Americas Earnings Structure

My mission is to transform the Shiseido Finance function into a team of highly talented and nimble business partners and catalysts for change. My team needs to be constantly seeking out best practices and opportunities to be better, driving the sustainable growth of our business as value-adding partners to our operations across the globe. We will actively influence the future direction of the Company by developing and supporting appropriate growth strategies, including M&A. Our success depends on how quickly we can deliver key information and insights to relevant leaders, in real-time, leveraging the very latest technology and industry thinking.

I plan to drive corporate value by facilitating the right dialogue around how we optimize our business structure and systems, ensuring that we drive appropriate standards and industry-leading practices across our global business. I am also committed to building the capability to dynamically segment our business and provide multiple dimensions as to how we view and measure our performance.

I will also seek to promote constructive dialogue with our shareholders while ensuring that we focus on relevant financial return indices. Striking the right balance between capital investment, optimizing dividends and paying down debt will continue to be a strong area of focus.

Michael Coombs

Corporate Officer

Michael Coombs

Corporate Officer

Chief Financial Officer

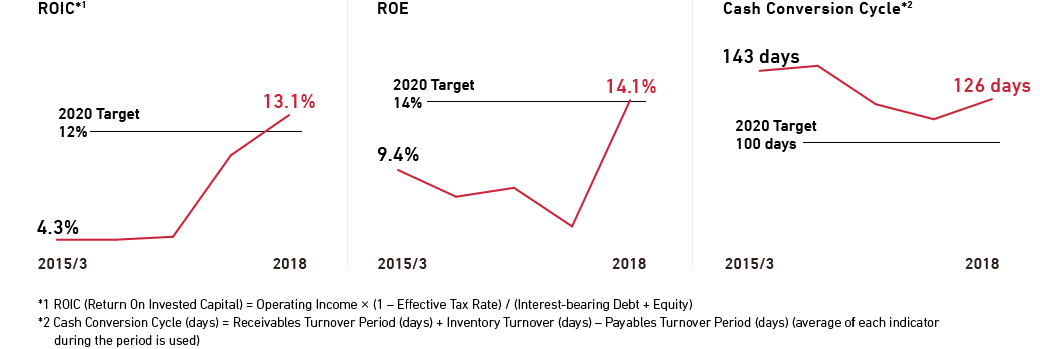

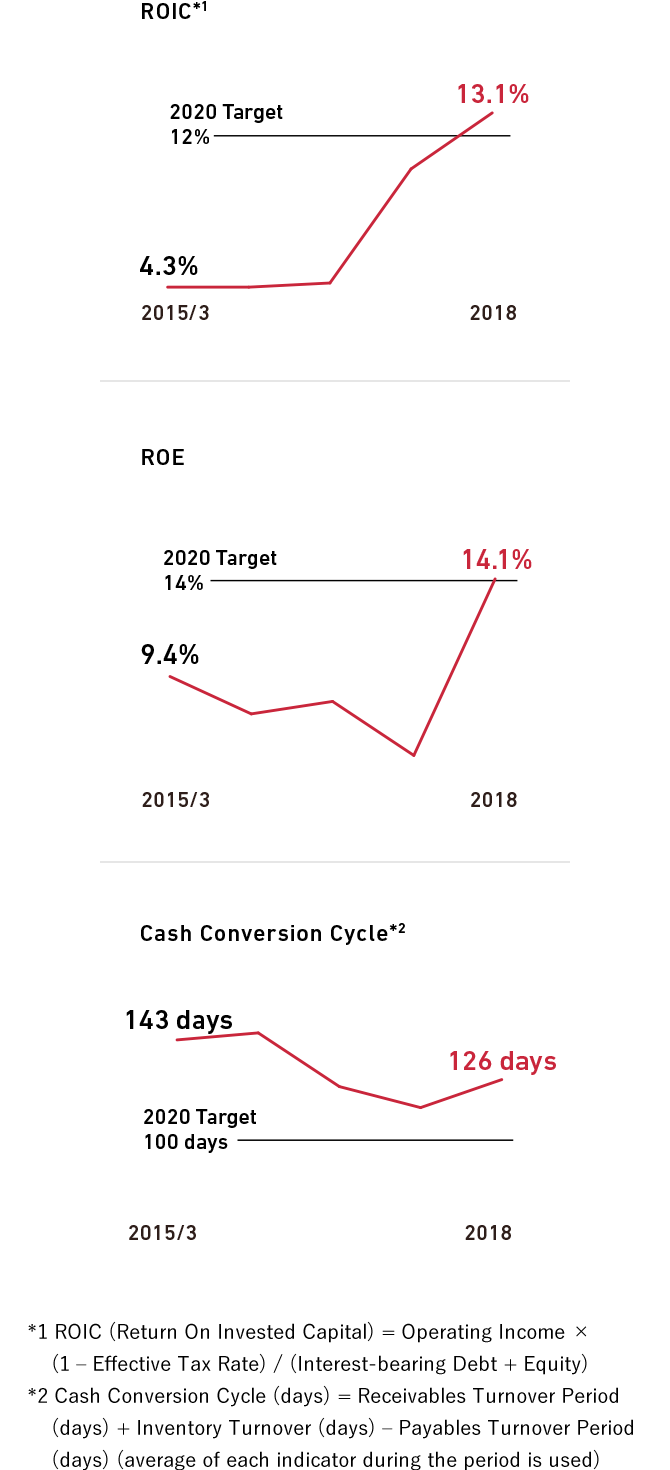

Our capital efficiency has improved significantly thanks to our robust business performance.

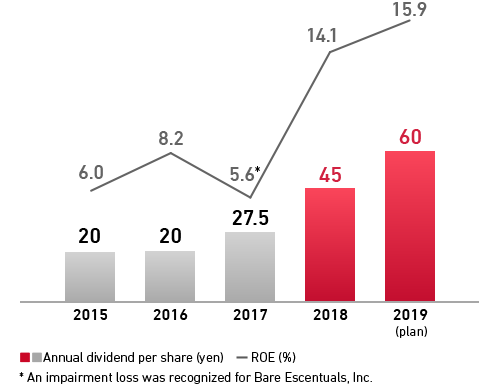

In 2018, we realized ROIC of 13.1% and ROE of 14.1%, thereby reaching our original 2020 targets for ROIC of 12% and ROE of 14%, both two years ahead of schedule. Meanwhile, we recorded a cash conversion cycle (CCC) of 126 days, which was longer than that of the previous fiscal year, as we secured product and raw material inventories with the aim of minimizing out-of-stock situations. For 2020, we will strive to reach our CCC target of 100 days or less while continuing efforts to reduce SKUs and establish flexible production and supply capacity.

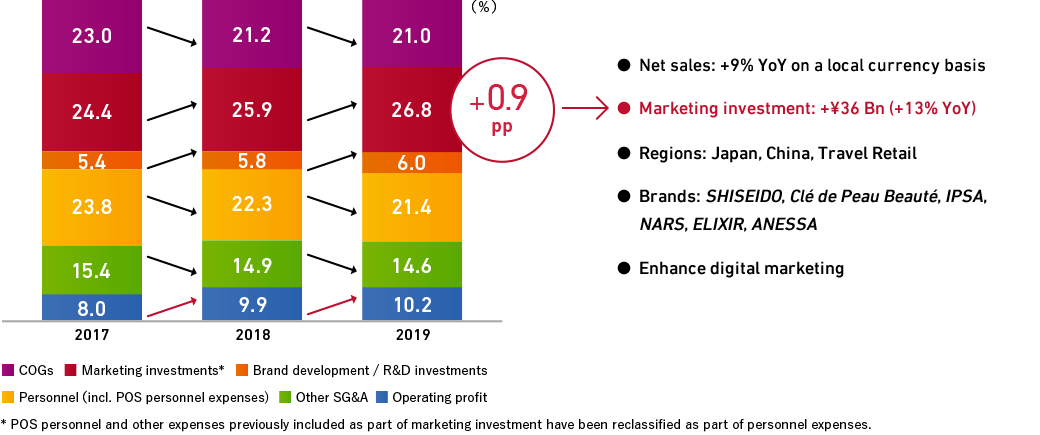

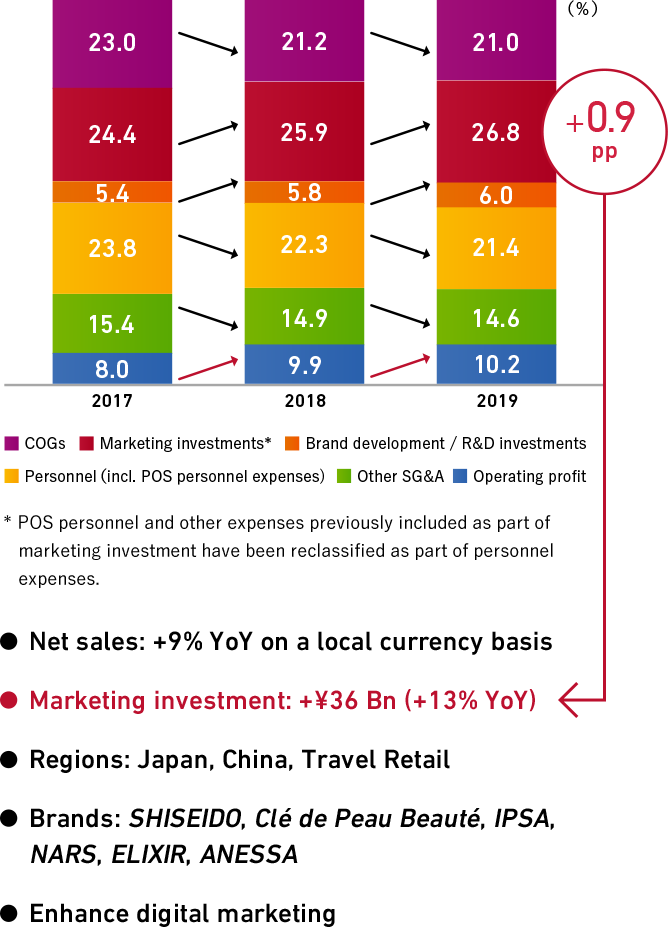

We are giving the utmost priority to maximizing profits through sustainable sales growth. In 2018, we continued to strengthen investment for growth in such areas as marketing and brand research and development. Also, in addition to revising our business portfolio, we realized sales increases centered on our prestige brands and skincare products, which have high profitability and high repeat purchase rates. In this way, we significantly improved the cost of sales ratio. Furthermore, we are taking steps to appropriately control personnel and other SG&A expenses, which has also contributed to steady improvement in profitability.

In 2019, we will continue to aggressively invest in priority areas as we work to realize both sales growth and improved profitability.

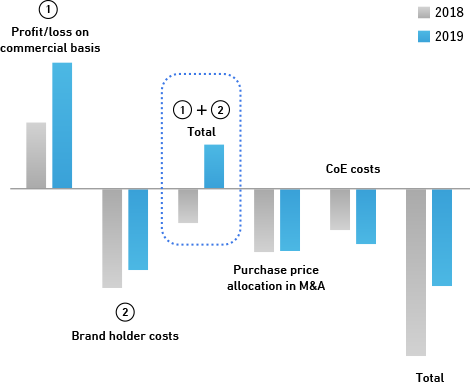

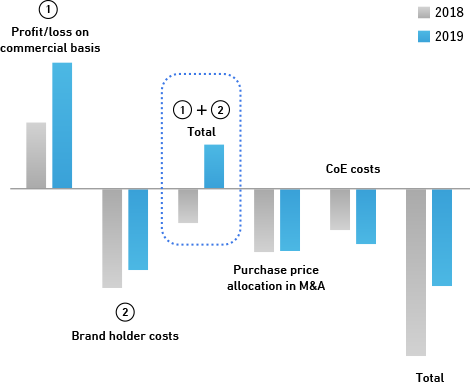

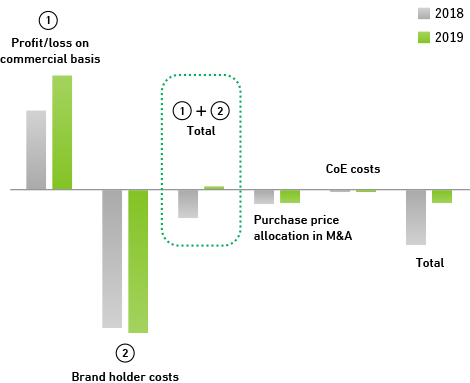

To realize continuous growth, it is important that we steadily increase sales and enhance profitability from our commercial base. In both the Americas and EMEA, commercial based profits are positive (①). Meanwhile, total profit is low because of the large burden of brand holders cost related to NARS, bareMinerals and LAURA MERCIER in the Americas, and Dolce&Gabbana and other designer fragrance brands in EMEA (②). In 2019, we aim to increase profit based on the combined commercial profit and brand holder costs in reach region (①+②).

Also, in order to expand further on a global scale, we will strengthen investment as a brand holder in brand development and creative. Meanwhile, we will steadily raise ROI while working to shift investment toward digital marketing and strictly control the management of profits and losses by brand. At the same time, we will move forward with structural reforms to bareMinerals in the Americas.

Additionally, we will realize a robust cost structure by thoroughly managing fixed costs incurred at our regional headquarters in the Americas and EMEA. In 2020, we will aim for a double-digit operating margin on an organic basis that excludes such factors as amortization of goodwill recorded in the Americas and EMEA and cost related to Centers of Excellence, which are covered as a function of these headquarters.

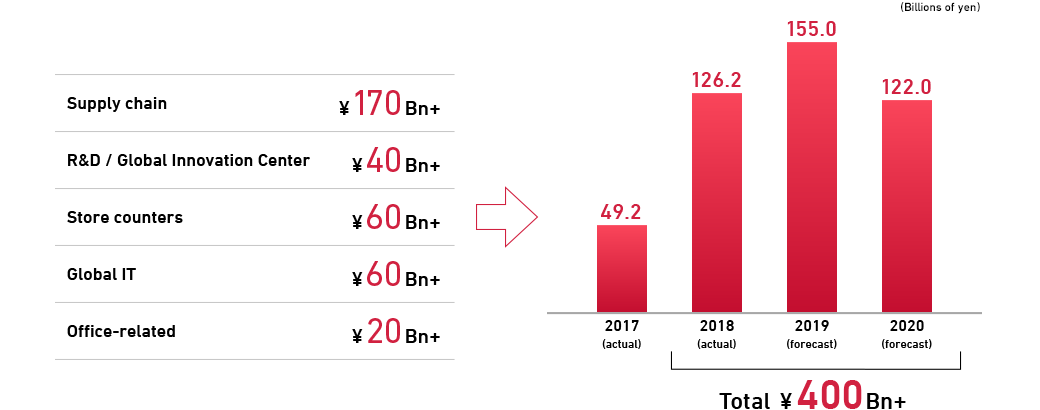

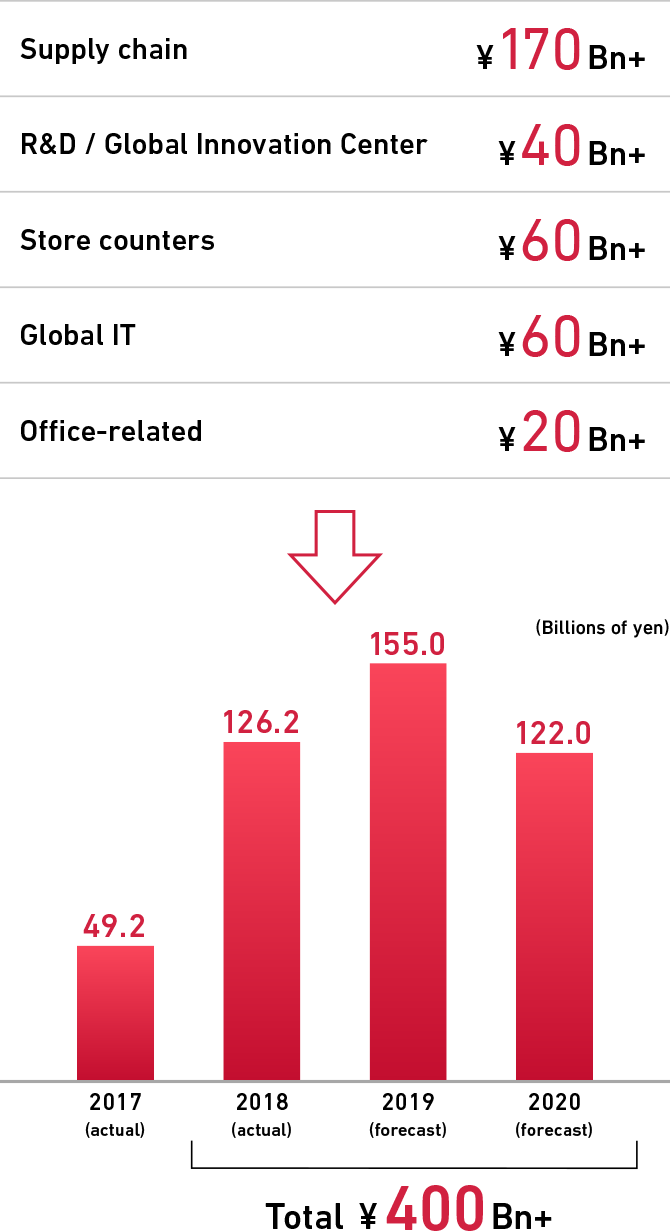

Over the three-year period from 2018 to 2020, we plan to invest a cumulative total of over 400 billion yen. In particular, we will prioritize the strengthening of investment in supply chain management as we work to establish a supply capacity that can provide the appropriate amount of products at the appropriate time to respond to the anticipated demand increases going forward. The funds for the majority of these investments will be coming from cash inflows generated from our core businesses and interest-bearing debt funding that leverages our financial structure, which we have gradually improved over time.

To swiftly and decisively carry out investment for sustainable growth in a timely manner, we strive to maintain an appropriate level of shareholders’ equity. To that end, we place emphasis on free cash flow and the CCC and are strengthening our cash flow and balance sheet management. In these ways, we are implementing management with a focus on capital efficiency.

To ensure that we maintain a single-A credit rating, which allows us to raise funds under advantageous terms, we target a debt-to-equity ratio of 0.3 and an interest-bearing debt to EBITDA ratio of 1.0. While doing so, we implement fund-raising activities that support future growth in a timely manner using optimal methods that give consideration to the market environment and other factors. However, to realize an optimal capital structure that helps further improve capital efficiency, we may periodically revise these targets, as well as our shareholder return policy, in consideration of profitability and our ability to generate cash flow.

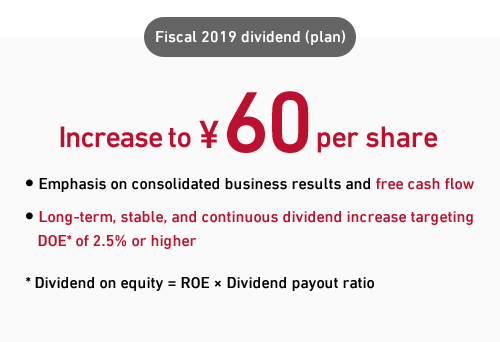

In regard to the Company’s shareholder return policy, we aim for total returns that comprise direct returns of profits to shareholders and medium-to-long-term share price gains. Based on this approach, we will emphasize strategic investment toward sustainable growth and aim to maximize corporate value. Meanwhile, we will adopt a basic approach of enhancing invested capital efficiency while considering the cost of capital, in order to increase dividends and share price over the medium to long term. In determining dividends, we will focus on our consolidated business results and free cash flow as we work to realize stable and continuous shareholder returns over the long term that target a DOE (dividend on equity) ratio—which is a measure of capital policy—of 2.5% or higher. Also, we maintain an approach of flexibly buying back shares with consideration for the market environment. Guided by the above approaches, in 2019 we will increase our annual dividend per share to ¥60, the highest level ever. Through this dividend, we will expand our shareholder returns.