The Shiseido Group including the Company has established BEAUTY INNOVATIONS FOR A BETTER WORLD as OUR MISSION in its Corporate Philosophy THE SHISEIDO PHILOSOPHY, and defines corporate governance as the “platform to realize sustainable growth through fulfilling OUR MISSION.” We strive to maximize medium-to-long-term corporate and shareholder value by implementing and reinforcing corporate governance to maintain and improve management transparency, fairness, and speed, and through dialogue with all stakeholders, from consumers, business partners, employees, and shareholders to society and the earth. At the same time, by fulfilling its responsibilities as a public entity of society, Shiseido works to optimize the value it delivers to respective stakeholders.

KEY FIGURES

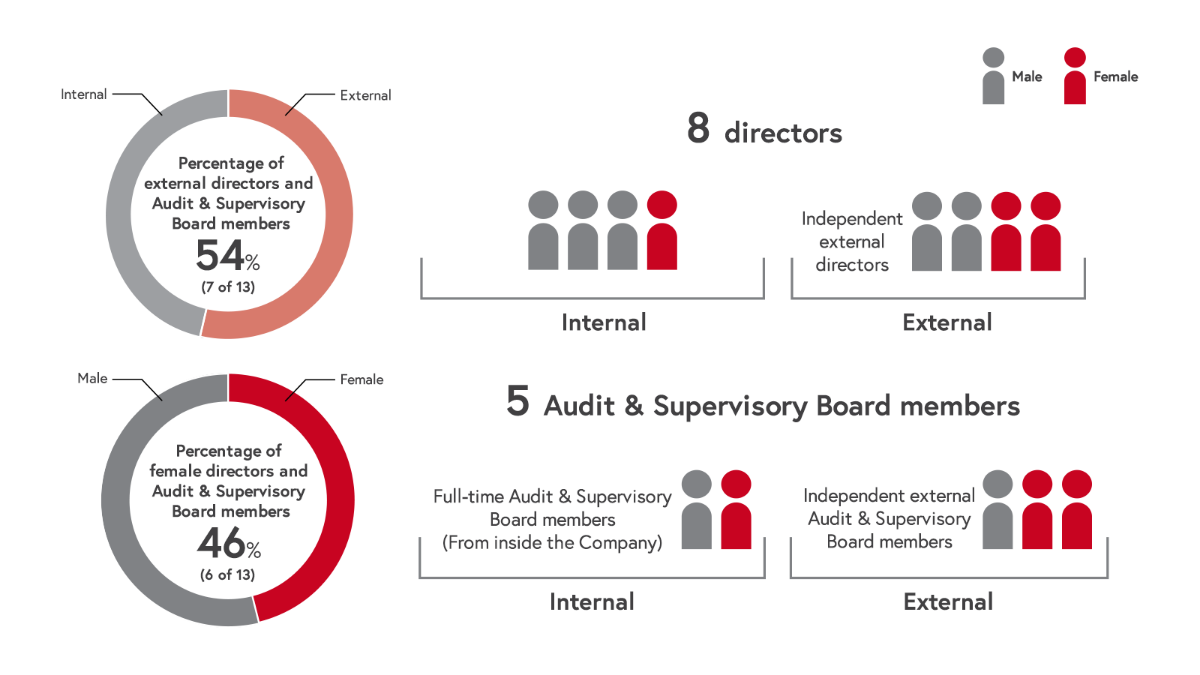

External Directors

and A&SB Members

54%

Female Directors

and A&SB Members

46%

Weight of Social Value Indicators in LTI

20%

Shiseido’s Governance in Numbers

Directors and Audit & Supervisory Board Members

(As of March 31, 2022)

Diversity of Directors and Audit & Supervisory Board Members

Shiseido requires its directors and Audit & Supervisory Board members to supervise business execution and conduct decision-making on critical matters. Therefore, we encourage various viewpoints and backgrounds in addition to diverse and sophisticated skills. When selecting candidates, we place importance on ensuring diversity, taking into account not only gender equality, but also other attributes such as age, nationality, personality, as well as insights and experiences in various fields related to management. In addition, Shiseido has set a certain maximum term of office for external directors and Audit & Supervisory Board members in order to reflect their independent views to our management, and by allowing a handover period from long-serving external directors and Audit & Supervisory Board members to newly appointed ones to ensure appropriate transition. Moreover, executive officers in charge of relevant domains join the meetings of the Board of Directors depending on the agenda and provide necessary explanations to ensure fruitful discussions.

Diversity of Directors and Audit & Supervisory Board Members (PDF)

○:Knowledge and expertise which the Company expects the relevant candidate will demonstrate

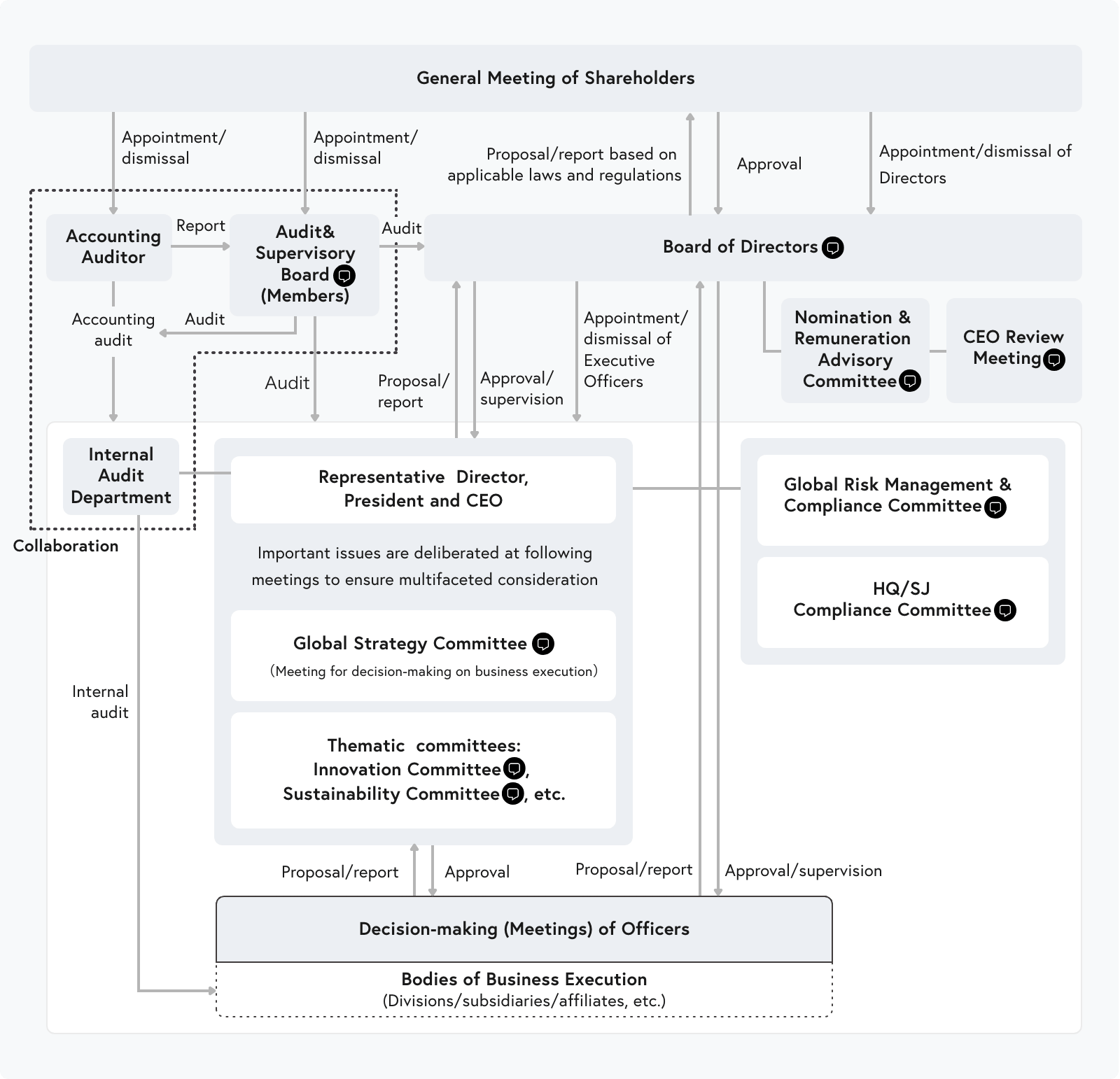

Corporate Governance Structure

Shiseido has adopted a system of checks and balances whereby business execution is supervised by the Board of Directors with audit for legality and appropriateness by the Audit & Supervisory Board (a company with an audit & supervisory board system). In order to maintain and improve management transparency, fairness, and speed as per the Basic Policy for Corporate Governance, we have reinforced the supervisory function of the Board of Directors by incorporating outstanding features, including those of a company with a nominating committee and a company with an audit and supervisory committee.

The Shiseido Group has introduced a global matrix organization that crossmatches six regions with brand categories. Under this matrix organization, the global headquarters is responsible for supervising the overall Group and providing necessary support, while many of the responsibilities and authorities are delegated to the respective regional headquarters of Japan, China, Asia Pacific, the Americas, EMEA, and Travel Retail.

We held repeated discussions on an ideal corporate governance system under this matrix organization, including the composition and operation of the Board of Directors. As a result, we concluded that a monitoring board-type structure would ensure sufficient and effective supervisory functions over the Shiseido Group overall. Therefore, we resolved on the monitoring board-type corporate governance while leveraging the advantages of a company with an audit & supervisory board structure.

Based on that, the Company established its view on the ratio of external directors on the Board of Directors.

In the Company’s Articles of Incorporation, the maximum number of directors is set at 12. Respecting this upper limit and in consideration of the Company’s business portfolio and scale, an optimum number of directors are elected such that they are able to appropriately supervise the management.

For external directors, the number is set at three or above to allow such members a certain degree of influence within the board. In addition, the Company has established the target of electing half or more of its directors from outside.

For selecting external directors, high priority is given to independence. Our basic principle is that candidates for external directors are required to meet the Company’s “Criteria for Independence of External Directors and Audit & Supervisory Board Members” as well as possess highly independent thinking.

Corporate governance framework and activities related to business execution and corporate governance of the Company from January 1, 2022 are as follows.

Hover mouse over for details.

Management System of Executive Officers

The Company abolished the corporate officer system in January 2022 and fully transitioned into a management system centering on executive officers.

The executive officer management system was first introduced in January 2021. Executive officers bear responsibility as CXOs for the key duties and roles in each business area required from the Group-wide management perspective with the aim of further improving profitability under the Company’s medium-to-long-term strategy WIN 2023 and Beyond.

We will appoint a diverse range of officers both internally and externally across the globe to assign the right person to the right position to further advance diversity management beyond the boundaries of gender, nationality, age, or any other attributes.

Appointments, Dismissals, and Succession Plans

Nomination of candidates for directors and appointment of corporate officers and executive officers are determined upon resolution by the Board of Directors. Prior to this, the Nomination & Remuneration Advisory Committee, chaired by an external director, submits a report assessing the candidates’ appropriateness for the position.

Appointment of the President and CEO is carefully reviewed by the Nomination & Remuneration Advisory Committee in addition to the above procedures. At the same time, Shiseido realizes the importance of a succession plan for the CEO. The company considers that the appointment of a successor candidate requires the involvement of the incumbent CEO, who shall also be responsible for formulating the succession plan.

Regarding selection of specific candidates for the President and CEO, the Nomination & Remuneration Advisory Committee receives full reports from the President and CEO on the specific nomination for successor from various perspectives. The Nomination & Remuneration Advisory Committee members themselves meet and exchange opinions with candidates, evaluating them from an independent perspective as well as the Company’s management issues. Since the Nomination & Remuneration Advisory Committee performs certain important functions of the Board of Directors, the Board respects the committee’s judgement.

Evaluation of the Effectiveness of the Board of Directors

The Company evaluates the effectiveness of the Board of Directors with the purpose of identifying issues and points to be improved within the Board and increasing the effectiveness of the Board. The Company conducts annual questionnaire surveys and interviews with all directors and Audit & Supervisory Board members to evaluate and analyze the Board of Directors, the Nomination & Remuneration Advisory Committee, and the Audit & Supervisory Board. The secretariat of the Board of Directors summarizes, analyses, and identifies issues. The identified issues and opinions are reported to the Board of Directors, and all members of the Board discuss how to respond.

In addition, third-party organizations regularly check and evaluate the effectiveness of these assessments to ensure transparency and objectivity.

Key Topics Discussed by the Board of Directors and Meetings of Directors in 2021

- Medium-to-Long-Term Strategy (WIN2023 and Beyond)

- Sustainability Management Strategy

- Transfer and Joint Venture of Personal Care Business

- Termination of License with Dolce&Gabbana S.r.l.

- Strategic Partnership with Accenture and Establishment of Joint Venture

- Transfer of bareMinerals, BUXOM, and Laura Mercier

- Important Risks of the Shiseido Group

- Revision of Corporate Governance Code and Corporate Governance of the Company

- Selection of Prime Market

- Adoption of International Financial Reporting Standards (IFRS)

- Occupational Safety and Health Management

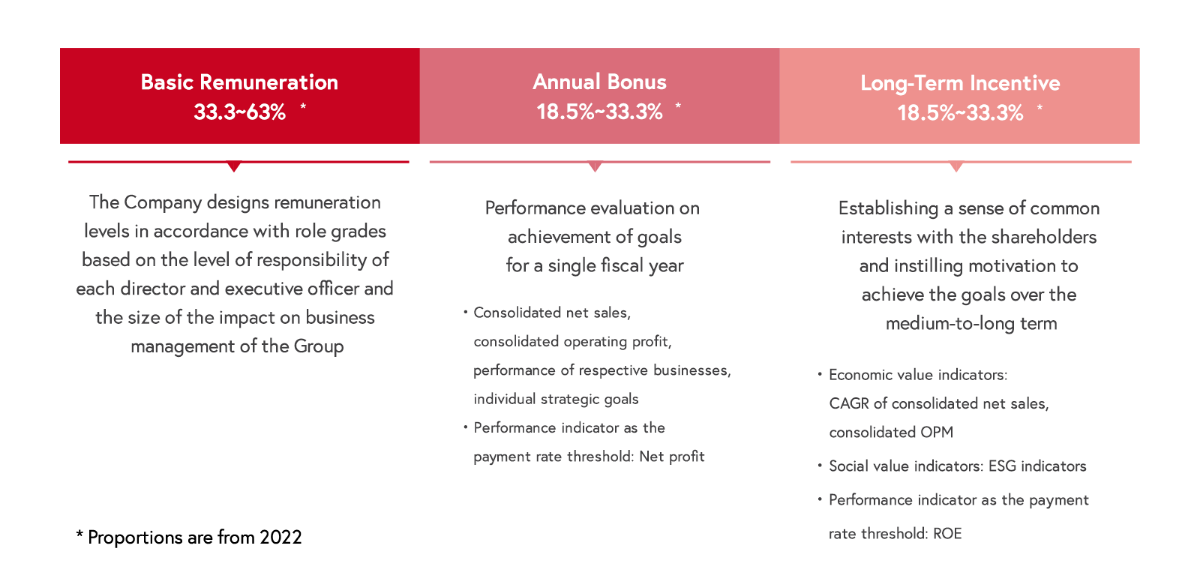

Executive Remuneration: Striking a Balance between Short-Term and Long-Term Incentives

Shiseido regards executive remuneration policy as a matter of utmost importance for corporate governance.

The directors and executive officers remuneration policy of the Company is deliberated in the Nomination & Remuneration Advisory Committee chaired by an external director to ensure objectivity, and the outcome is reported to the Board of Directors for the resolution.

Composition of Executive Remuneration

Key Points of the Remuneration System

- Comprises basic remuneration, which is offered as fixed remuneration, and annual bonuses and long-term incentives, which are offered as performance-linked remuneration

- Introduces a role grade system designed so that the higher the role grade, the greater the ratio of the performance-linked component of remuneration

- The Company sets remuneration levels by making comparisons with companies in the same industry or of the same scale in Japan and overseas and by taking the Company’s financial condition into consideration.

- Deems the achievement of performance targets in a single fiscal year and in the medium to long term to be of equal importance and sets performance indicators for annual bonuses and long-term incentives consistent with their respective objectives

- With particular emphasis on long-term incentives, sets indicators that can evaluate performance from the perspectives of both economic and social value in order to maintain and improve corporate value

Long-Term Incentive Plan

Aim of Introducing the Long-Term Incentive Plan (LTI)

We have introduced performance share units, a type of performance-linked stock remuneration, to establish effective incentives for creating long-term corporate value and foster an awareness of the common interests we have with our shareholders.

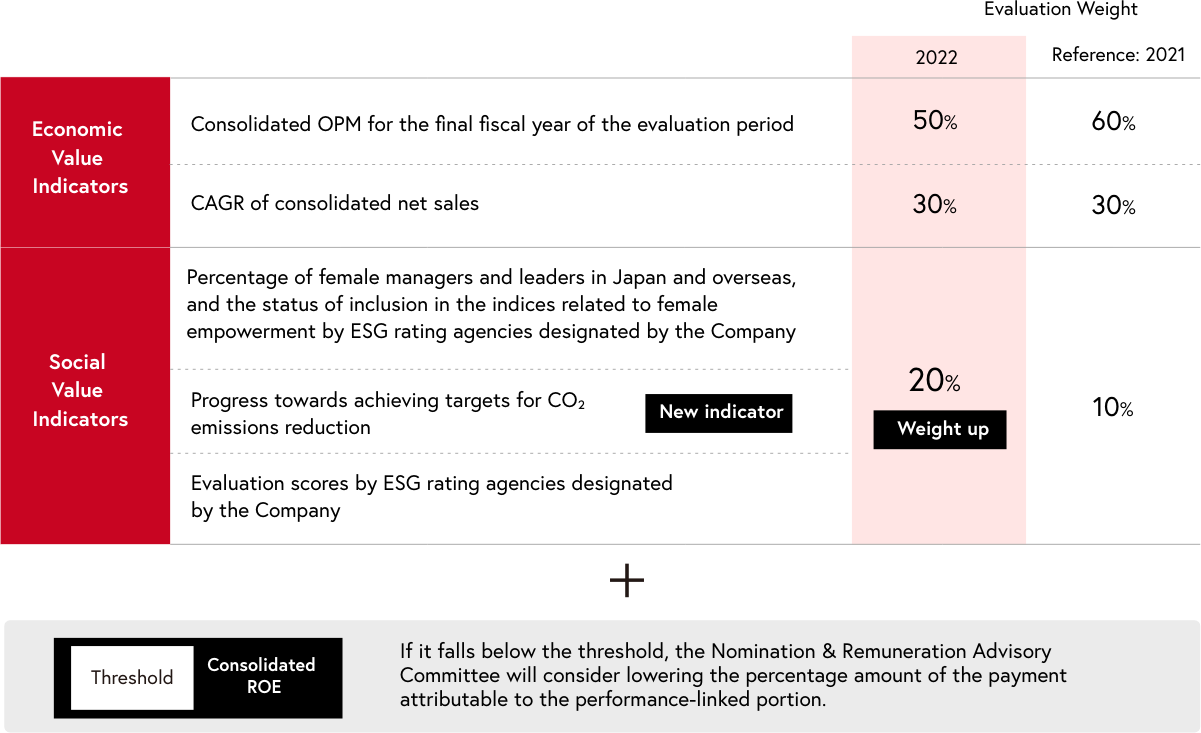

Performance Indicators and Evaluation Weights for Performance-Linked Portion of the LTI

- The Company has set long-term goals of consolidated net sales of 2 trillion yen, and operating margin of 18%, and requires a certain minimum level of continuous growth in sales and profits to achieve these targets. While the highest priority is placed on achieving the operating profit margin, the rate of growth in net sales is also treated as an evaluation indicator related to economic value.

- From the perspective of enhancing social value, which includes elements such as environmental, social and governance, and continuously improving and evolving, we have set target values for multiple indicators, both internal and external. Of these, the Company places the most emphasis on initiatives for women's empowerment, while also promoting environmental measures by setting a new environmental indicator for FY2022: target for reductions in CO₂ emissions, which is an important initiative within our sustainability strategy. Following this, the evaluation weight for social value indicators has been raised from 10% to 20%.

- Consolidated ROE, which is an important indicator for shareholders, has been included as an evaluation indicator for determining the payment rate threshold. When it falls below a predetermined level, the Company will consider whether to reduce the payment rate for the performance-linked portion.

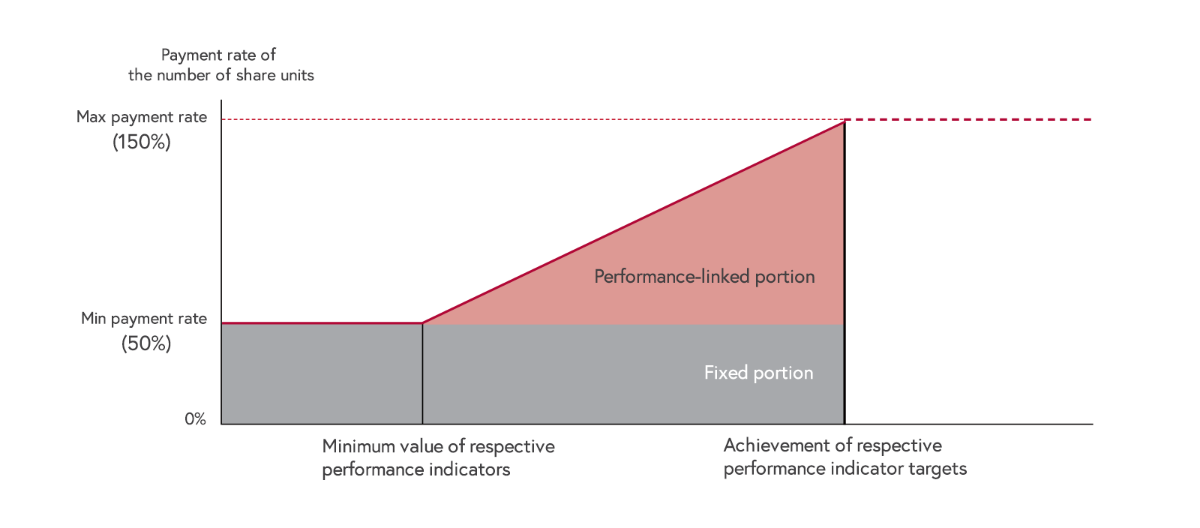

Model for Payment Rate of the Number of Share Units for LTI

- For this type of remuneration, reference share units are allotted to eligible parties each fiscal year, and the number of units is adjusted in accordance with the degree of progress towards performance evaluation indicators during the evaluation period. After the end of the evaluation period, monetary remuneration claims and cash are paid to eligible parties for the delivery of the shares of the Company's common stock of a number corresponding to the applicable number of share units. With this share-based approach, performance is reflected in remuneration.

- Our performance share units are composed of two parts: a performance-linked portion and a fixed portion.

Performance-linked portion:

(a) CAGR for the 3-year performance evaluation period

(b) Consolidated operating profit margin in the final fiscal year of the evaluation period

(c) Reference share units are adjusted and shares delivered in accordance with the degree of progress towards environmental, social, and governance (ESG) targets

Fixed portion:

Not linked to performance, and its purpose is to share a sense of common interests with shareholders and to attract and retain outstanding talent