TRANSFORMATION

KEY FIGURES

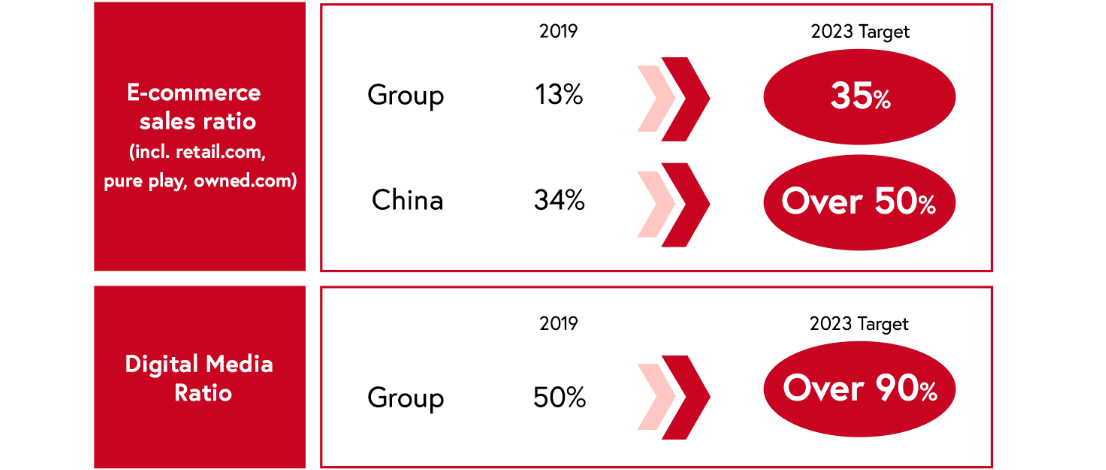

2023 Target for

Global EC Sales Ratio

35%

2023 Target for

Global Digital Media Ratio

over90%

FOCUS

Rollout Completion

2023

CONTENTS

Q1.Could you both give a brief self-introduction and explain your roles at Shiseido?

Q2.What are the DX challenges that Shiseido faces?

Q3.How does Shiseido plan to transform its value chain through DX, and how does SIB fit into these plans?

Q4.Please tell us more about the DX strategy and roadmap at SIB and Shiseido Japan.

Q5.What are your medium-to-long-term goals?

Q1.Could you both give a brief self-introduction and explain your roles at Shiseido?

TakanoI have two main roles. As Chief Information Technology Officer (CITO) of Shiseido’s global headquarters, I am responsible for formulating and implementing Group-wide IT strategies and overseeing information security. I also serve as a Co-Representative Director for Shiseido Interactive Beauty Company, Limited (“SIB”), a strategic subsidiary responsible for digital transformation (DX) in Japan. Angelica Munson, Chief Digital Officer (CDO) of our global headquarters, is responsible for guiding the Group’s overall DX strategy, while I am supporting its IT infrastructure. I worked at multiple foreign-owned companies as CIO/Head of IT Division before joining Shiseido in 2019.

SugimotoI am a second-generation Japanese American from San Francisco, but I started my career as a civil servant. Since then, I’ve had 20 years of experience in the digital space in finance and beauty. I joined Shiseido in 2020 and was appointed as CDO of Shiseido Japan. At SIB, I am Vice President and Head of the DX Division.

Q2.What are the DX challenges that Shiseido faces?

TakanoFirst, there is the challenge of system platforms. Many Japanese companies, including Shiseido, have long operated and optimized legacy systems in isolation. Without sufficient interface between functions and value chains, the system platforms for each region were being developed independently. Compared to overseas competitors who actively invested in IT early on and quickly adapted to the fast-changing industry landscape, we experienced difficulties linking and integrating data, so we lacked agility and flexibility in our response to environmental change. Amid such uncertainty, we needed to rebuild our system platforms to assess the business environment and ensure the execution of our strategies. In November 2019, we launched the business transformation project FOCUS, which emphasizes the standardization of business processes and the deployment of an integrated core systems to accelerate and improve productivity across our business.

Also, we had to address internal capability challenges. In the past, Shiseido often relied on external partners to build its internal systems. However, high dependence on outsourcing reduces our agility and flexibility, and makes it difficult to develop in-house digital and IT talents. I believe that strengthening the acquisition and education of professional experts is our top priority.

SugimotoThe key to staying relevant in the current business climate is adapting to changes in consumer behavior amid the COVID-19 pandemic.

Before COVID-19, people would go out shopping and in the process, gather information through various touchpoints from the signs they saw to the conversations they had with shop assistants. However, with fewer opportunities for people to go out, the amount of information acquired and the number of instances for sensory stimulation have decreased. I believe that the pandemic is even affecting the hunter-gatherer behavior that has been with humans for millions of years and underlies our instinctive urge to go out and collect things and gather information. As a result, consumers now use digital tools and platforms to seek personalized experiences in their own homes and other personal spaces, and they also value creativity and sense of purpose, as we see in recent keywords like mindfulness and well-being.

In the case of cosmetics, we can no longer rely on the behavioral sequence of visiting a store, talking to a beauty consultant (BC), experiencing direct skin diagnosis, trying out the product, and eventually making a purchase. To share the enjoyment of "healthy beauty" with consumers, we must align our thinking, values, and behavior with those of the consumer. We are aiming to use consumer data efficiently to provide new beauty experiences tailored to every individual so that they can feel involved in the process.

Q3.How does Shiseido plan to transform its value chain through DX, and how does SIB fit into these plans?

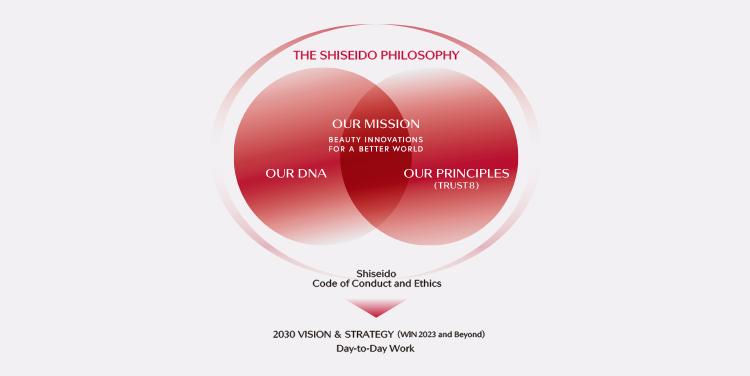

TakanoShiseido has formulated a vision for DX based on the challenges we have just raised. We are committed to being the “Global No. 1 Data-Driven Skin Beauty Company.”

In light of the changes in purchasing behavior, we need to understand our consumers more deeply than ever before and provide each of them with the best personalized value. It is imperative that we propose beauty experiences based on a wide range of data that includes customer information, purchasing trends, and skin conditions. To this end, we will undergo a consumer-based overhaul of our value chain, linking R&D to procurement, production, logistics, marketing, and sales through integrated data. To optimize the timing, channels, and methods of product and service delivery, we will also link information on supply and demand trends, production, and logistics in real time.

SIB was established as a joint venture with Accenture to implement these changes in a swift and focused manner. Essential to harnessing consumer data and becoming a “Data-Driven Skin Beauty Company,” the successful digital transformation within marketing and sales in each of our regions will be key. In particular, we considered DX in the Japan region to be the most pressing issue since the region lags in terms of mobility and flexibility.

SIB also brings together Shiseido’s global IT team, the IT and DX teams at Shiseido Japan, and Accenture's advanced expertise, knowledge, and rich experience to accelerate our digital initiatives. You could say that the fate of Shiseido’s DX rests on the success of SIB.

Q4.Please tell us more about the DX strategy and roadmap at SIB and Shiseido Japan.

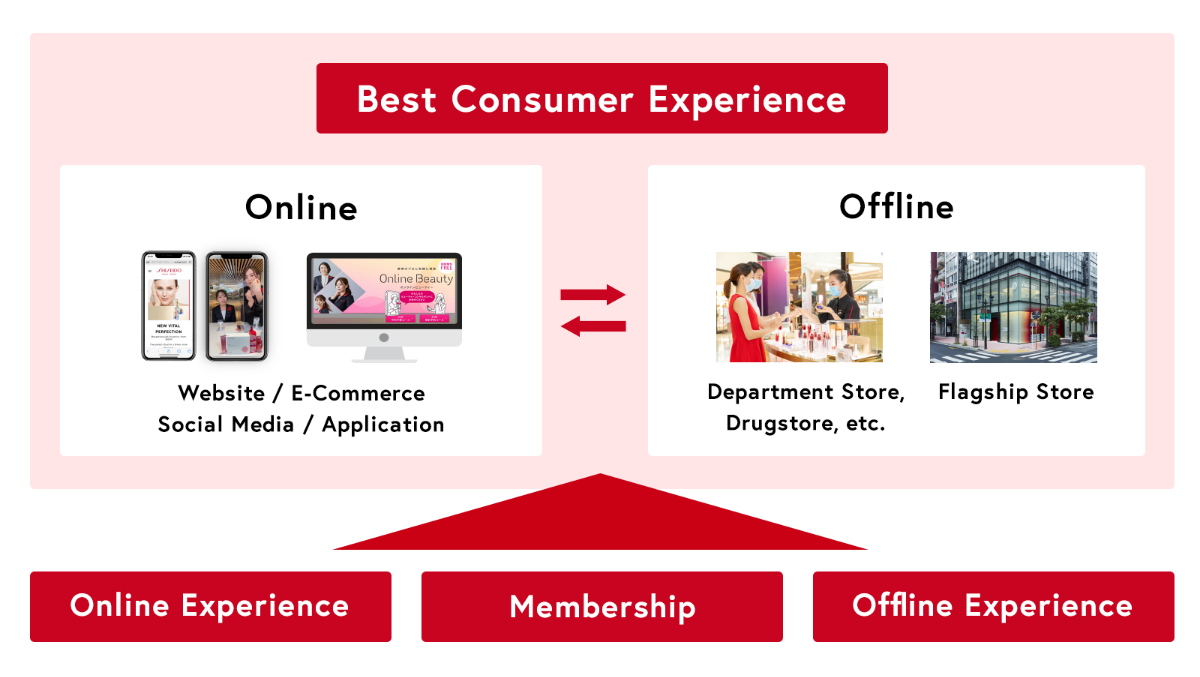

TakanoSIB’s basic strategy is providing the best tailor-made consumer experience possible, independent of time and place, by linking the consumer journey with Shiseido’s unique OMOTENASHI philosophy. This journey can occur both online and offline, such as on social media, websites, e-commerce (EC), retailers’ stores, and Shiseido flagship stores, and is not an easy task since we have a diverse range of brands and are expanding into various channels. However, we plan to proceed with three approaches in mind.

The first is consumer data. We will analyze and utilize a variety of consumer data across multiple touchpoints. The second is traceability, which visualizes the logistics and distribution channels through which products and services reach consumers and includes environmental aspects from raw material procurement to waste disposal. The third is personalization, which provides truly desirable products and services suited to each individual and creates a bespoke experience.

SugimotoWe’ve been discussing these ideas for a long time and launched some of the initiatives in 2020, before we even established SIB. What is important here is to develop measures not from the perspective of the value chain but from the viewpoint of the consumer journey.

First, we are trying to integrate our different platforms to provide beauty experiences at every touchpoint while making the most of these platforms. In 2021, we conducted BC livestreams on each brand websites as well as our holistic beauty service website watashi+ throughout the year, and they were well received. Our department store BCs offer web counseling, and with average customer satisfaction at over 80%, the number of new users is on the rise. The use of our Hada Pasha, or cloud-based skin analysis technology, enables users to diagnose their skin using a snapshot from their smartphone or tablet. Other functions, like the augmented reality makeup filter, are also of great help in providing personalized beauty experiences. We regard our BCs as one of Shiseido’s assets and offer highly specialized training in these digital technologies to nurture Omni BCs, whose aim is to increase engagement with consumers both on- and offline. The Omni BCs at SIB are leading the training of other BCs at Shiseido Japan, and together they produce opportunities to foster consumer empathy by meeting users where they are through digital means, such as live commerce, one-on-one web counseling, seminars, and through social media. The effect of BCs becoming influencers themselves has also been significant, and we have seen a large increase in engagement in addition to our reach and number of impressions on social media.

In EC, Shiseido has integrated its platforms while maintaining the characteristics of each of our brands, and our dedicated platform for specialty stores, Omise+, provides online services for major business partners. As a result, Shiseido maintained its No.1 share of the domestic cosmetics EC market in 2021. These activities give us direct access to a wide range of consumer data. Based on this data, we use predictive modeling to build a cyclical model for co-creating consumer lifetime value between consumers, our business partners, and Shiseido.

TakanoIn terms of data, we have already analyzed and organized its value and assessed the purpose of its use. We not only share the same way of looking at and thinking about the data with each of our brands but are also visualizing the marketing return on investment (ROI) of each brand and incorporating data-driven decision-making into our business processes. Members from various departments and positions can now discuss current issues and next steps by looking at the same datasets, which has already improved our marketing ROI.

Still, the most important initiative at SIB is professional development. One of the main objectives of establishing SIB was to bring together and intensively train digital IT specialists to accelerate the time-consuming professional development process and raise everyone’s capabilities at once. In addition to the ease of incorporating Accenture’s expertise, SIB provides opportunities for talent management where individuals can better design their career paths, so there are plenty of opportunities available to our members. In addition to introducing a 15-level skills assessment, we are focused on external recruitment emphasizing diversity, and in January 2022, we launched an SIB-specific HR system.

Q5.What are your medium-to-long-term goals?

SugimotoShiseido has a vision of becoming a “Personal Beauty Wellness Company” by 2030. Although the COVID-19 pandemic will continue to make things difficult, we still place the utmost importance on the positive emotions derived from beauty and on deepening long-term engagement with consumers. It will be increasingly important to promote data-driven solutions for products, services, and communications that match consumers’ diversifying values and lifestyles. In addition to ingredients and efficacy, location and usability are also important requirements, and developing new platforms will be imperative as well.

There are many things that Shiseido cannot do on its own, so we need to co-create with our business partners and consumers and promote collaboration with other industries in order to accelerate DX throughout Japan.

TakanoFrom a short-term perspective, SIB has drawn a roadmap for 2023, the culmination of WIN 2023.

In terms of talent, we plan to increase the number of employees from 220 to 350 by 2023 and raise the percentage of senior professionals (those who clear level 8 or above of the 15-level skills assessment) from 11% to 30% or higher. In the future, I would like to expand the scope of SIB’s digital IT talent pool to overseas and train professionals who can respond globally.

In terms of systems, our targets are development and upgrade of our data platforms to accelerate new marketing models, as well as the global rollout and go-live of FOCUS by 2023. Improving our ROI is also crucial. While we continue to aggressively invest in innovative initiatives, by the end of 2023 we plan to reduce existing IT costs outside of FOCUS and DX by about 10% compared to 2020. The key drivers will be promoting in-house production with improved capability, on one hand, and increasing productivity and optimizing operation and maintenance, on the other.

Prompt and precise implementation of these initiatives will help us pave a new path forward to becoming the “Global No. 1 Data-Driven Skin Beauty Company.” I believe that we can use the SIB framework to accelerate DX on a global scale while looking beyond SIB to consider new forms of DX and increase the speed of the process. Compared to our competitors overseas, we currently lag behind in terms of system platforms and EC sales. However, rather than simply catching up, we intend to overtake them by using DX to a competitive advantage in providing data-driven “Beauty Wellness” for each and every individual.

Also, Sugimoto mentioned DX in Japan, a popular topic among Japanese companies. In my conversations with other CITOs and CDOs, I often hear them say that they want to revitalize the country and raise the level of digital literacy in Japan. It will be essential for the business community to work together to rebuild these platforms, and Shiseido has a responsibility to become a showcase of DX for other companies. I believe that SIB is well-positioned to embody the potential of DX in Japan.

April 2022

SHISEIDO'S DIGITAL TRANSFORMATION JOURNEY

Related Data (2021)

Shiseido’s Global Digital Transformation (DX) Targets

DX Data (Shiseido Group in 2021)

I joined Shiseido in September 2019 as Vice President of the newly established Business Transformation department, setting out to leverage my multiple years of experience in DX program management. Two months later, we launched business transformation program FOCUS (“First One Connected and Unified Shiseido”), a project I now lead together with our CFO Takayuki Yokota.

Our newly established Business Transformation team is driving the design and gradual implementation of FOCUS, a globally shared IT platform. I can say with confidence that FOCUS is a best-in-class system that offers standardized data and optimized processes. While having such capabilities is not necessarily a competitive advantage in the current environment, the absence of advanced, real-time business analytics can be an impediment to achieving our strategy if not addressed with urgency.

Utilization of global data is becoming increasingly important as the business environment is changing with unprecedented speed. Shiseido has launched several transformation efforts since 2015, but the truth is that we have lagged behind our global peers in leveraging data. FOCUS will bridge this gap and enable Shiseido to leapfrog the competition by connecting every region and business function within the Shiseido Group through one system and unified data for finance, supply network, procurement, marketing, and human resources. Having more in-depth and relevant data available in real time from anywhere in the world will accelerate Shiseido’s response to changes in the market environment and consumer needs. It will enable agile business decisions in line with our “Think Global, Act Local” principle. Moreover, as the core of business operations, this global standard system will trigger changes in workstyle, increase productivity and drive value creation.

The FOCUS program brings together an international team of people from global headquarters and regions, leveraging diverse needs and perspectives for a common goal—to be globally connected and unified in ways of working through data, processes, systems, and operations. During 2021, FOCUS went live in three regions—Americas, APAC and EMEA—with ongoing deployments. In 2023, we will implement FOCUS in China and Japan.

The cumulative capital expenditure plan for 2020 to 2023 is ¥50 billion. Once completed, FOCUS will provide the data necessary to accelerate Shiseido’s business activities and decision-making. This will contribute to achieving our medium-term target of 15% OPM, accelerating revenue growth, and building a stronger, more resilient business foundation for the future.

April 2022