EMEA Business

- TOP

- Strategy by Region

- EMEA Business

Accelerating the Growth of Dolce&Gabbana

through Increased Marketing Investment

FY2018 Results

Review of 2018

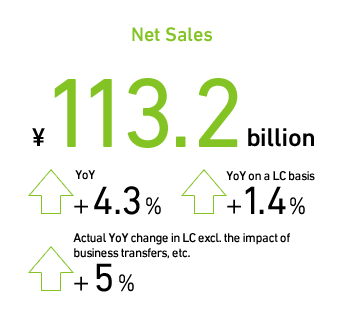

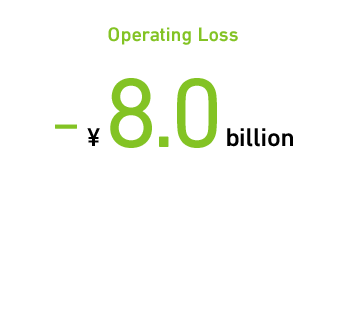

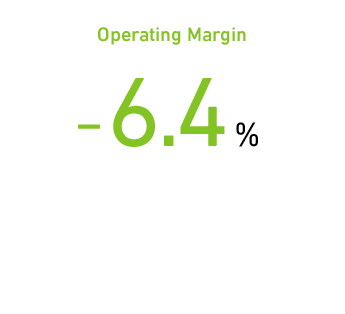

With the aim of realizing sustainable growth, we strengthened marketing investment in Dolce&Gabbana, which achieved a solid performance. Skincare products under the SHISEIDO brand also performed well, allowing us to increase our share. In addition, NARS continued to see significant growth. In terms of improving profitability, we promoted efforts to optimize the EMEA Business’s organizational structure and other initiatives. Meanwhile, the business as a whole remained negative in income, with an operating loss of ¥8.0 billion, due to strengthening marketing investment including brand holder costs in order to enhance our brand equity. The EMEA Business possesses functions regarding our commercial businesses as well as brand holder functions, which involve being responsible for the development of fragrance brands, among other matters. The business also possesses functions related to the Centers of Excellence, which conduct the global development of fragrances. Accordingly, it bears the cost of strategic investment in these functions. The commercial businesses in the EMEA Business saw a high single-digit operating profit margin. However, these businesses are now absorbing the cost of the brand holder investment, which means they have yet to become profitable.

In the EMEA business, we will accelerate the global development of the fragrance brand Dolce&Gabbana originating in Europe and work to further improve the profitability.

Future Market Landscape

In the EMEA prestige market, growth is expected to be driven by mainly the Middle East.

Key Strategies

In fragrances, we will continue to expand investment centered on Dolce&Gabbana. For cosmetics, we will aim to increase the awareness and equity of our prestige brands. We will also reinforce the presence of SHISEIDO, Clé de Peau Beauté, bareMinerals, NARS, and LAURA MERCIER, as well as strive to improve profitability resulting from growth in sales.

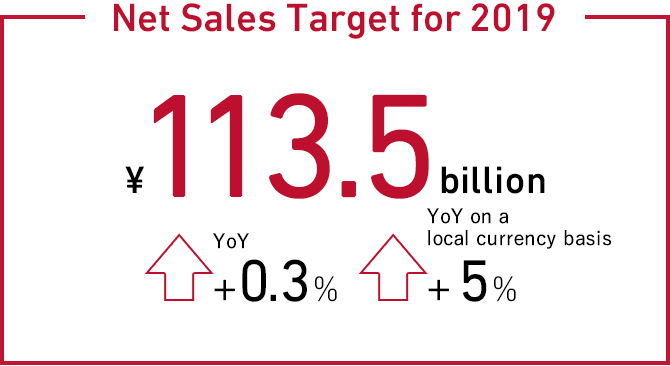

VISION 2020 Strategies and Targets

-

- Expand fragrance growth

- Reinforce SHISEIDO brand equity in the skincare category

- Enhance our presence in makeup

- Further optimize integrated organizations