to be allotted at the General Meeting of Shareholders, the Company shall increase or decrease the number of stock acquisition rights to be granted in the range of 0 to the maximum by using the performance indicators for annual bonuses for the preceding fiscal year. In addition, the Company has introduced a mechanism when the stock acquisition rights vest that limits the exercise of stock acquisition rights to 30 to 100 percent of the allotted number, according to consolidated results and other indicators up to the preceding fiscal year. The Company is thereby enhancing the incentive to improve medium-to-long-term business performance and achieve targets.

In 2018, the Company will continue to provide performance-linked stock options under its long-term incentive-type remuneration scheme, but it will also keep considering the possibility of shifting to a stock compensation approach that would be better tailored to its remuneration philosophy.

- Terms and Conditions

Regarding Performance on

Long-Term Incentive-Type

Remuneration -

When stock acquisition rights are allotted:

- Use the same consolidated results data (net sales, operating income, and net income attributable to owners of parent), evaluation of responsibility for business performance, and personal performance evaluation that are employed in calculating the annual bonus for each officer.

- Determine the number of stock acquisition rights to be allotted based on deliberation by and resolution of the Board of Directors.

When the stock acquisition rights vest:

- Calculate the operating income growth rate by comparing operating income for the fiscal year preceding the fiscal year in which the stock acquisition right allotment date is included with the subsequent fiscal year.

- Calculate the operating income growth rates for the same fiscal years as above for international cosmetics industry sales leaders including Kao Corporation (Japan), L'Oreal S.A. (France), and Estée Lauder Companies Inc. (U.S.A.), which have been designated in advance for peer comparison.

- Decide the number of stock acquisition rights allotted to each director or corporate officer exercisable by comparing the operating income growth rate of the Company with its designated peers.

Schedule of Allotment and Exercise of Long-Term Incentive-Type Remuneration

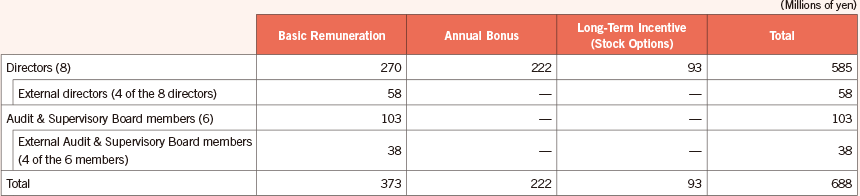

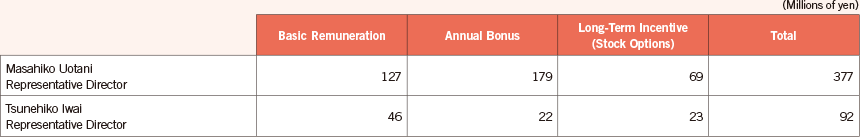

Remuneration for Directors and Audit & Supervisory Board Members for the Year Ended December 2017

- 1. The total of the above basic remuneration and annual bonus for directors has the ceiling amount of ¥2.0 billion or less (including a total of ¥0.2 billion or less for external directors) as per the resolution of the 118th Ordinary General Meeting of Shareholders held on March 27, 2018. Basic remuneration for Audit & Supervisory Board members has the ceiling amount of ¥10 million per month as per the resolution of the 105th Ordinary General Meeting of Shareholders held on June 29, 2005.

- 2. The amount of long-term incentive-type stock options indicated above represents the expenses for the year ended December 2017 associated with stock options (stock acquisition rights) granted, upon the approval of the Ordinary General Meeting of Shareholders, in consideration of duties executed by directors.

- 3. In addition to the above payments, ¥16 million was recognized for the year ended December 2017 as expenses associated with stock options granted to one director when that director was a corporate officer, not a director.

- 4. None of the directors or the Audit & Supervisory Board members will be paid remuneration other than the executive remuneration described above (including remuneration described in Notes 1 through 3, above).

Remuneration by Type to Representative Directors and Directors Whose Total Remuneration Exceeded ¥100 Million for the Year Ended December 2017

- 1. The amount of long-term incentive-type stock options indicated above represents the expenses for the year ended December 2017 associated with stock options (stock acquisition rights) granted, upon the approval of the Ordinary General Meeting of Shareholders, in consideration of duties executed by directors.

- 2. Neither of the two directors above will be paid remuneration other than the remuneration described above.

Risk Management and Compliance

Compliance Committee

The Company has established the Compliance Committee as a committee that reports directly to the CEO. This committee oversees all areas in which Shiseido should fulfill its social responsibilities. In addition to accurately assessing social changes and in-house conditions, identifying main causes of management risks, and deliberating and approving measures to prevent or mitigate risks, the committee reports incidents where risks have occurred and examines measures to prevent recurrence. Furthermore, the committee reports whistle-blowing matters and matters raised for consultation, considers measures to fundamentally improve the workplace culture, monitors compliance-related activities, and examines issues that need to be improved. As risk management relates closely with the characteristics of the industry in which the Company operates and the business model it employs, as well as with the Company's management strategies, the Compliance Committee reports directly to the CEO, who bears the most responsibility for business execution, and submits reports to the Board of Directors when necessary.

Risk Monitoring by the Board of Directors

Monitoring risk on a Group-wide basis is an important matter toward which the Board of Directors should focus its efforts. The Board of Directors receives reports on the main causes of risks identified by the Compliance Committee and provides feedback on the measures the committee has developed to prevent and mitigate risks. Also, in regard to individual matters reported and strategies proposed, the Board of Directors holds discussions on the prerequisites of individual issues, the level of risk tolerance, and maximum risk limits to confirm whether or not risks are being considered in an appropriate manner. Through these means, the Board identifies management risks, implements measures to prevent and mitigate such risks, and works to realize an adequate level of risk taking.

In addition to receiving reports and proposals on individual matters and reports from the Compliance Committee, the Board of Directors compiles information related to risk through the exchange of information with the Audit & Supervisory Board. This information helps the Board realize highly effective risk monitoring.

Revised List of Major Risks

Among items pertaining to its business and financial conditions, the Company revises the list of risks it believes could impact its financial or business performance in a timely fashion based on examinations made by the Compliance Committee. In undertaking these revisions, the Company not only determined the necessity of existing risk items and additional risk items, it also revised the level of priority given in the event a risk should occur based on the significance of a given risk's impact.

At the time that this annual report was published, the Company believed that, in light of conditions surrounding its business in 2017, the following items have the potential to significantly impact the decision-making of investors.

- Business Risks

-

- Consumer Services

- Quality Control

- Strategic Investment Activities

- Information Security Risks

- Competitive Environment of the Cosmetics Industry

- Responding Appropriately to Market Needs

- Specific Business Partners

- Operational Risks

- Hiring and Developing Talented Human Resources

- Consideration for the Environment and Human Rights

- Material Litigation

- Regulatory Risks

- Raw Material Price Fluctuations

- Exchange Rate Fluctuations

- Share Price Fluctuations

- Geopolitical Risks

- Natural Disasters and Accidents

- Decrease in Brand Value

Please see "Business and Other Risks" for details.

Whistle-Blowing System

To discover issues that violate laws, the articles of incorporation, or other regulations within Shiseido and to promptly correct such issues, the Company has established the Compliance Committee Hotline to serve as a means of reporting compliance-related issues. In addition, the Company has set up hotlines at each Group company, where employees in charge of corporate ethics promotion act as a contact for whistle-blowing and consultations. In the Japan region, the Company has established one hotline as an internal point of contact staffed by in-house counselors and another as an external point of contact staffed by out-of-house counselors. The Company has also created the Reporting E-mail to Audit & Supervisory Board Members that allows for direct reports to the Audit & Supervisory Board members, and is pursuing efforts to make all of these hotlines well-known among its employees.

To secure the effectiveness of these whistle-blowing systems, the Company has developed internal regulations to ensure that directors, Audit & Supervisory Board Members, corporate officers, and employees are not dismissed, discharged from service, or receive any other disadvantageous treatment due to reporting or seeking consultation on compliance-related issues. The Company is also taking steps to make these regulations well-known.