Our Business Portfolio Approach

The Shiseido Group is shifting to a new business structure, with skin beauty positioned as our core category, in line with our medium-to-long-term business strategy WIN 2023 and Beyond. We aim to become a global leader in skin beauty by 2030 and have launched a fundamental business transformation to that end.

In the three-year period from 2021 to 2023, we are laying the foundations to become a skin beauty company around three pillars of global transformation: business portfolio restructuring, improved profitability, and digital transformation.

Our business portfolio will focus management resources on the core business of premium skin beauty, an area of Shiseido’s strength and high growth potential. We plan to cultivate brands with unique global value and develop new businesses, including in the beauty devices and inner beauty categories.

2021 was a year of “Groundwork” focused on transformation and preparation for the future growth of Shiseido, and we made many difficult decisions, such as the transfer of several businesses and brands. In February, we announced the transfer and joint venture of our Personal Care (PC) business; in April, we terminated our global licensing agreement with Dolce&Gabbana S.r.l.; and in August, we transferred our prestige makeup brands bareMinerals, BUXOM, and Laura Mercier. These actions were taken to maximize the potential of our businesses and brands to achieve further growth in the future, which in turn will lead to contributions to our customers and consumers.

The Global Transformation Committee held more than 100 discussions regarding structural reforms, and the Board of Directors met multiple times to discuss various viewpoints and fully consider a number of possibilities before making decisions on these business transfers and other transformations. These global reforms were led and implemented with a sense of urgency by the respective regional headquarters, who assumed responsibility and ownership.

The direct financial impact of these three projects on our 2021 financial results in terms of extraordinary profits and losses is as follows.

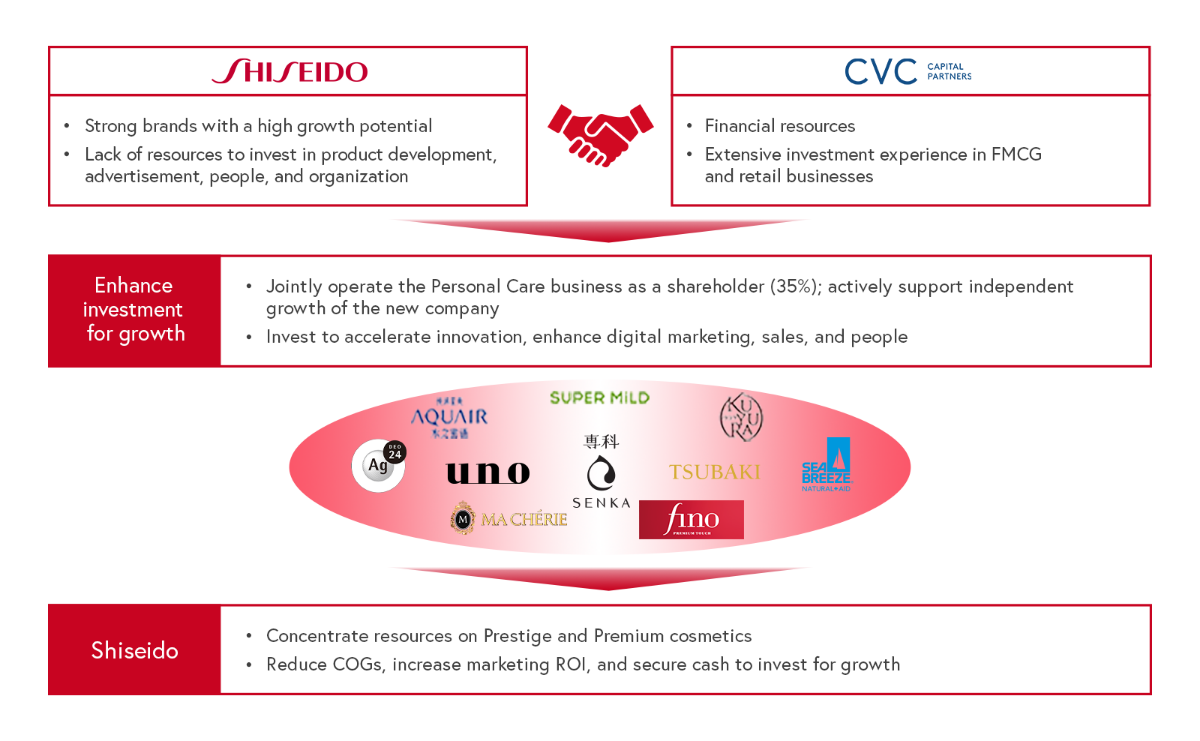

Transfer of Personal Care Business & Setup of Joint Venture

Our Personal Care business included the TSUBAKI hair care and SENKA skin care brands, which had long been known for high value-added products with a strong consumer base in Japan, China, and other countries and regions throughout Asia. However, its competitive environment, business model, and areas of research all differed from those of the premium skin beauty business. Having considered a wide range of strategic options for further growth and development, the Group determined that spinning off the Personal Care business and creating a business environment for enhanced investment in growth, such as flexible strategies focused on mass business and talent development for rapid decision-making and value creation, would lead to the further growth and development of the business, its brands and employees, and that this would ultimately contribute to our consumers and customers.

The business was transferred to private equity fund CVC Capital Partners, which has an extensive track record in improving the corporate value of portfolio companies over the medium-to-long-term, through a joint venture in which Shiseido made a 35% investment in the operating company. Shiseido is committed to the continued operation of the business in cooperation with CVC Capital Partners. Please find a summary of the project timeline below.

For details, please refer to the Tokyo Stock Exchange disclosure and the CEO’s message below.

- Notice of Company Split (Simple Absorption-type Split) and Other Changes Accompanying the Transfer of the Personal Care Business (February 3, 2021)

- Message from the CEO: Commitment to further growth (February 3, 2021)

- Notice Regarding Completion of the Transfer of the Personal Care Business (in Japan, etc.) and Start of Joint Venture Business Operation (July 1, 2021)

Termination of Global Licensing Agreement with Dolce&Gabbana

Shiseido concluded a global licensing agreement with Dolce&Gabbana S.r.l. on October 1, 2016, through Beauté Prestige International S.A.S., an entity responsible for the Group’s fragrance business at its regional headquarters in EMEA. The scope of the agreement covered the development, production, distribution, and marketing of Dolce&Gabbana fragrances, makeup, and skincare products.

In April 2021, in light of the restructuring of our business portfolio under WIN 2023 and Beyond, Shiseido and Dolce&Gabbana resolved after negotiations to terminate the agreement. As a result, the business activities related to this license agreement in all markets were terminated effective December 31, 2021. Following the termination, an agreement was concluded to continue the global production and distribution of Dolce&Gabbana beauty products until the end of 2022.

For details, please refer to the Tokyo Stock Exchange disclosure below.

Transfer of Prestige Makeup Brands bareMinerals, BUXOM, and Laura Mercier

In line with strategies outlined in WIN 2023 and Beyond to prioritize our brands, optimize our portfolio, and strengthen our competitive advantages, we decided to transfer three of the Company’s makeup brands—bareMinerals and BUXOM, acquired in 2010, and Laura Mercier, acquired in 2016—to an external party. The transfer of the brands’ employees was a critical consideration in this transaction.

Among the numerous interested contenders, we reached an agreement on the transfer with Advent International (“Advent”), a private equity partnership founded in 1984 with a global investment track record in consumer products. Shiseido believes that Advent will provide the support needed for further global growth and success of the brands through marketing investment and their extensive experience with business expansions.

In December 2021, the transaction was executed through a transfer of all related assets of the three brands (including all shares of Bare Escentuals K.K. (Japan), a wholly owned subsidiary of SAC and the operating company of bareMinerals in Japan) to the newly formed Advent affiliate AI Beauty Holdings Ltd.

For details, please refer to the Tokyo Stock Exchange disclosure below.