KEY FIGURES

ROIC

by 2023

14%

ROE

by 2023

18%

EBITDA Margin

by 2023

20%

CONTENTS

Q1.What has Shiseido achieved in 2021 from a financial perspective?

Q2.Please tell us about the progress of KPIs stipulated in WIN 2023 (operating profit margin, inventory reduction, productivity improvements), including specific measures (performance and priorities) and positioning for 2022.

Q3.What is your approach to capital strategy and cash allocation?

Q4.How would you characterize your policy on shareholder returns?

Q5.What is your commitment to WIN 2023?

Q1.What has Shiseido achieved in 2021 from a financial perspective?

2021 proved to be just as challenging as the previous year due to the continued spread of COVID-19. Nevertheless, we were able to implement key strategies of WIN 2023, such as growing our skin beauty brands, accelerating digital transformation (DX), and executing region-led transformations. Moreover, Shiseido has significantly improved the cost management structure realizing great agility, has reduced fixed cost base in line with market changes, and has built a solid financial foundation.

During my first year as CFO, we have continued steady investment in our future growth, including new factories, DX and IT, despite the challenging business environment. To secure such investments and to improve our capital efficiency, we are taking strategic actions, such as reducing our inventory and managing our costs with agility. As a result, we have become considerably stronger as a company from a financial perspective, capable of generating a steady cash flow.

Q2.Please tell us about the progress of KPIs stipulated in WIN 2023 (operating profit margin, inventory reduction, productivity improvements), including specific measures (performance and priorities) and positioning for 2022.

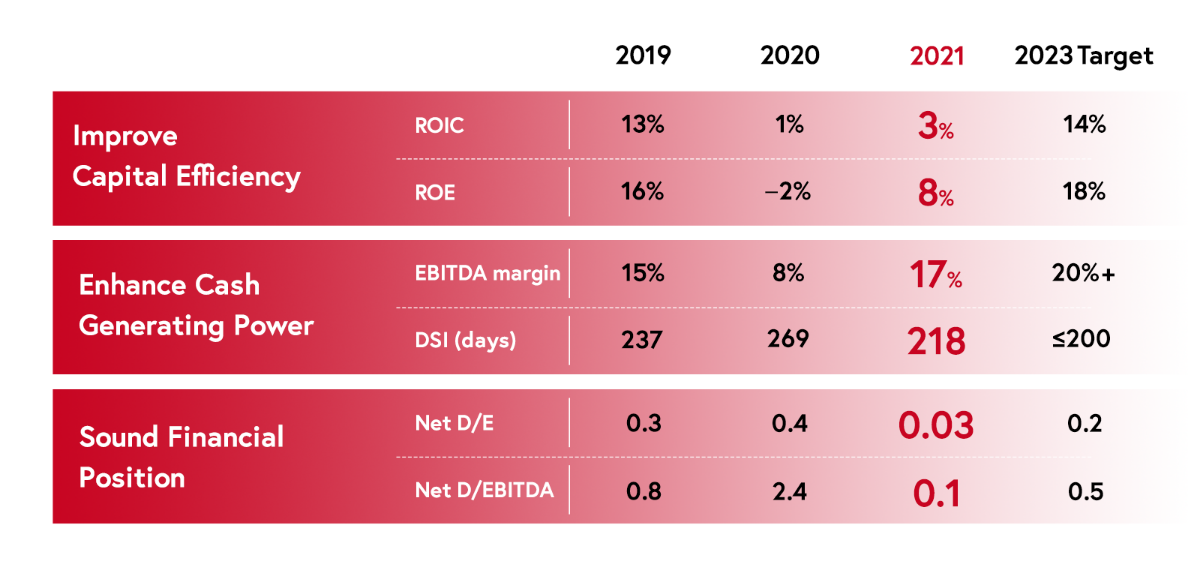

We are steadily implementing our strategic actions to achieve 15% operating profit margin by 2023. Our COGS ratio has also improved from favorable product mix by growing our skin beauty brands and from reducing inventory levels by improving demand forecasting capabilities in each of our regions. SG&A expenses have improved thanks to higher marketing ROI by focusing on digital and cross-border marketing, optimizing our fixed costs through structural reforms, and managing our costs with agility in response to market changes. In particular, we see significant improvements coming from Americas and EMEA through our transformation initiatives. The two businesses combined contributed more than 90% of the 26.6 billion yen increase in our consolidated operating profits.

We have also improved our inventory management by collective efforts not only in Global headquarters Supply Network Division but also in each of our regions and affiliates, by setting out specific KPIs related to inventory reduction. In addition, we have leveraged AI to improve our demand forecast accuracy and our lead time in procurement, production, and delivery. As a result, we have reduced our days sales of inventory (DSI) from 269 days in 2020 to 218 days in 2021, making steady progress toward our WIN 2023 target of 200 days or less. This has helped improve the efficiency of our working capital and cash generation.

Moving forward, our priority is to deliver clear benefits coming from the structural reforms and investments for growth we made in 2021. Our structural reforms are expected to reduce SKU and inventory level, optimize fixed costs, and improve our product mix through skin beauty focus, thereby increasing our overall Company productivity. We will further accelerate these initiatives to provide visible improvements in our profitability and margins.

Q3.What is your approach to capital strategy and cash allocation?

We are making steady progress toward our WIN 2023 financial targets of 14% ROIC and 18% ROE.

Rather than increasing ROE through excessive leverage, our focus is to increase our underlying profit and cash generation capabilities. Therefore, we consider ROIC to be our most important financial indicator for improving capital efficiencies, and we are actively managing our balance sheet by taking various actions such as reviewing our business portfolio and selling idle assets that do not contribute to growth.

We also place importance on cash flow generation. In 2021, we have generated free cash flow of over 30 billion yen, excluding business transfer-related extraordinary income. This was achieved through improving our working capital mainly by reducing inventory turnover.

Generated cash was allocated to investments for medium-to-long-term growth, including DX and IT as well as new production facilities such as Osaka Ibaraki Factory and Fukuoka Kurume Factory. We have also been able to reduce our interest-bearing debt, realizing a sound financial basis whilst maintaining future growth investments.

We will continue to build a robust financial foundation and ensure steady cash generation to achieve the financial targets set out in WIN 2023 and further improve our capital efficiency.

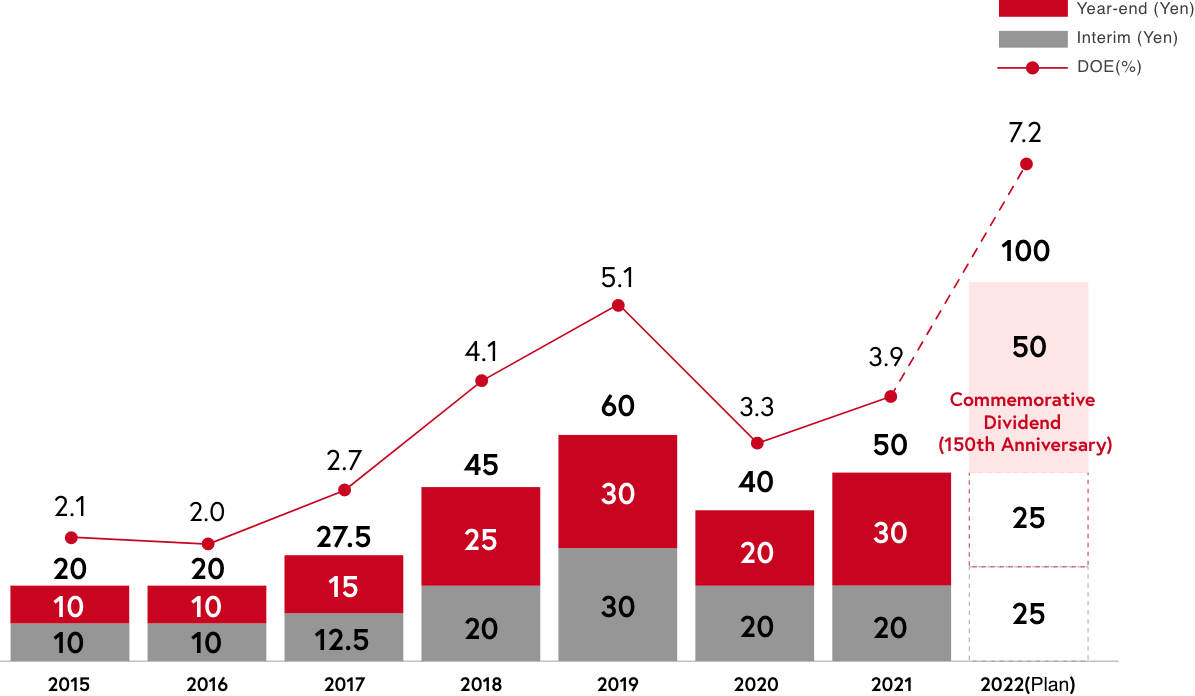

Q4.How would you characterize your policy on shareholder returns?

Our total shareholder return policy aims to maximize shareholder returns both through immediate direct means, and through medium-to-long term stock price increases.

Upon determining our dividend levels, we consider consolidated financial results and free cash flow, aiming to realize long-term steady returns with a dividend-on-equity (DOE) ratio of 2.5% or higher.

Based on this, we increased our annual dividend by 10 yen per share from the previous year to 50 yen per share in 2021 (interim 20 yen and year-end 30 yen).

2022 marks the 150th anniversary of Shiseido’s founding. Therefore, in addition to the ordinary dividend of 50 yen per share for 2022, we plan to pay a commemorative dividend of 50 yen per share to express our gratitude to our shareholders and commitment to future growth.

Q5.What is your commitment to WIN 2023?

As CFO of Shiseido, my mission is to ensure steady execution of WIN 2023 and drive transformation by acting as a catalyst in improving our profitability and cash generation whilst maintaining high governance and compliance standards. Despite uncertainties in our environment which may affect our outlook, we are committed to achieve our WIN 2023 goals and will build a sound financial basis to ensure steady long-term growth. At the same time, as the project owner of the Group-wide FOCUS program, I will ensure its roll-out in all regions by the end of 2023 in order to realize best-in-class management processes through standardization, automation, and streamlining of data.

Moreover, I believe it is crucial to enhance capital market understanding of our business and brand growth potential for sustainable corporate value improvements. To do so, effective communication with our consumers, capital markets, and all other stakeholders is essential. I also believe that proactive investor relations can support such dialogues and effectively reduce our cost of capital. Therefore, as CFO, I am committed to taking the lead and engaging in proactive dialogues to build the trust with all of our stakeholders and ensure that our strategies and policies are in place to make WIN 2023 a success. Finally, I welcome feedback from our stakeholders as we should leverage it to realize future growth and improve our medium-to-long-term corporate value.

April 2022