Message from the CFO

Executive Officer

Chief Financial Officer

- Q1.Please give us a review of the previous medium-term strategy WIN 2023 from a financial perspective.

- Q2.Could you explain the financial targets of SHIFT 2025 and Beyond, the new medium-term strategy announced in February 2023?

- Q3.Please explain the key points to achieving your goals.

- Q4.What is your strategy for capital and cash allocation in maximizing corporate value?

- Q5.Finally, please tell us where you focus on as CFO.

Q1.

When WIN 2023 was initially launched in August 2020, we assumed that the market would recover from COVID-19 in the second half of 2020 for China and the second half of 2021 for Japan, but these assumptions turned out very different. Due to the sluggish market recovery of our largest regions, Japan and China, both sales and profits fell far short of our initial plan. In particular, recovery of sales growth and profitability of our Japan business is now the most important points to be tackled.

In order to achieve “selection and focus” in our business, we went through major structural reforms which resulted in divesting over 200 billion yen in sales and completed the successive transactions as planned. As a result, the ratio of skincare sales expanded to over 70% and profitability in the Americas and EMEA significantly improved. As we went through a challenging business environment, we continued to invest for medium-to-long-term growth, accelerated digital transformation (DX), and establish new factories (Nasu, Osaka Ibaraki, Fukuoka Kurume), which are now running smoothly. These efforts have improved productivity and laid the foundation needed to support our future growth. In addition, the cash obtained through structural reforms was used to reduce interest-bearing debt, helping us secure a strong financial base and prepare the company for future growth.

Q2.

The strategy of SHIFT 2025 and Beyond is essentially to shift from defense to offense. We aim to expand sales and improve efficiency through strategic investments, increase profitability and our capabilities to generate cash, and shift to a highly profitable business structure that allows us to generate the fund for continued future investment.

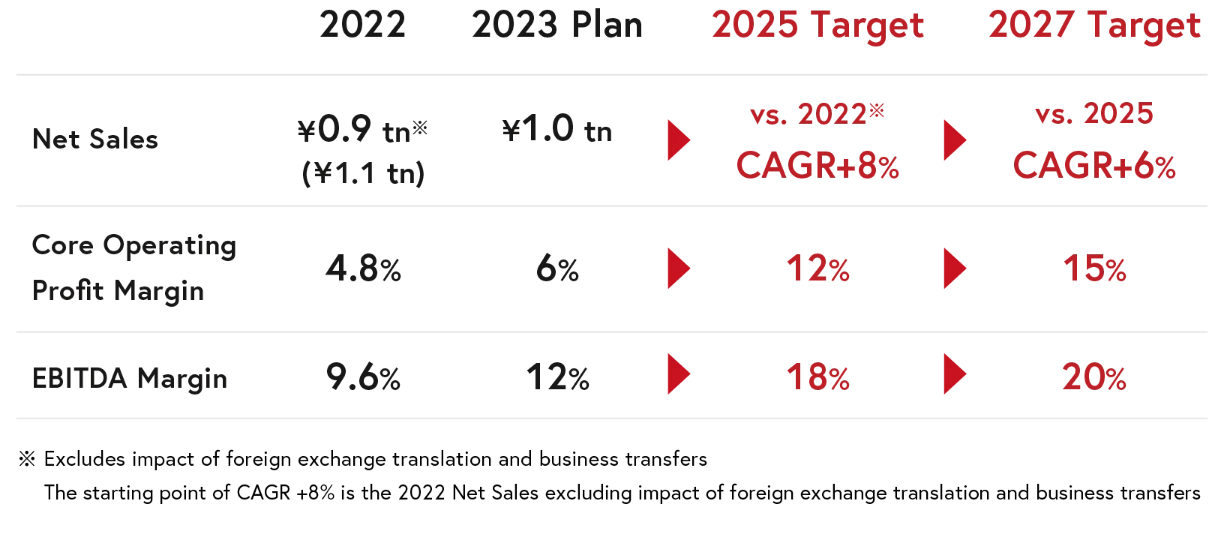

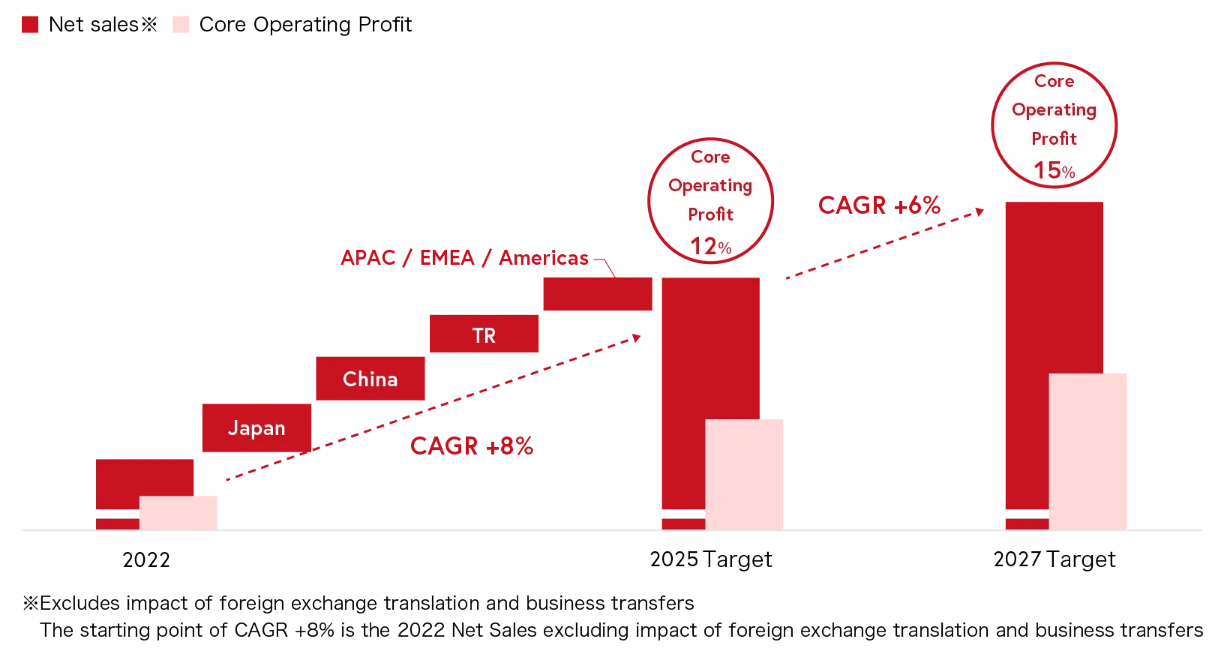

We aim to increase sales at a compound annual growth rate (CAGR) of 8% from 2023 to 2025 and CAGR of 6% for the following two years, starting from the base point of 0.9 trillion yen in 2022, which excludes the impact of business transfers. Until 2025, we are determined to focus on recovery in Japan and China while strengthening our brands to exceed market growth in each region and gain share.

In addition to such robust sales growth, we will promote cost optimization in each region to achieve an operating profit margin of 15% as initially targeted in WIN 2023. Our core operating profit margin target in SHIFT 2025 and Beyond is 12% in 2025 and 15% in 2027, with EBITDA margins of 18% and 20%, respectively.

Regarding capital efficiency, we will drive growth by leveraging the financial base established through previous structural reforms.

With higher profitability, we will increase the return on invested capital (ROIC)—our most important capital efficiency indicator—and return on equity (ROE) to 12% and 14%, respectively, in 2025.

With major investments, including structural reforms and production site construction, completed, free cash flow is expected to reach 100 billion yen in 2025. In terms of financial stability, we are targeting a net debt-to-equity ratio of less than 0.2 and a net debt-to-EBITDA ratio of less than 0.5 by 2025. Our policy to maintain a single A rating remains unchanged, which allows us to finance the required sources of funds for future investments at low cost and in a timely manner, and we will continue to monitor capital efficiency to control our financial leverage.

Q3.

The biggest driver to achieve our target profit ratio is to expand sales. Shiseido plans to achieve a net sales CAGR of 8% by 2025, with Japan, China, and Travel Retail becoming the primary driver for businesses growth. In both Japan and China, it will be important to seize opportunities for market recovery and expand our market share through aggressive investment in skin beauty categories and to target Chinese consumers across these regions, including Travel Retail. We also plan to achieve growth that outperforms the market and expands the scale of our business in Asia Pacific, Americas, and EMEA.

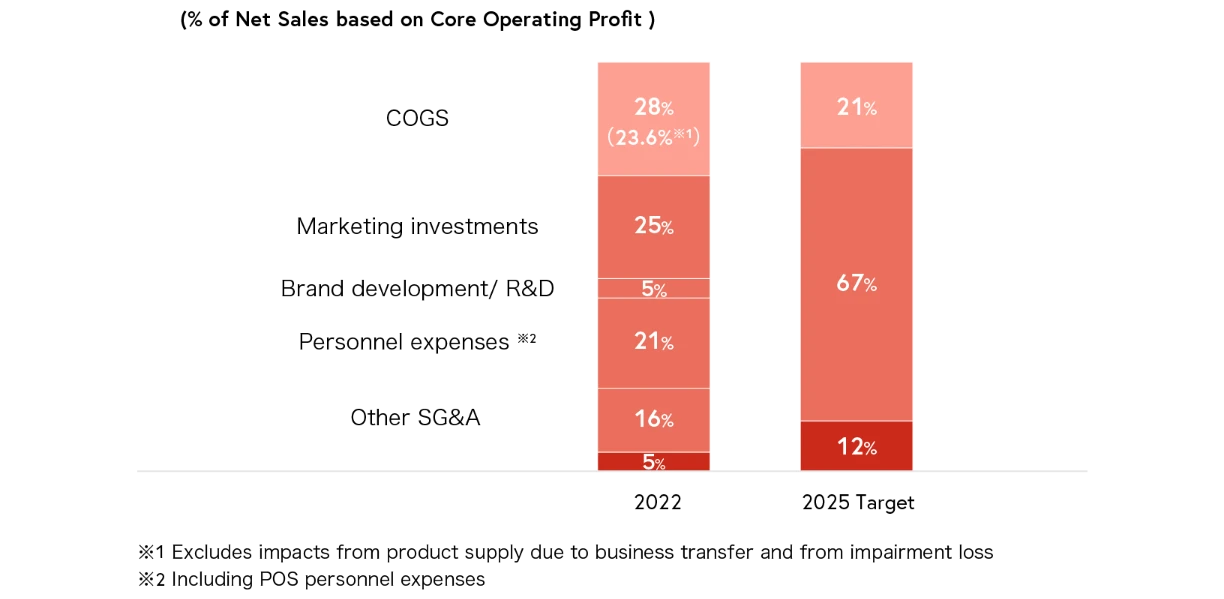

To transition to a high profitability business structure, one of our major targets for 2025 is to achieve a COGS ratio of 21%, an improvement of 2.6 percentage points compared to 23.6% on a like-for-like basis in 2022 while maintaining our SG&A ratio at 67%, the same level as 2022.

By promoting FOCUS, we expect to drive cost reduction by decreasing the number of returns and inventory write-offs through improving forecast accuracy. Other drivers include further improvements to our brand and product mix, higher capacity utilization at new factories, reduction of outsourcing, and optimizing the supply network sites.

Regarding SG&A, whilst making additional investments of more than 100 billion yen over the next three years to enhance brand values, it is essential to reduce personnel and other expenses ratio. We will reduce and optimize fixed costs by improving productivity and efficiency through the completion of FOCUS and cost structure reforms in each region.

Q4.

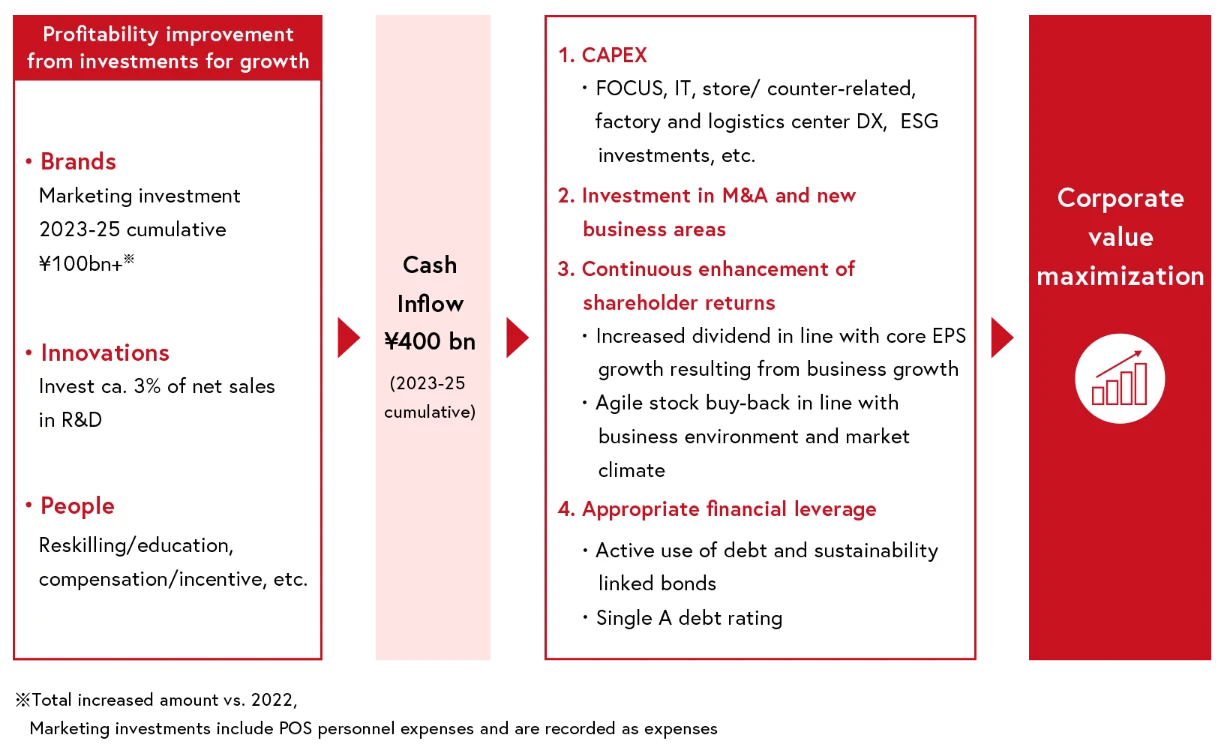

We want to achieve a virtuous cycle by aggressive investment that drives profitability which enhances corporate value.

Our capital policy remains unchanged. We will improve intrinsic profitability and cash generation rather than increasing ROE through excessive leverage. We have set ROIC to be the most important indicator of capital efficiency, which we will continue to improve through various steps which include balance sheet management, reviewing our business portfolio, and selling idle assets that do not contribute to growth.

Under SHIFT 2025 and Beyond, we expect to generate a cumulative operating cash flow of 400 billion yen over three years by improving profitability through investment in brands, innovations, and people.

The cash generated will first be allocated to capital investments such as FOCUS, IT facilities in each region, DX for factories and distribution centers, and the introduction of advanced environmentally friendly equipment. We will also allocate sources to M&A and new businesses and technology investments.

M&A will target specific areas that cannot be developed in-house or requires a faster pace of growth and to gain sufficient return on investment.

Shiseido is committed to enhancing shareholder returns in line with improved profitability based on stable cash dividends, while managing our financial leverage appropriately.

Furthermore, we will adhere to the previous policy to maximize shareholder returns both through immediate direct means, and though medium-to-long-term stock price increases.

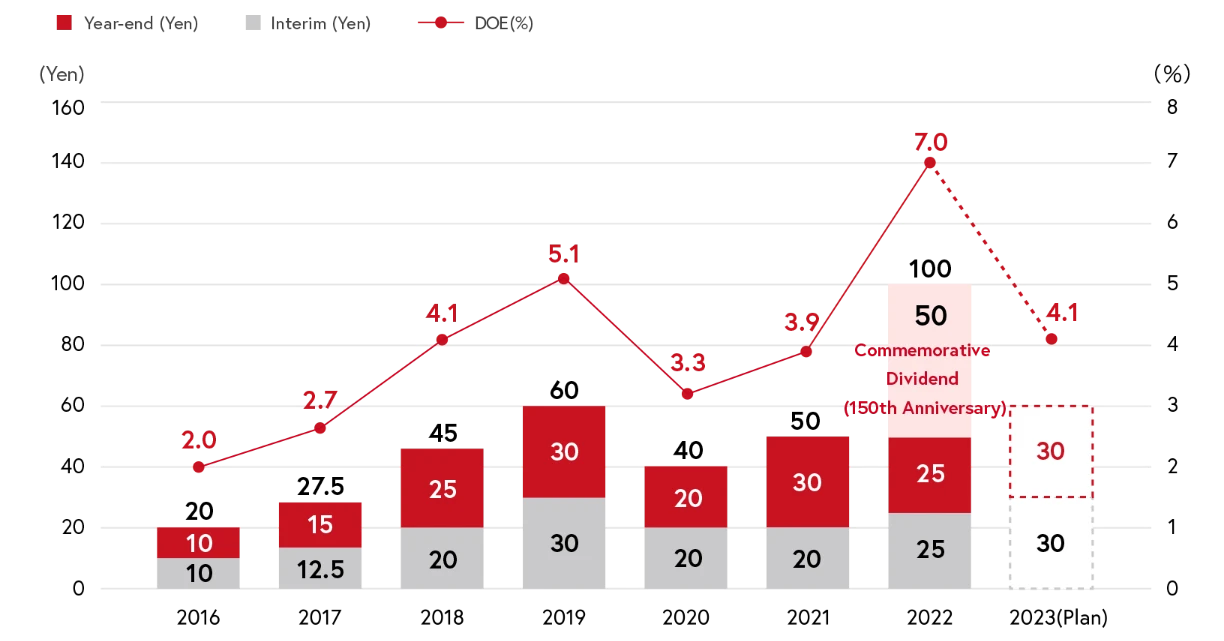

Upon determining our dividend levels, we consider consolidated financial results and free cash flow, aiming to realize long-term steady returns with a dividend-on-equity (DOE) ratio of 2.5% or higher. Shiseido is committed to increasing dividends in line with core EPS growth over the medium term, based on our earnings.

Changes in cash dividend per share / Dividend on equity (DOE)

Q5.

As the CFO of Shiseido, my mission is to ensure steady execution of SHIFT 2025 and Beyond and drive transformation by acting as a catalyst in improving our profitability and cash generation whilst maintaining high governance and compliance standards.

I am the project owner of the FOCUS, a Group-wide project that aims to achieve many of the profitability improvements and corporate value enhancements I mentioned above. FOCUS mission is not merely system reform—it is digital business transformation. The introduction of a globally integrated enterprise resource planning (ERP) system across all regions will go live in the first half of 2024, followed by all factories and R&D facilities by the end of 2025. We have also prepared a roadmap of three phases—standardization, automation, and sophistication —as we head towards 2030. Many benefits are expected after the start of operation, including inventory optimization by improving the accuracy of supply and demand forecasting, reduction of slow-moving inventories, optimizing operational efficiency by developing global standard processes, and improvement of marketing ROI through data visualization. The global data obtained through FOCUS will help make real-time business analysis and more agile, sophisticated decision-making possible. By changing how each employee works, it will improve productivity and allow us to reallocate time to value creation. In this way, we will achieve our goal of becoming the “Global No.1 Data-Driven Skin Beauty & Wellness Company.”

I believe that it is important to continue constructive dialogue with our shareholders and investors to increase our corporate value over the medium to long term. Shiseido will continue to provide information on market trends, strategy updates, and sustainability activities, as well as the achievements and challenges regarding our initiatives. I will make every effort to listen to the concerns of our shareholders and investors, address those concerns as management, and apply their perspectives in management and IR activities. We will also constantly examine more effective ways of disclosure to enhance dialogue with external parties.

April 2023