Characteristics by Region (2021)

- Japan

- China

- Asia Pacific

- Americas

- EMEA

- Travel Retail

Net Sales

¥276.2bn

Operating Profit

¥9.6bn

Operating Margin

3.2%

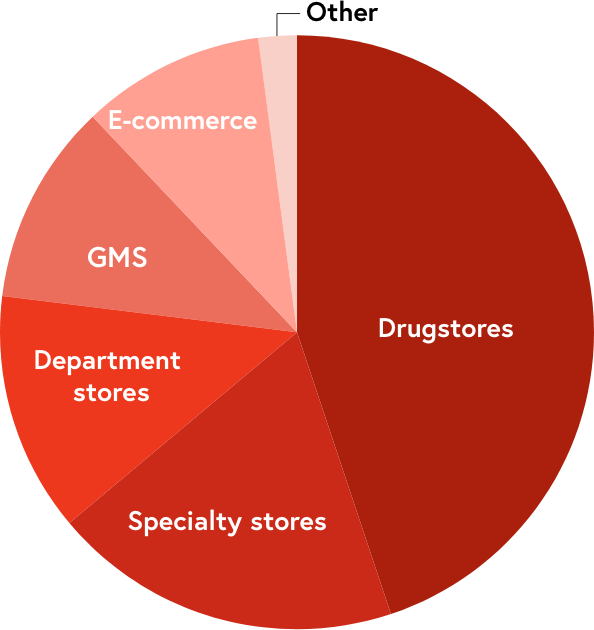

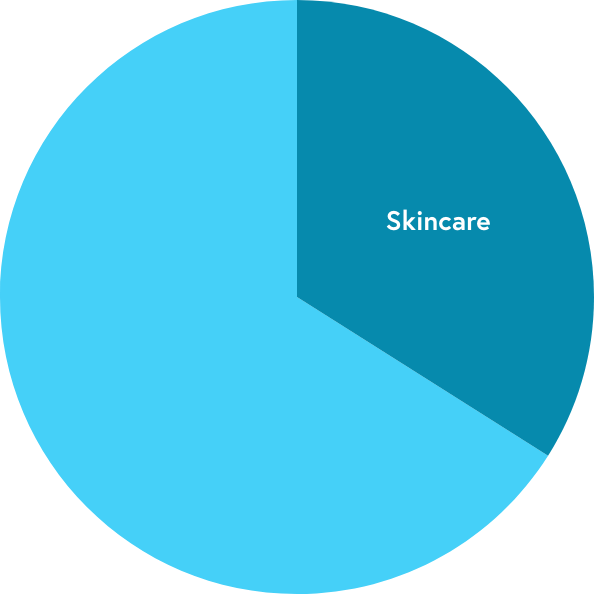

Share of Total Sales by Category

- Prestige

- Cosmetics

- Personal Care

- Others

Net Sales

¥274.7bn

Operating Profit

¥1.2bn

Operating Margin

0.4%

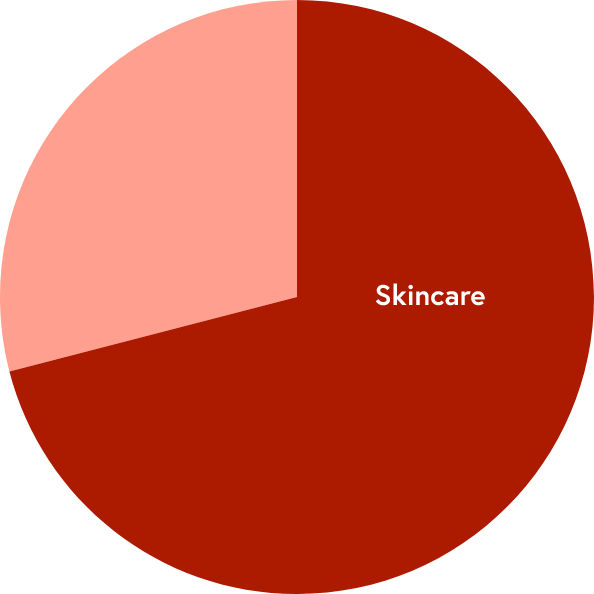

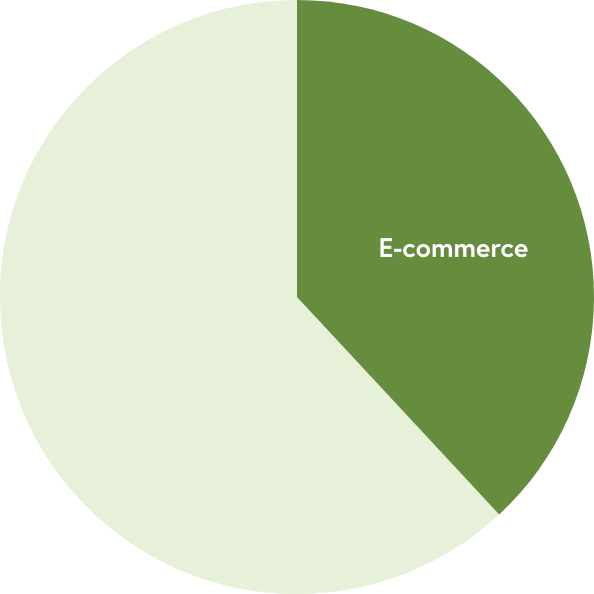

Share of Total Sales by Category

- Prestige

- Cosmetics

- Fragrance

- Personal Care

Net Sales

¥65.0bn

Operating Profit

¥3.7bn

Operating Margin

5.6%

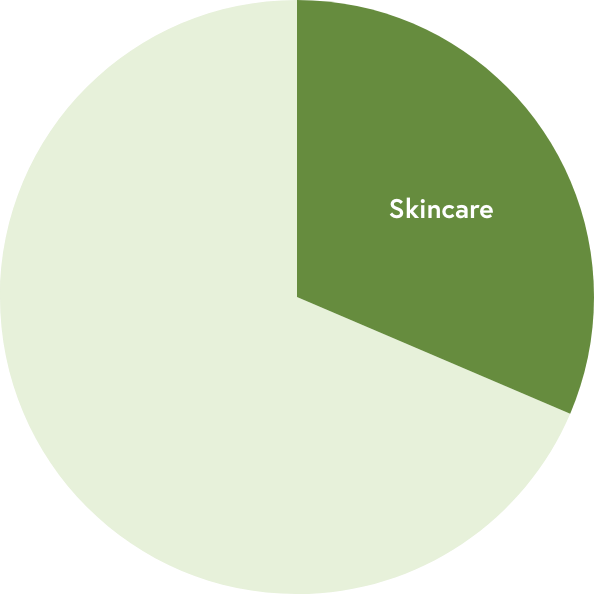

Share of Total Sales by Category

- Prestige

- Cosmetics

- Fragrance

- Personal Care

Net Sales

¥121.4bn

Operating Profit

¥−13.2bn

Operating Margin

−8.9%

Share of Total Sales by Category

- Prestige

- Fragrance

- Others

Net Sales

¥117.0bn

Operating Profit

¥2.5bn

Operating Margin

1.9%

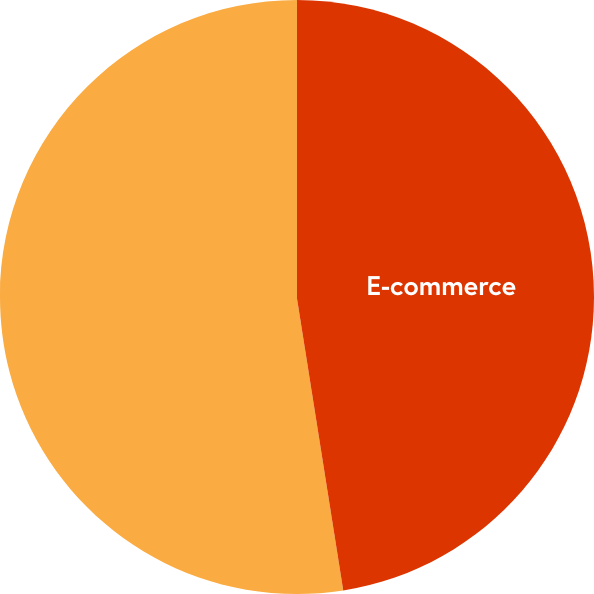

Share of Total Sales by Category

- Prestige

- Fragrance

- Others

Net Sales

¥120.5bn

Operating Profit

¥22.0bn

Operating Margin

18.2%

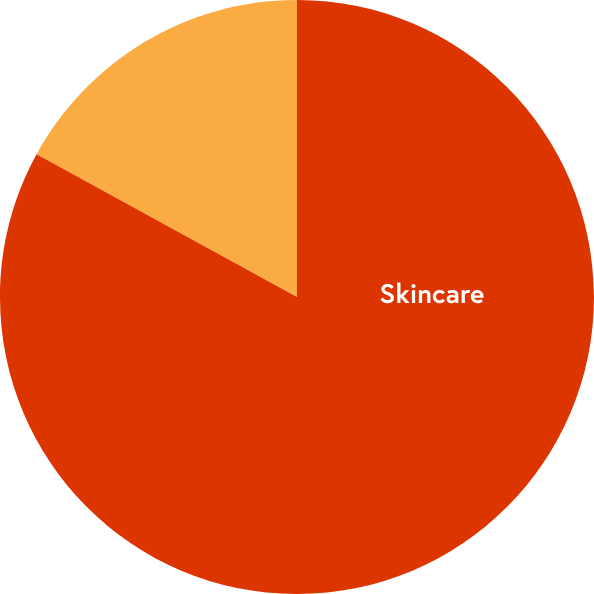

Share of Total Sales by Category

- Prestige

- Cosmetics

- Fragrance

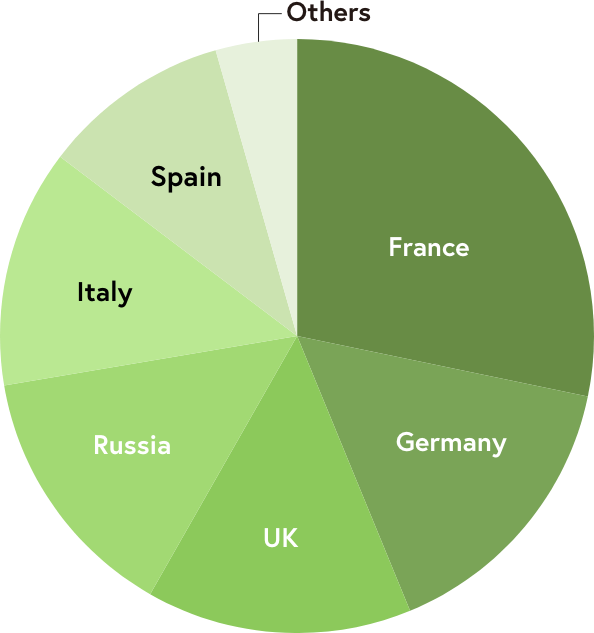

- Japan

- China

- Asia Pacific

- Americas

- EMEA

- Travel Retail

2021 Review

Regions

Japan Business

Gradual Recovery, Mainly in Prestige, Amid Delayed Market Recovery

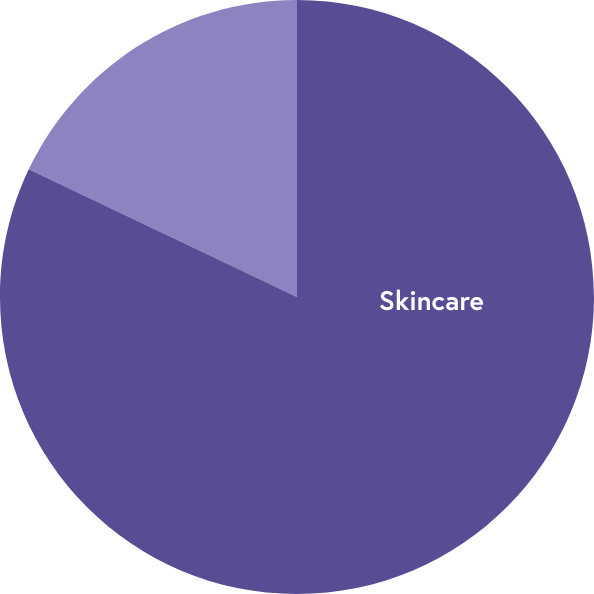

- In the Japan Business, we strategically strengthened investment in the skin beauty category in line with new consumer needs prompted by the COVID-19 pandemic and achieved market share gains, mainly in base makeup and suncare.

- In addition, we engaged with a large number of consumers through various omnichannel initiatives in collaboration with business partners, such as live commerce events and online video counseling. Consequently, e-commerce sales grew by double digits.

- We also continued activities started last year aimed at maximizing the value we provide to consumers, in particular, development and launch of versatile products that address changes in consumer needs, such as BB cream that holds fast even under a mask, and revolutionary products with the Second Skin technology.

- Furthermore, we launched the “Shiseido Hand-in-Hand Project” that aims to show our respect and gratitude to medical workers across Japan, in which we provided support for all those at medical sites by making donations and gifting products, and thus contributed to preventing the spread of COVID-19.

- Meanwhile, under the declared state of emergency, sales were hit by shortened operating hours in the retail sector and a downturn in consumer traffic due to a tendency to stay at home. Other factors included a drop in visitors to Japan, which resulted in low inbound demand.

- Net Sales: ¥276.2 billion, Year-on-year change: -8.9% (Like for like: -1.4%)

- Operating Profit: ¥9.6 billion, Year-on-year change: -0.9%, Operating Profit Margin: 3.2% Operating profit was down mainly due to lower margins resulting from a decline in sales, which outweighed higher margins accompanying an increase in intercompany sales in the first half of the fiscal year and effective cost management in line with market changes.

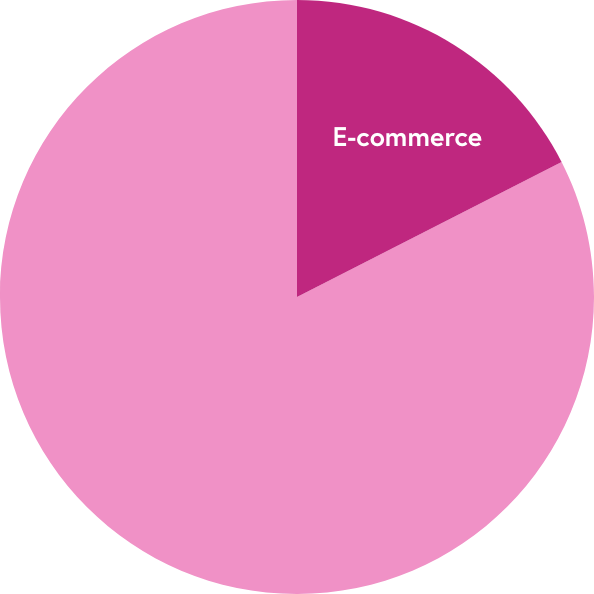

China Business

Largely Ahead of Market for Singles’ Day

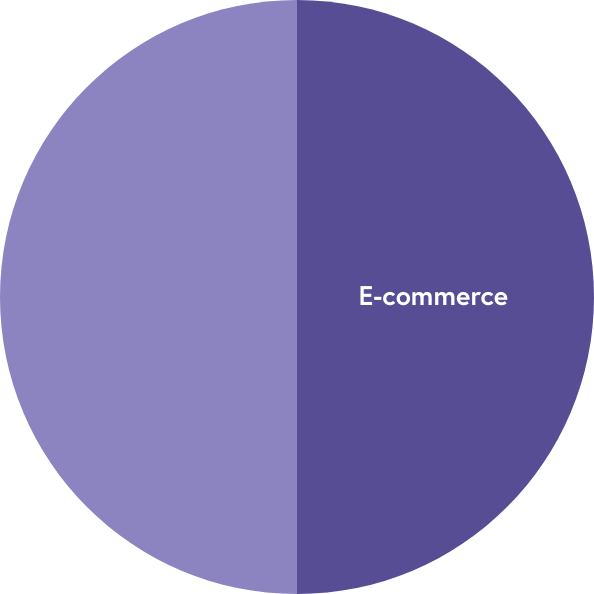

- The China Business was affected by partial retail closures and a drop in consumer traffic due to new COVID-19 variant outbreaks in key metropolitan areas. However, e-commerce remained strong thanks to strategic investment and drove sales growth.

- E-commerce accounted for high 40% of total sales, mainly due to sales growth well above the market for the Singles’ Day, China’s largest e-commerce event.

- Moreover, continued strategic investment in prestige brands drove market share gains in the high-end category, specifically for Clé de Peau Beauté and NARS.

- Net Sales: ¥274.7 billion, Year-on-year change: +16.5%, FX-neutral basis: +7.0% (Like for like: +19.1%)

- Operating Profit: ¥1.2 billion, Year-on-year change: -93.6%, Operating Profit Margin: 0.4%

Operating profit dropped due to increased investment in major brands, higher COGs, and the impact of the Personal Care business transfer, among other factors.

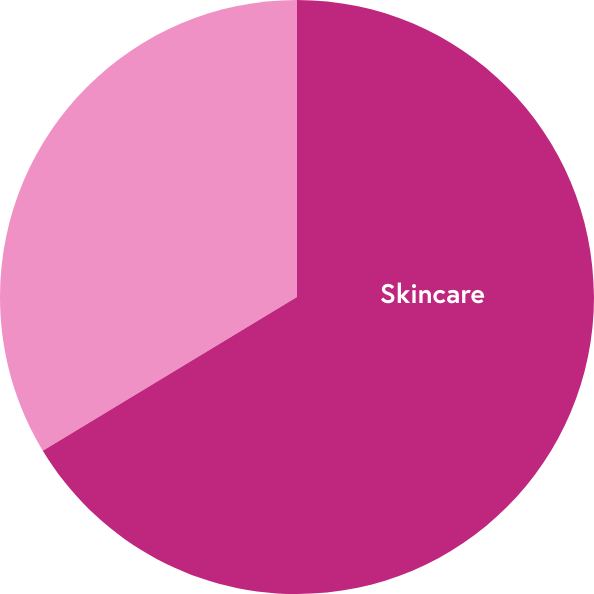

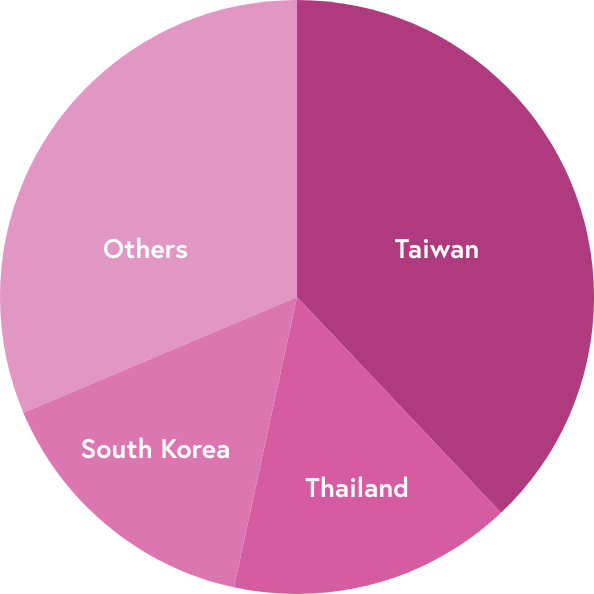

Asia Pacific Business

Growth Led by E-commerce

- In the Asia Pacific Business, while the impact of COVID-19-related lockdowns continued in some countries and regions, we increased our share in e-commerce across Asia, thanks to strengthened expansion into key e-commerce platforms in various regions and robust growth of prestige brands such as SHISEIDO and NARS.

- Furthermore, we actively conducted promotions such as Mother’s Day campaigns in various countries and regions, in addition to further rollout of our Drunk Elephant brand.

- Net Sales: ¥65.0 billion, Year-on-year change: +9.9%, FX-neutral basis: +3.8% (Like for like: +5.8%)

- Operating Profit: ¥3.7 billion, Year-on-year change: +15.1%, Operating Profit Margin: 5.6%

Operating profit grew mainly due to higher margins accompanying an increase in sales.

Americas Business

Cosmetics Market Recovered, Recording Robust Growth

- In the Americas, while impacts from the spread of COVID-19 continued, vaccination rollout drove the recovery of the cosmetics market, including makeup, which had struggled.

- In this market environment, our U.S.-based skincare brand Drunk Elephant opened new doors, while NARS grew its share due to virtual store openings and other digital marketing initiatives.

- In addition, SHISEIDO, Clé de Peau Beauté, and fragrance brands also performed well on the back of strengthened promotions.

- Net Sales: ¥121.4 billion, Year-on-year: +32.8%, FX-neutral basis: +28.4% (Like for like: +29.9%), exceeding 2019 results.

- Operating Loss: ¥13.2 billion, Year-on-year change: +¥9.5 billion, Operating Profit Margin: -8.9%

Operating loss contracted mainly due to higher margins accompanying an increase in sales and improved profitability from reductions in fixed costs of the commercial business.

EMEA Business

Strong Recovery, Gained Share Across All Categories

- In EMEA, while impacts from the spread of COVID-19 continued, vaccination rollout aided market recovery, mainly in skincare and fragrances.

- We succeeded in capturing this turnaround to increase share in all categories through further rollout of our Clé de Peau Beauté and Drunk Elephant brands and e-commerce sales expansion thanks to online video counseling and digital promotions.

- Net Sales: ¥117.0 billion, Year-on-year change: +24.1%, FX-neutral basis: +16.4% (Like for like: +16.5%)

- Operating Profit: ¥2.5 billion, Year-on-year change: +15.7 billion, Operating Profit Margin: 1.9%

Operating profit made a long-awaited return to profit mainly thanks to higher margins associated with an increase in sales, improved profitability of the commercial business, efficiency of advertising expenses due to focused investment in digital media, and lower fixed costs.

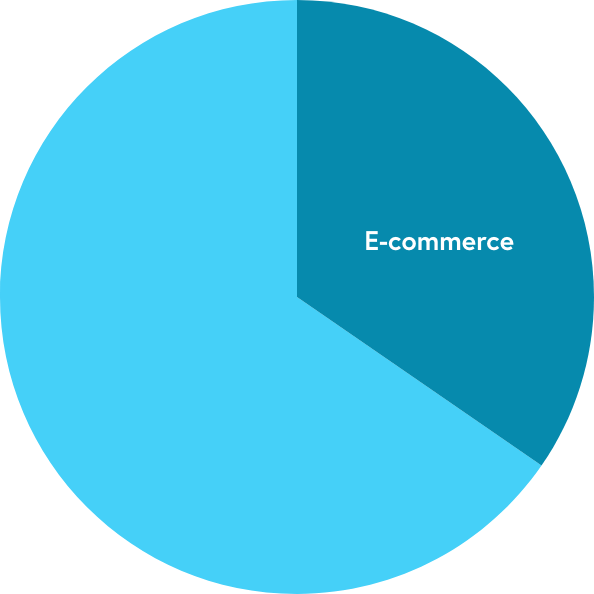

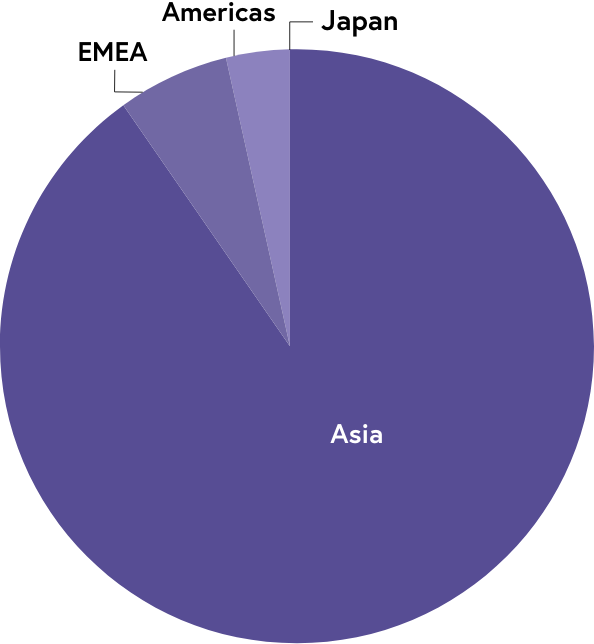

Travel Retail Business

Growth in Asia, Particularly on Hainan Island in China, Despite Global Decline in Travelers

- The Travel Retail Business was continuously affected by considerable reductions in international flights and the resulting decline in travelers worldwide. However, sales still accelerated significantly, mainly for e-commerce in Hainan Island, China.

- Overall, net sales grew substantially, mostly in Asia, as we strengthened the rollout of Drunk Elephant and increased the number of counters for major brands on Hainan Island.

- Net Sales: ¥120.5 billion, Year-on-year change: +22.3%, FX-neutral basis: +18.4%

- Operating Profit: ¥22.0 billion, Year-on-year change: +49.9%, Operating Profit Margin: 18.2%

Operating profit increased mainly due to higher margins accompanying increased sales.