Americas Business

- TOP

- Strategy by Region

- Americas Business

Strengthening Core Brands through Active

Investment in Digital Domains

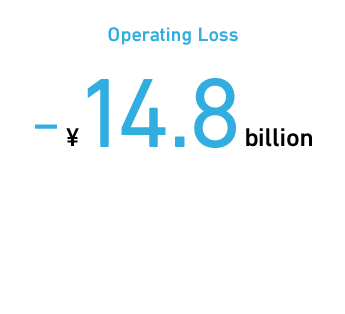

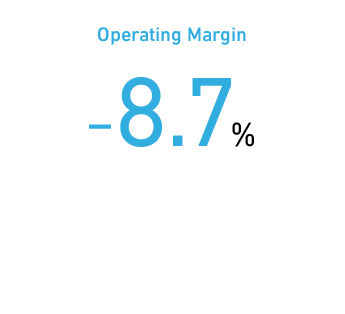

FY2018 Results

Review of 2018

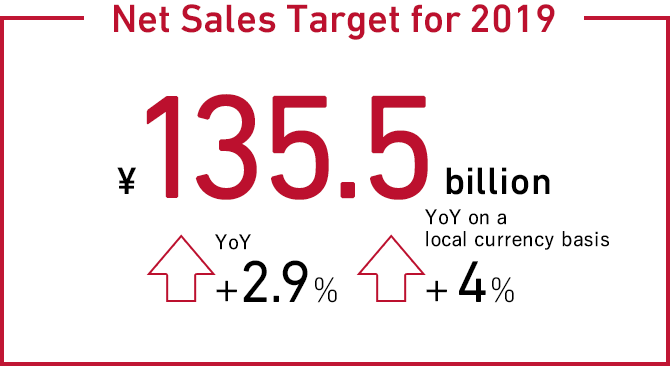

Net sales in the Americas Business increased 4% on a local currency basis that excludes the impact of business transfers and other factors. Through active marketing investment, we continued to realize growth for such prestige brands as SHISEIDO, NARS, and LAURA MERCIER, with a solid performance by the fragrance brand Dolce&Gabbana as well. Guided by our new brand strategy, we commenced a new marketing campaign for bareMinerals based on the concept of “The Power of Good,” thereby carrying out a renewal of the brand. On the other hand, net sales were down on a year-on-year basis due in part to the impact of closing unprofitable stores.

Operating loss increased due not only to the strengthening of active marketing investment, including brand holder costs but also costs associated with reinforcing the organization of the Centers of Excellence, which will contribute to value creation in the future. The Americas Business possesses functions regarding our commercial businesses as well as brand holder functions, which involve being responsible for the development of makeup brands that we offer on a global basis. It also possesses functions related to the Centers of Excellence, which act as our base creating value in terms of makeup and digital technologies. Accordingly, the business bears the cost of strategic investment in these functions. The commercial businesses in the Americas Business saw a high single-digit operating profit margin. However, these businesses are now absorbing the cost of the brand holder investment, which means they have yet to become profitable.

In the Americas business, we will continue to improve profitability of NARS and LAURA MERCIER and promote structural reform of bareMinerals.

Future Market Landscape

In the prestige market, we expect both makeup and skincare categories to lead our growth in the U.S. market. Market conditions in the department store channel will likely be difficult, while significant growth is anticipated in e-commerce.

Key Strategies

To build a strong position in the U.S. market, we will continue to accelerate the growth of NARS and LAURA MERCIER while taking steps to reinforce SHISEIDO and Clé de Peau Beauté. In addition to our existing channels, we will work to bolster sales through our owned

e-commerce as well as other retail sites by collaborating with major e-commerce platformers, among other initiatives.

Also, through such efforts as enhancing sales growth and reducing fixed costs, we will promote a gradual return to profitability. In regard to bareMinerals, we expect to complete the closure of unprofitable stores during 2019.

VISION 2020 Strategies and Targets

-

- Boost digital sales

- Aggressively pursue growth of makeup brands

- Strictly control costs and allocate resources to deliver better profitability

- Adapt team in terms of size, skill, and agility to embrace the future