Corporate Strategies and 2022 Results

VISION 2020 and WIN 2023

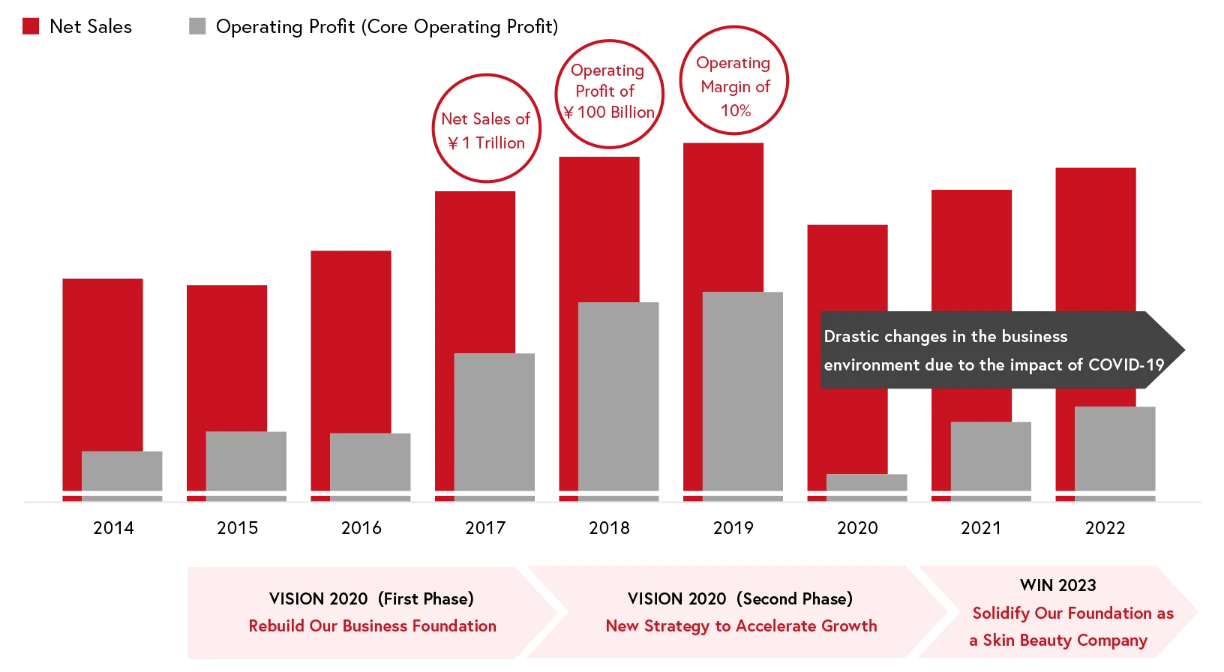

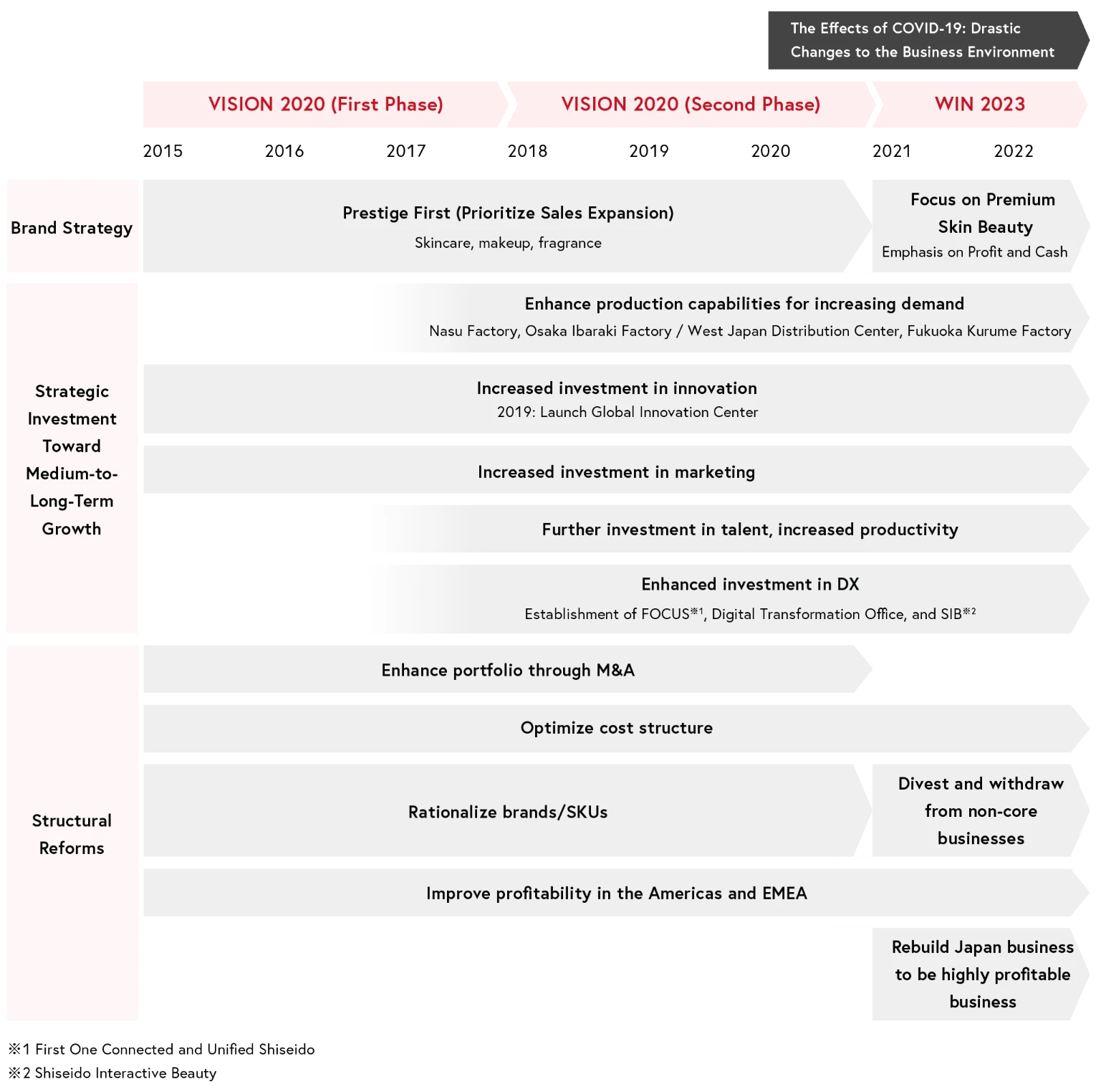

In 2015, Shiseido launched its medium-to-long-term strategy, VISION 2020, for the company to remain vital for the next 100 years. To “Be a Global Winner with Our Heritage,” we first invested in Shiseido’s high price range skincare, makeup, and fragrance as part of our Prestige First strategy.

In addition to investing in our R&D, supply chain, digital, and IT, which are the foundations for sustainable growth, we built a global matrix organization integrating regions and brand categories based on our “Think Global, Act Local” concept, delegating broad responsibility and authority to each regional headquarters.

As a result of these reforms, we surpassed 1 trillion yen in net sales in 2017, three years ahead of the VISION 2020 target. In 2018, our operating profit rose to 100 billion yen, two years ahead of schedule. And in 2019, we reached our operating margin target of 10%.

Despite this steady growth, the spread of COVID-19 in 2020 rapidly changed the business environment and brought to light several management issues. Shift in consumer values and purchasing behavior required urgent changes to our business model, which had been based on high fixed costs footed in high gross profit margins. We reassessed this cost structure and aimed to improve profitability in the Americas and EMEA businesses, reduce our dependence on inbound tourist demand in the Japan business, and address other key issues.

In 2021, we took these challenges and the external business environments into consideration in order to formulate our medium-term strategy WIN 2023. Accounting for 2021 to 2023, WIN 2023 represents the first step toward our 2030 vision to become a "Personal Beauty Wellness Company."

Designed to solidify our foundation as a skin beauty company, WIN 2023 included implementing structural reforms to achieve an operating margin of 15%, restructuring our business portfolio, increasing cost competitiveness, and improving productivity and efficiency to enhance profitability.

Regarding our brand strategy, we concentrated our resources on skin beauty, an area of our strength and where strong market growth is expected. We aimed to promote our brands, expand our portfolio, and develop new businesses in this area. We targeted to increase our Skincare Sales Ratio to 80% by 2023 and already achieved over 70% in 2022.

In addition, we positioned digital transformation (DX) as crucial for rebuilding our business foundation, and we have thereby been expanding our skin diagnostic capabilities through data and beauty tech, accelerating e-commerce and omnichannel initiatives, strengthening our data analytics and digital marketing expertise, acquiring and training digital talent, consolidating our organizational structure, and increasing business collaboration with our partners. As a result, our e-commerce ratio grew to 33% in 2022, nearing our 2023 goal of 35%. We also established the R&D philosophy DYNAMIC HARMONY under our new R&D structure, revamped in January 2021, and to work on new strategies to drive innovation. For our supply network, we strengthened our production and logistics and started operations at three new domestic factories in Nasu, Osaka Ibaraki, and Fukuoka Kurume.

We improved our profitability and financial base through these initiatives, but our net sales and profits for 2022 continue to be challenging, primarily due to the sluggish recovery of markets in Japan and China because of COVID-19.

Rebuild Our Business Foundation

New Strategy

to Accelerate Growth

Solidify Our Foundation as a Skin Beauty Company

Transitions in Investment and Structural Reforms

Since the launch of VISION 2020 in 2015, Shiseido has accelerated selection and concentration, aggressive investment and structural reforms.

We approach capital investment in line with our growth strategies to put Prestige First and Focus on Skin Beauty. Accordingly, we have improved our production and distribution by building the Nasu Factory (operating since December 2019), the Osaka Ibaraki Factory and West Japan Distribution Center (operating since December 2020), and the Fukuoka Kurume Factory (operating since May 2022). These plants are responsible for manufacturing skincare products, and they have all contributed to expanding capacity, ramping up in-house production, improving production efficiency, and enhancing environment responsibilities.

At the same time, we made progress on strengthening our R&D activities. We built the Shiseido Global Innovation Center in Yokohama (opened in April 2019 and commonly referred to as S/PARK) and the Shiseido China Innovation Center (operating since October 2021) located in Shanghai Fengxian District in the Oriental Beauty Valley, a health and beauty industry-focused economic district.

It is crucial to invest in areas like marketing and R&D for our growth. Under VISION 2020 and WIN 2023, we have endeavored to improve profitability and implemented structural reforms, while continuing to aggressively invest in enhancing brand value over the medium to long term by promoting brand selection and concentration. In addition to redesigning our store counters, offering better consumer touch points, offering samples, and conducting promotional activities, Shiseido accelerated its DX investments by building global ERP system and enhancing digital marketing using e-commerce and social networks. For DX, we established Shiseido Interactive Beauty Company, Limited. in 2021 in a strategic partnership with Accenture to operate as a subsidiary to accelerate DX in Japan. Also, FOCUS―our project to globally integrate our systems ―is planned to finish rolling out in all regions by the first half of 2024.

In R&D, we focused on product development centering on our skincare brands and leveraged our expertise in basic research. Shiseido has been aggressively enhancing its R&D. We have announced our plans to raise the R&D budget from the lower 2% range in the first three years of VISION 2020 to around 3% for the medium term in WIN 2023.

For structural reforms, we endeavored in the first three years of VISION 2020 to establish the foundation for sound growth. First, we addressed a longstanding issue by optimizing distribution inventory in China and other Asian countries. At the same time, we integrated our back offices and other systems in the Americas and EMEA regions, as well as conducting cost structure reforms.

WIN 2023 is promoting global transformation that will concentrate resources on the premium skin beauty area by focusing on rebuilding our business portfolio, improving profitability, and DX. We implemented structural reforms on a scale exceeding 200 billion yen in sales, starting with the divestiture of the Personal Care business to the termination of our global licensing agreement of Dolce & Gabbana and transfer our prestige makeup brands bareMinerals, BUXOM, and Laura Mercier. These transformations have aided us in successfully establishing a robust revenue base for future growth.

Overview of 2022 Business Performance

Net Sales

Net Sales

Change

Change%

Neutral%

Robust sales in the Americas, EMEA, and Travel Retail offset year on year revenue decline in China caused by uncertain environments, including the continued spread of COVID-19 and China’s Zero-COVID policy. In Japan, the market for mid-priced products began to recover in the second half of the year; however, delayed recovery in the first half resulted in flat year on year performance. E-commerce sales achieved positive overall growth despite the slowdown of China’s largest e-commerce event, Double 11. High-prestige brands and product lines performed particularly well. Looking at the performance of specific brands, we saw Clé de Peau Beauté capture steady growth, mainly in China's high-prestige market, by strengthening the communication of its functionality and efficacy. Meanwhile, NARS and narciso rodriguez sustained robust global growth with new products, driving overall performance.

As a result, net sales increased 5.7% year on year to 1 trillion 67.4 billion yen, or 0.9% on a like-for-like basis excluding the impact of currency exchange and business transfers.

Our core operating profit increased by 8.8 billion yen to 51.3 billion yen. Key factors driving this increase include our continued flexible cost management across the Company, the reduction of fixed costs under structural reforms, the impact of the yen’s depreciation, and our additional investments of 10 billion yen into medium- to-long-term sustainable growth, some of which are already producing results.

Profit attributable to owners of parent was 34.2 billion yen, a decrease of 12.7 billion yen year on year. In 2021, we recorded a 58 billion yen gain in non-recurrent items, in part due to gains on the transfer of our Personal Care business. In 2022, the impairment loss associated with the transfer of manufacturing business for personal care products was partially offset by gains earned on transferring our Professional business, resulting in a loss of 4.8 billion yen in non-recurrent items.