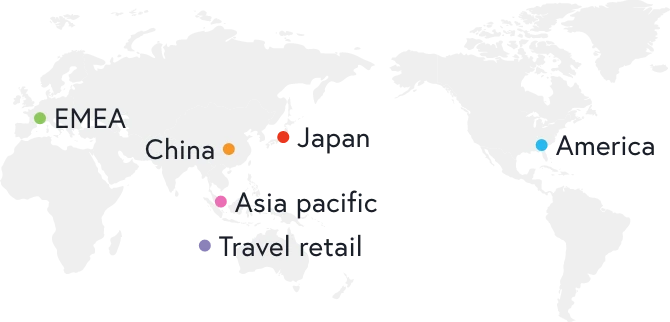

Regional Overview

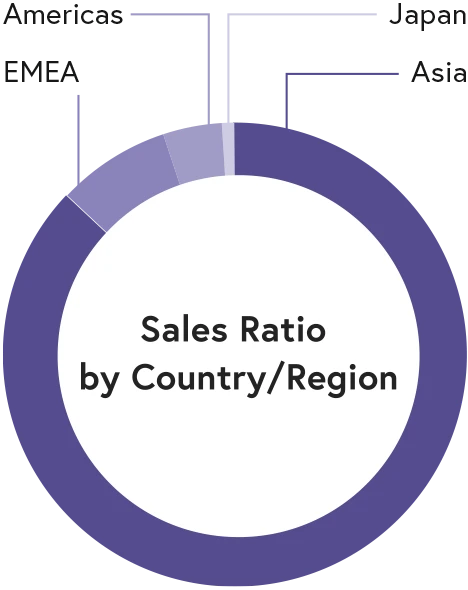

Net Sales by Region in 2022 and Major Brands

Six Regional Headquarters and Our Global Management Structure

Since 2016, we have had in place a matrix organization that cross-matches six regions with brand categories. The regional headquarters are responsible for and have authority over their respective businesses. Guided by a “Think Global, Act Local” approach, these headquarters implement flexible decision-making and marketing activities attuned to the needs of local consumers.

2022 Results

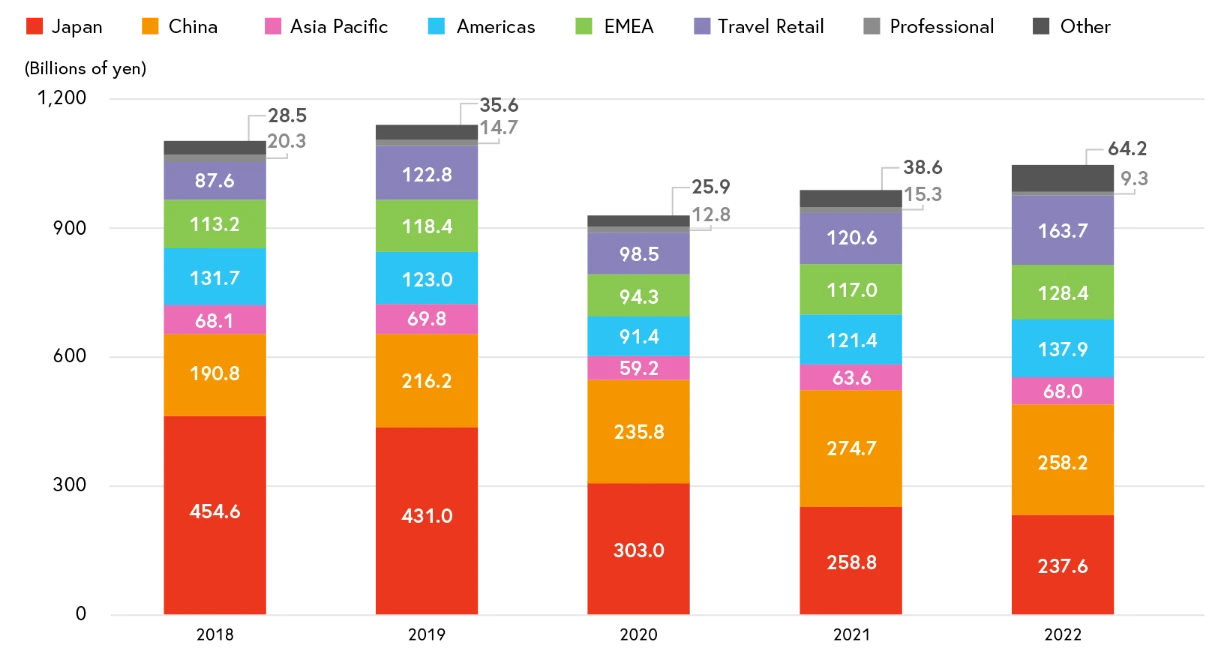

Net Sales by Reportable Segment

Net Sales by Reportable Segment

Change

Change

%

FX-Neutral %

%

Core Operating Profit by Reportable Segment

Change

Change

%

Profit

%

Profit

%

Operating Profit / Core Operating Profit Margin by Reportable Segment(%)

Japan Business

We will shift to aggressive marketing in Japan and return to a growth trajectory that outperforms the market through concentrated investment in the skin beauty category and constant product innovation.

In addition, we will advance structural reform to rebuild our earnings base.

Related Data

Market Environment

The first half of 2022 saw polarized consumption, particularly with customers trading down from mid-priced to low-priced products. In the third quarter, traffic recovered in department stores due to increasing opportunities to go out. The market for mid-priced products also began to recover in the second half of the year. Traffic from international tourists also gradually recovered starting in the fourth quarter.

2022 Review

- The mid-priced market, which had been slow to recover from the impact of COVID-19, started to show signs of recovery in the second half of the year.

- We continued to strengthen strategic investments in skin beauty brands throughout the year, through promotions commemorating the 150th anniversary of the Company’s funding, etc.

- In September, we launched renewed ELIXIR lotion and emulsion with the latest collagen technology.

- We introduced Beauty Key, a new membership service that consolidates the different services previously offered by each sales channel such as stores and e-commerce, and by each brand. Beauty Key allows us not only to offer counseling services to our customers tailored to their needs, but also to further strengthen digital communication.

ELIXIR lotion and emulsion revamped September 2022

New membership service "Beauty Key"

China Business

In light of the diversification of consumer values and stabilization of market growth, we practice ‘quality’-oriented marketing that focuses on brand building and increasing the number of loyal users without overly relying on large-scale promotions and price promotions. We will focus on enhancing consumer experience, developing and fostering exclusive products, and improving customer relationship management (CRM) using our own data platform.

Related Data

Market Environment

The market slowed down significantly in the first half of 2022 due to lockdowns in Shanghai, etc. In the second half of the year, too, the cosmetics market slowed down due to intermittent lockdowns in several cities and changes in consumption trends, including the consumers’ saving on the rise. The market for Double 11, China's largest e-commerce event, also dropped significantly below 2021 levels.

2022 Review

- We promoted a shift from growth centered on large-scale promotions to sustainable growth through better communication of the true value of our brands and products based on consumer needs.

- We outperformed the market and achieved year-on-year e-commerce sales growth, despite a significant decline below 2021 levels in the market of Double 11, China’s largest e-commerce event.

- Expanding into major platforms and strengthening communication focused on effects and efficacy were successful.

- We enhanced provision of experience value unique to real stores and continuous initiatives to expand our loyal consumer base.

SHISEIDO street-side pop-up event

Clé de Peau Beauté promotion on TikTok

Asia Pacific Business

We are continuing to strengthen our portfolio of prestige brands while, at the same time, focusing on business development to meet the unique needs of the region. In addition, we established and expanded our business base to steadily capture expected market growth in India and other markets.

Related Data

Market Environment

Markets recovered in many countries and regions (except Taiwan) as economic activity normalized in 2022.

Taiwan has experienced a recovery trend since the third quarter.

2022 Review

- We experienced substantial growth in countries and regions such as South Korea and Southeast Asia due to increased customer traffic to brick-and-mortar stores tied to economic reopening.

- E-commerce sales continued to grow thanks to efforts including further expansion to major e-commerce platforms and increased opportunities for consumer contact through digital technology.

- Brand leaders SHISEIDO, Clé de Peau Beauté, NARS, and ANESSA drove overall growth.

ANESSA Perfect UV Skincare Milk

Americas Business

We have established a robust business foundation after accomplishing the necessary structural reforms. Our attention will now shift towards reinforcing our foundation for future growth as the next key pillar of expansion. In addition to aggressively strengthening our brands, we will focus on promoting locally generated innovation and evolving our consumer engagement by using digital technologies.

Related Data

Market Environment

The beauty market grew across all categories as economic activity normalized. The prestige beauty market remained strong despite the inflationary pressure and recession concerns.

2022 Review

- The beauty market continued to grow across all categories as the impact of COVID-19 eased and economic activity normalized.

- NARS expanded market share thanks to the success of its new product, Light Reflecting Foundation, and robust e-commerce growth stemming from enhanced digital marketing.

- Brand SHISEIDO also performed well due to strengthening promotions.

Light Reflecting Foundation, a new NARS product

EMEA Business

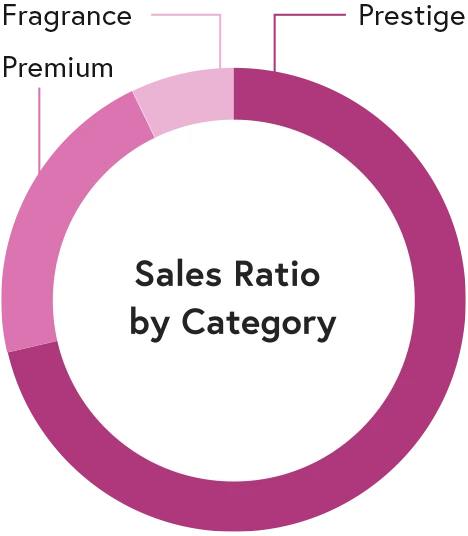

We aim to strengthen and nurture our prestige brands, building upon an earnings base enhanced by structural reforms and expanding our revenue in fragrance. We are also committed to exploring emerging skincare domains aligned with current market trends, such as sustainability.

Related Data

Market Environment

The beauty market grew across all categories as economic activity normalized and showed no decline in consumer purchase, remaining strong despite the concerns of inflation and recession. The makeup category showed particularly strong growth which had severe impact in 2021 due to COVID-19.

2022 Review

- NARS and narciso rodriguez achieved strong growth and increased their market share through promotions capturing demand recovery.

- Drunk Elephant expanded steadily, contributing to sales growth.

narciso rodriguez released the new fragrance MUSC NOIR ROSE.

Travel Retail Business

With the recovery of international travel and the growth in China’s Hainan island, we will increase investment in our Hainan business and prestige brands and strive to differentiate our brands and products by offering items exclusive to Travel Retail.

Related Data

Market Environment

The market slowed after the second quarter due to the impact of the Shanghai lockdowns, and the Hainan lockdown in August. Meanwhile, travel continued to pick up, and number of travelers increased in the US and Europe as economic activities normalized. Tourism in Japan also began to recover with the easing of border restrictions.

2022 Review

- Travel began to pick up again following the relaxation of COVID-19 restrictions, with rapid recovery centered in US and Europe.

- There was strong growth in Hainan despite the impact of lockdowns thanks to e-commerce growth and opening a new store in October at the world’s largest duty-free shopping mall in Haikou.

Our newly opened store in Hainan at the Haikou International Duty Free Shopping Complex