INTEGRATED REPORT 2023 Online Ver.

Financial StrategyMessage from the CFO

With an unwavering commitment to achieve our goals by 2025, we strive to maximize corporate value by transforming into a robust organization that can create a virtuous cycle of growth and reinvestments for the future.

Corporate Executive Officer

Executive Officer

Chief Financial OfficerTakayuki Yokota

With an unwavering commitment to achieve our goals by 2025, we strive to maximize corporate value by transforming into a robust organization that can create a virtuous cycle of growth and reinvestments for the future.

Q1. Could you please give us a financial review for 2023?

In 2023, the first year of our “SHIFT 2025 and Beyond” medium-term strategy, we worked to ensure sustainable growth and improve profitability. However, in the third quarter, we saw a slowdown in sales in the China and Travel Retail Businesses due to the significant impact of consumer pullback on Japanese products following the release of treated water. As a result, our core operating profit for the fiscal year 2023 was 39.8 billion yen with a year-on-year decline of 11.5 billion yen. On the other hand, the Japan Business returned to profitability by expanding its market share overall. While growth in low price ranges led the overall market in Japan, we delivered robust growth in focus areas in mid-to-high price range on the back of an increasing loyal customer base. The China Business also achieved significant improvement in profitability by fueling growth in focus areas through strategic investments, even amidst strong headwinds for Japanese products. The Asia Pacific Business achieved a strong double-digit growth, with a remarkable performance from NARS which has recently launched in India. Moreover, the Americas and EMEA Businesses both delivered double-digit growth, making progress in optimization of our regional footprint. Despite a significant decline in revenue due to tighter regulations, the Travel Retail Business has made progress as planned in optimizing retailer inventory levels.

Globally, we executed disciplined cost management aligned with changes in the business environment, carefully monitoring costs while continuing to invest in growth areas. By improving productivity, our COGS ratio improved by approximately one percentage point to 23.1% compared to the prior year on a like-for-like basis, which excludes the impact of business transfers and impairment losses.

Q2. What are the plans for 2024 and 2025?

Following the launch of “SHIFT 2025 and Beyond” in 2023, we have recently redefined our goals in light of the changing business environment.

Our goal is to achieve sustainable profit growth and develop a resilient business structure that can adapt to changing environment by realizing business transformation that leverages both growth strategies and structural reforms. In terms of growth strategies, the China and Travel Retail Businesses will aim for quality growth—less promotion driven, more brand equity driven, as the market shifts away from high growth to stable growth. Meanwhile, we will accelerate the growth of our Americas, EMEA, and Asia Pacific Businesses and optimize our regional footprint. To help drive our transformation, we will implement cost reduction measures on a global basis, targeting over 40.0 billion yen. In addition to reducing COGS, we will also drive higher gross profit by improving our brand, product, and channel mix. The implementation of FOCUS![]() which allows for improvement in productivity and efficiency, as well as reductions in sales returns and inventory write-offs with enhanced inventory management accuracy is also expected to bring significant benefits to our business. While we expect our net sales to grow with a CAGR of +8% between 2023 and 2025, we will be targeting a core operating profit margin of 9% and EBITDA margin of 15% in 2025.

which allows for improvement in productivity and efficiency, as well as reductions in sales returns and inventory write-offs with enhanced inventory management accuracy is also expected to bring significant benefits to our business. While we expect our net sales to grow with a CAGR of +8% between 2023 and 2025, we will be targeting a core operating profit margin of 9% and EBITDA margin of 15% in 2025.

As for the detail of our 2024 plan, we forecast net sales of 1 trillion yen, an 8% year-on-year increase on a like-for-like basis. We expect that the Japan, Americas, EMEA, and Asia Pacific Businesses will maintain strong growth momentum and achieve double-digit growth outperforming the market. The China and Travel Retail Businesses are also poised for steady recovery as the market has already bottomed out. We expect a core operating profit to increase year-on-year by 15.2 billion yen (+38%) to 55.0 billion yen, with a core operating profit margin of 5.5%. In addition to implementing the initiatives for improving profitability that I mentioned earlier, we will also stay committed to strategic investments in our brands and projects like FOCUS to drive sustainable growth. As we expect to recognize -30.0 billion yen in non-recurring items for costs primarily related to structural reforms, profit attributable to owners of parent is expected to be 22.0 billion yen, remaining almost flat year-on-year. We will accelerate structural reforms to achieve profitable growth from 2025 onwards. With respect to our dividend policy, we remain committed to providing stable returns to our shareholders and plan to declare a total annual dividend of 60 yen per share which is unchanged from the fiscal year 2023.

Q3. Could you tell us about the financial targets of SHIFT 2025 and Beyond?

We have established three financial targets under SHIFT 2025 and Beyond; “Improvement of capital efficiency,” “Improvement of cash generation,” and “Sound financial position.”

In terms of capital efficiency, one of the most important metrics will be the Return on Invested Capital (ROIC), which has been hovering below the weighted average cost of capital (WACC) in 2023 and 2024. We will be working to improve our ROIC as quickly as possible with a strong sense of urgency. The biggest driver will be an improvement in profitability, which we aim to realize through cost optimization and growth strategies. Through these efforts, we will achieve an ROIC of 9% and an ROE of 11% in 2025. In terms of free cash flow, we will secure 100.0 billion yen by driving higher profits, with normalized level of CAPEX after completing a round of major investments, improving working capital efficiency, and selling idle assets. Days sales in inventory (DSI), which we use as an indicator of cash generation, is set at 200 days to be well positioned for future recovery in the market environment. In terms of keeping sound financial position, our policy remains unchanged as we continue to focus on maintaining a credit rating of A, which allows us to secure funds invested for growth at lower cost and in a timely manner. As KPIs, we aim to achieve a net D/E of 0.2 or less and a net D/EBITDA of 0.5 or less in 2025. We will continue to monitor the market environment and our capital efficiency to control financial leverage at adequate level.

Financial Targets

| 2023 Results | 2024 Outlook | 2025 Targets | ||

|---|---|---|---|---|

| Improvement of capital efficiency | ROIC | 4.0% | 5% | 9% |

| ROE | 3.6% | 4% | 11% | |

| Improvement of cash generation | Free cash flow | ¥53.5 bn | ¥70.0 bn | ¥100.0 bn |

| DSI | 197 days (235 days |

230 days | 200 days | |

| Sound financial position | Net D/E | 0.06× | 0.1× | 0.2× or less |

| Net D/EBITDA | 0.39× | 0.6× | 0.5× or less | |

Q4. What is your approach to capital policy to enhance corporate value?

Our basic approach for enhancing corporate value is to create a cycle of growth and reinvestment where robust sales growth is achieved through proactive investment, thereby increasing profitability and capital efficiency to generate additional sources of capital invested to propel further growth in the future. There is no change to our capital policy which prioritize our fundamental ability to drive profits and cash flow, rather than increasing ROE by utilizing excessive leverage.

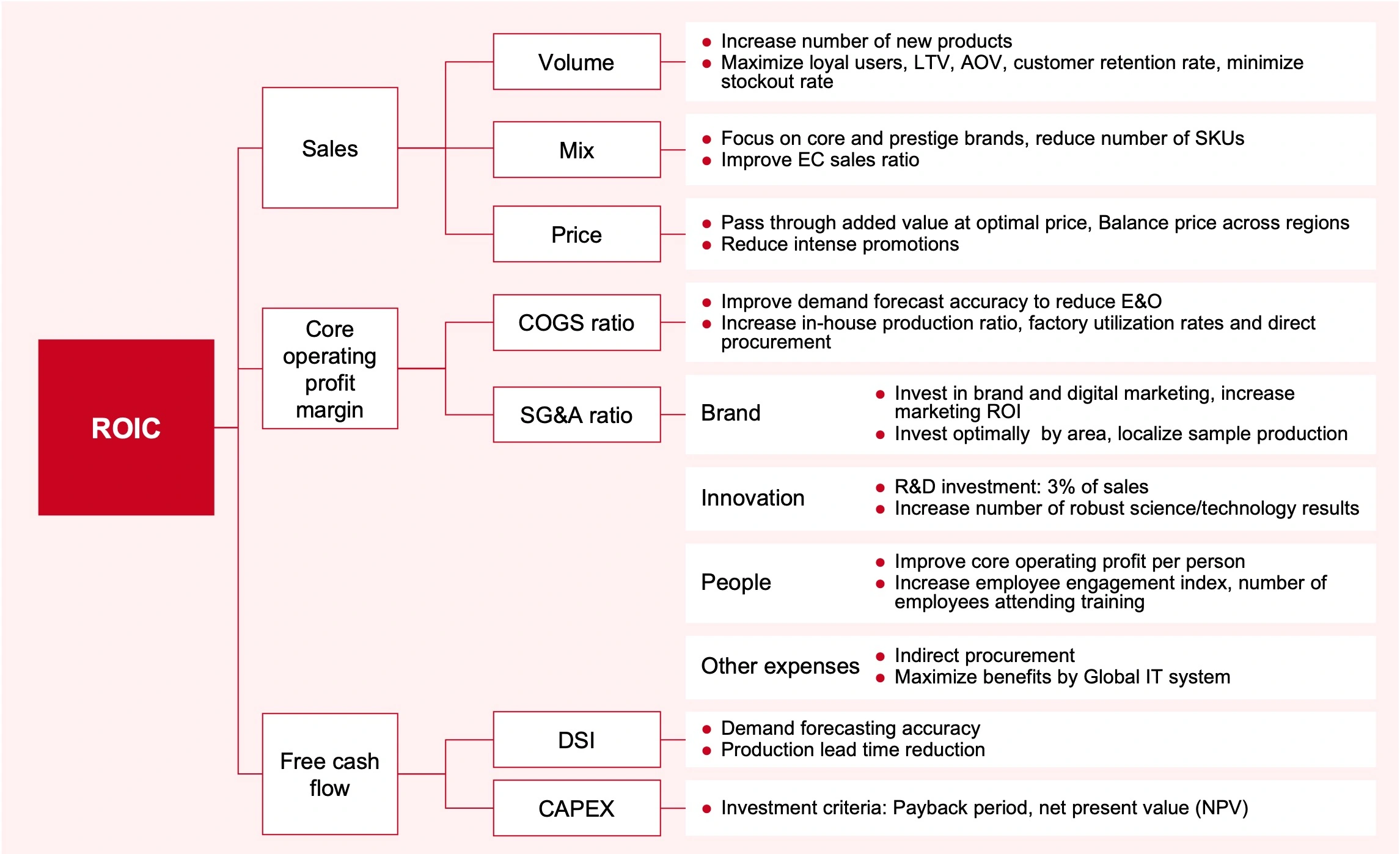

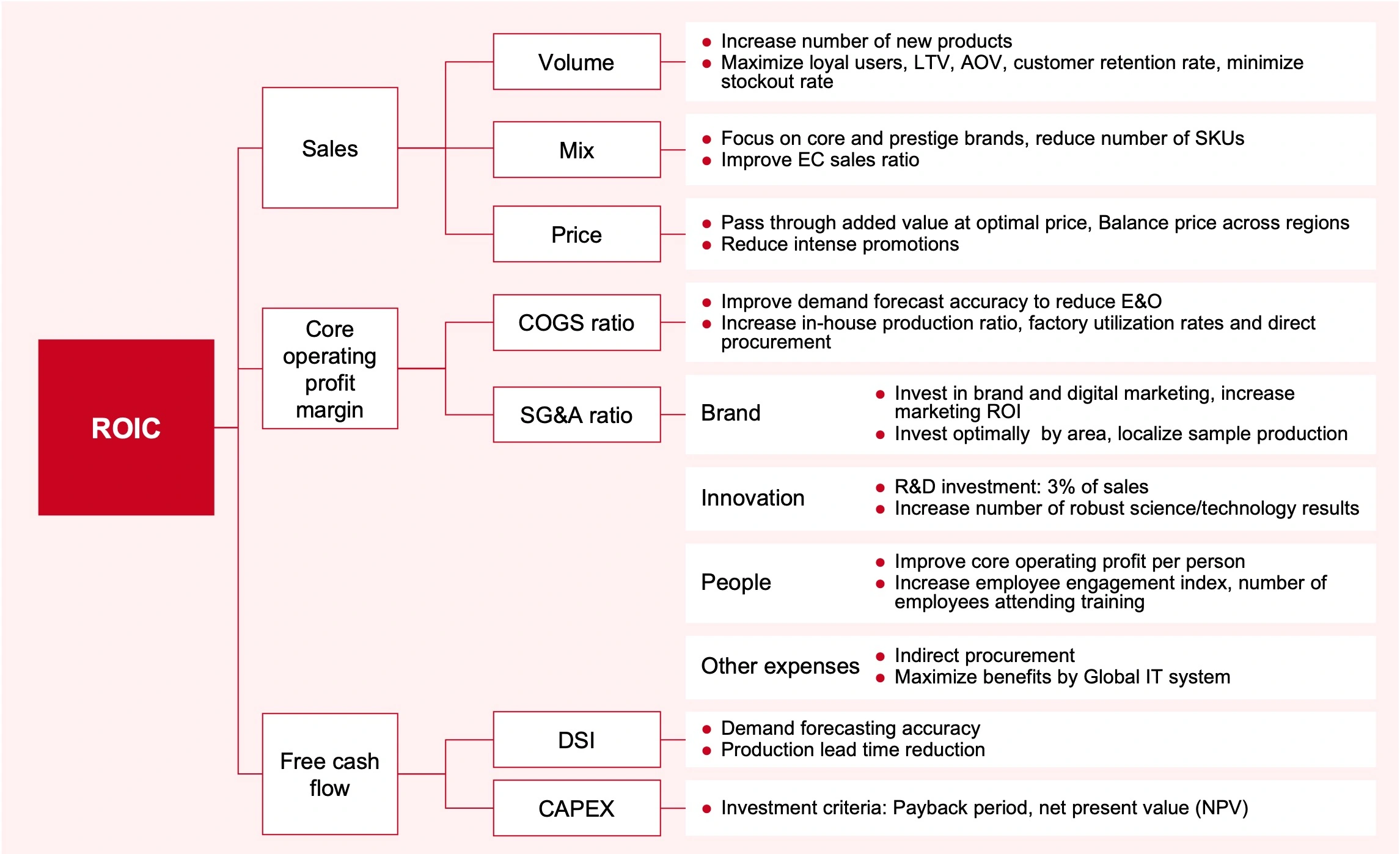

For ROIC, we will prioritize investment efficiency over the medium-to-long term by incorporating it into evaluation metrics aligned with strategic and operational aspects of each region and department. The figure below shows these evaluation metrics in a diagram of strategy tree structured to improve ROIC under the “SHIFT 2025 and Beyond” strategy. Each of the criteria related to sales growth (volume, mix, and price) is monitored for measuring the progress of our growth strategy. The criteria related to COGS ratio and other SG&A expenses under SG&A ratio show our progress of structural reforms and cost reduction measures. On the other hand, our brands, innovation, and people are the key drivers of value creation that contribute to sales growth. We will prioritize investment in these areas as a source of value creation.

As mentioned above, we will also work to improve free cash flow. This is also an area where we can expect to see results from FOCUS. As the criteria for selecting capital expenditures, we are working on to improve ROI by considering, among other things, the payback period for investments and net present value (NPV).

We are also focusing on strengthening ESG activities and dialogue with stakeholders as a way to enhance corporate value. We have received high ratings by external ESG organizations such as the DJSI, MSCI, and CDP. We will continue to promote ESG activities integrated with our growth strategies, while understanding social needs and expectations. ESG criteria are also incorporated as social value metrics in the long-term incentive compensation for directors and other officers, and we aim to share the awareness towards sustainable profit with shareholders.

April 2024